The curious case of FACT - Fertilizers & Chemicals Travancore Ltd.

About the company -

The company is engaged in the manufacturing and selling of fertilizers, its by-products and Caprolactam. It is under the administrative control of the Department of Fertilizers, Ministry of Chemicals & Fertilizers, Government of India.

Recent price movement -

The big move from 140 to 310 in a month on heavy volumes. Doubler in a month

A 8,600cr market cap company suddenly become a 17,000cr market cap company

Well, the liquidity has got a major role to play in it.

Lets see how

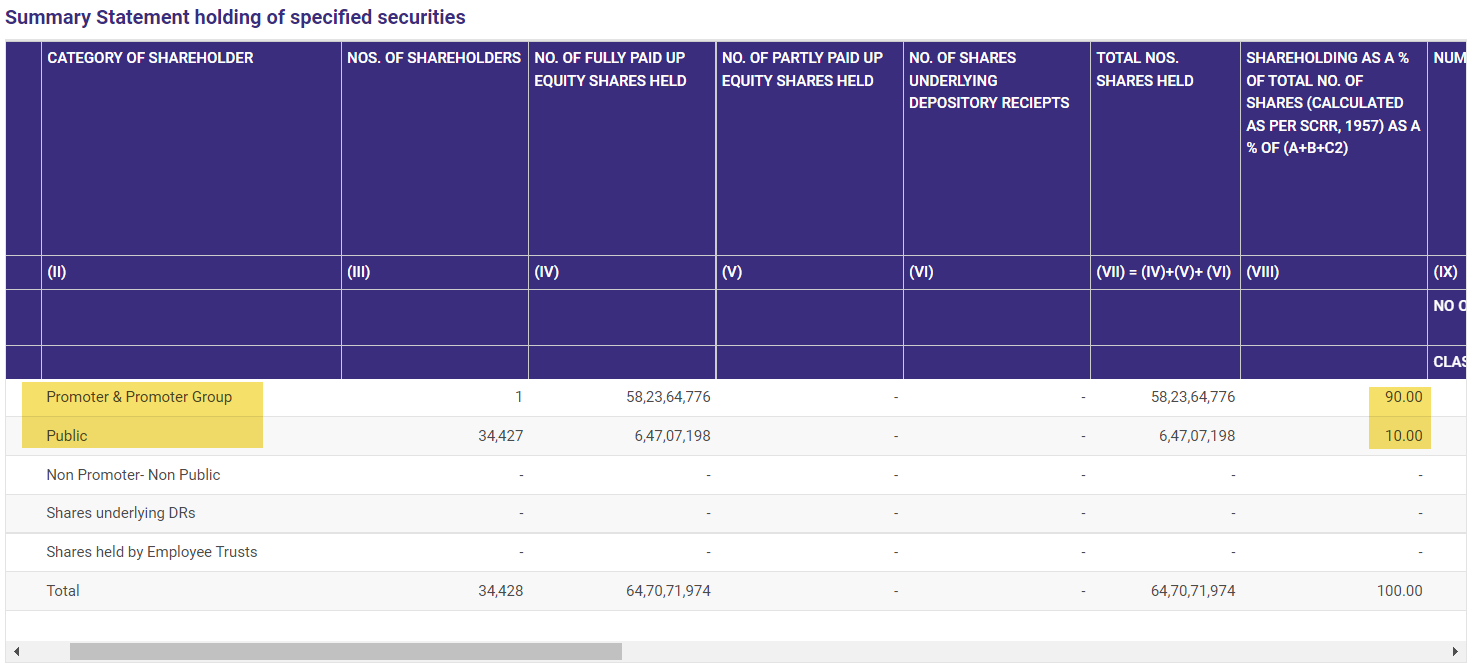

Shareholding of FACT –

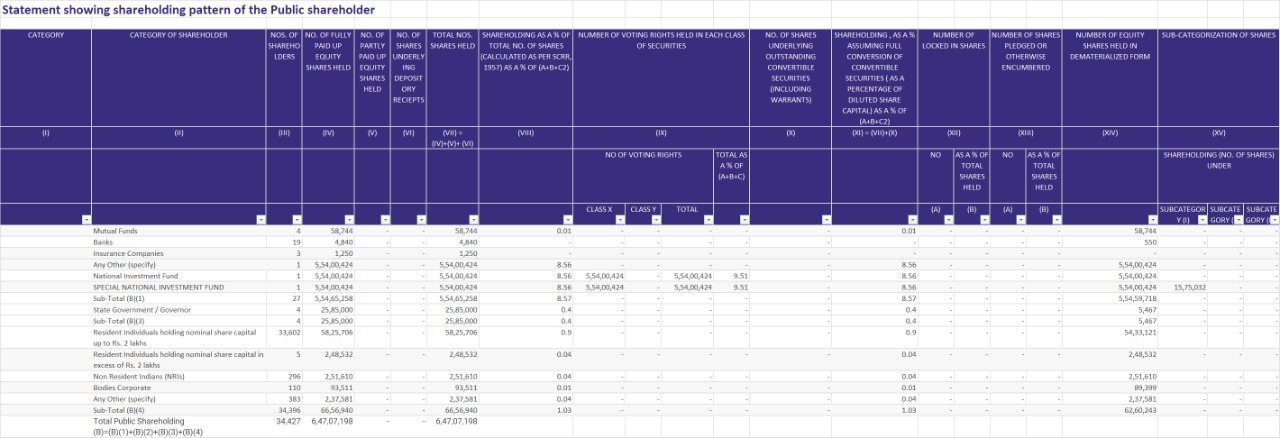

Promoter – The Govt. holds 90% of the company and Public holds 10% stake making the free float market cap at 1/10th of the original market cap!!

Further breaking down the Public shareholding, out of 10%, 8.56% is held by National Investment Fund and another 0.4% with State govt, which means actual free float is just 1% ONLY or 67.22lk shares ONLY.

So, if actual market cap before rise was 8kcr the free float mkt cap was only 80cr or after the doubling it is still at 160-170cr. Surprised?

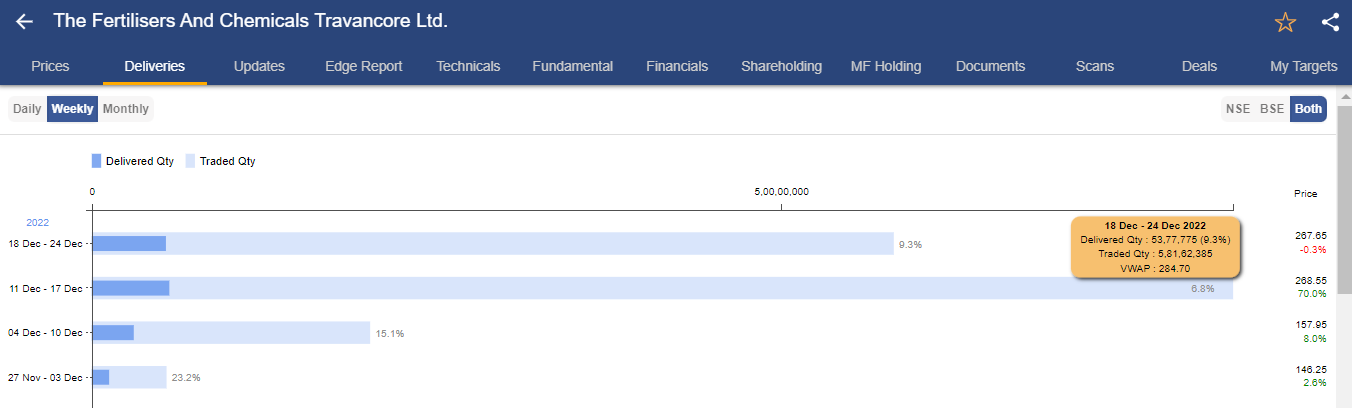

Volumes –

Now let’s look at traded and delivery volumes for last 2 weeks,

Total traded volumes = 14cr (21 times free float shares)

Total delivery volumes = 1.10cr (1.6 times free float shares)

Free float shares ~67.22lks

Got to be careful here!!

Disclosure: No view on business, no positions, just a post facto analysis

Technical Traders Room

What is it?

Subscribe

https://rigi.club/jcp/l7BZLqDa7i

Other Services