Had posted this during the day.

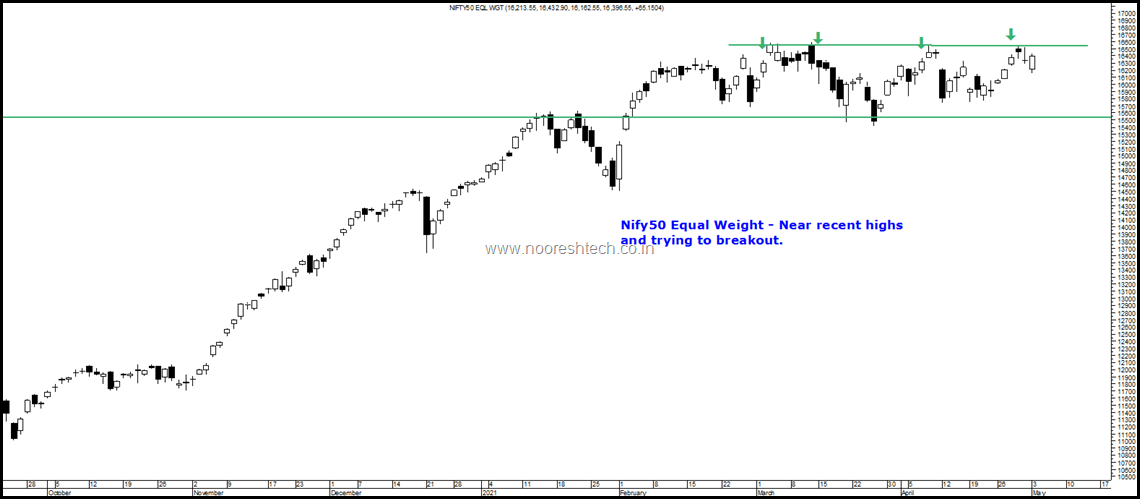

One of the reasons to be either #Neutral or #Bullish and not beairsh on the #Nifty. This is not usual - #Nifty50EqualWeight near 52 week highs and #Nifty50 struggling.

https://twitter.com/nooreshtech/status/1389101387208740866

Since the last few months have been mentioning how its a good time to avoid the large heavyweights and focus on broader markets. Still the same view.

1) February 15th – Nifty at 15300 -

MicroCaps,Smallcaps, Midcaps - Time to be selective here and maybe avoid largecaps for the short term.

Conclusion

- Large HeavyWeights of Nifty50 could now start underperforming even the smaller Nifty50 Weights.

- Time to avoid the Top 5-10 weights of the Nifty and focus on the rest of the Nifty and even Micro-Caps/Smallcaps/Midcaps.

Since the last few months the best thing to do has been avoid the top weights of the Nifty.

Nifty 50 – At the same place !!

Nifty50 Equal Weight

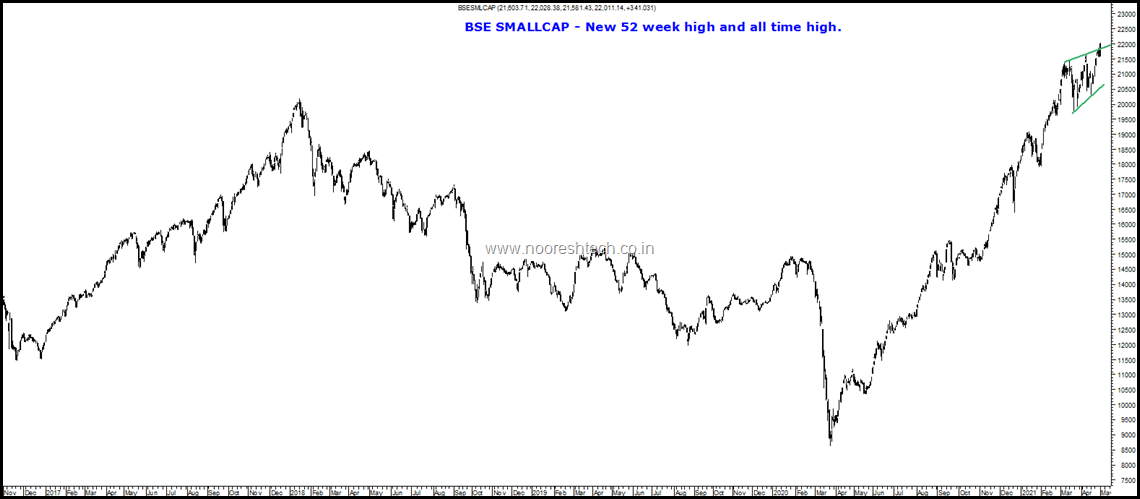

BSE SMALLCAP 100

Divergence in BSE Smallcap & Nifty

The recent divergence is not Smallcap diverging with Nifty but the other way round.

Nifty has diverged with every other Index Nifty100/Nifty Next50/Nifty Midcap 100 due to the top heavyweights – Reliance, HDFC Bank, HDFC, Infosys and some others going sideways.

Finally the reversion from the period of 2018-2020 where Nifty kept on making new highs but rest of the indices could not.

We would get scared if Bse Smallcap starts diverging with Nifty500/Nifty Equal Weight/Nifty Next 50.

Its time to remain stock specific and ride.

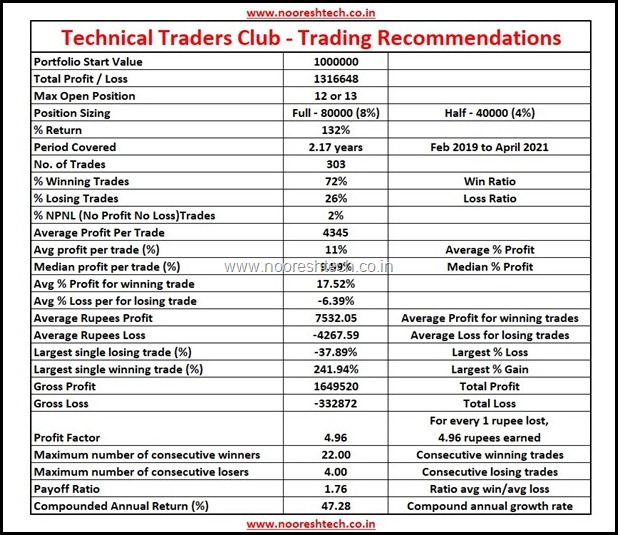

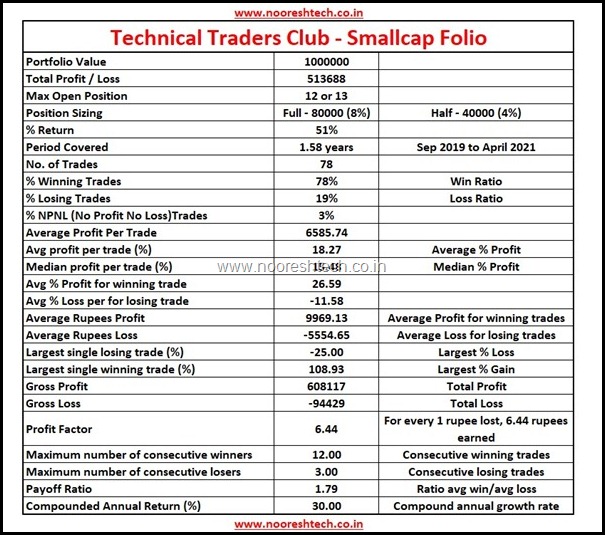

Research Services

Subscription Link

Half Yearly = Rs 15340. ( Including GST )

Annual = Rs 25960 ( Including GST )

( No better time to talk about performance ![]() )

)