Nifty Technical View

- In a tight range 14100-14150 on downside and 14700-14750.

- Lower Tops and Lower Bottoms but not sharp ones, indicate a correction and consolidation period.

- A move beyond this might need some positive or negative triggers.

- Momentum if it can cross 14750

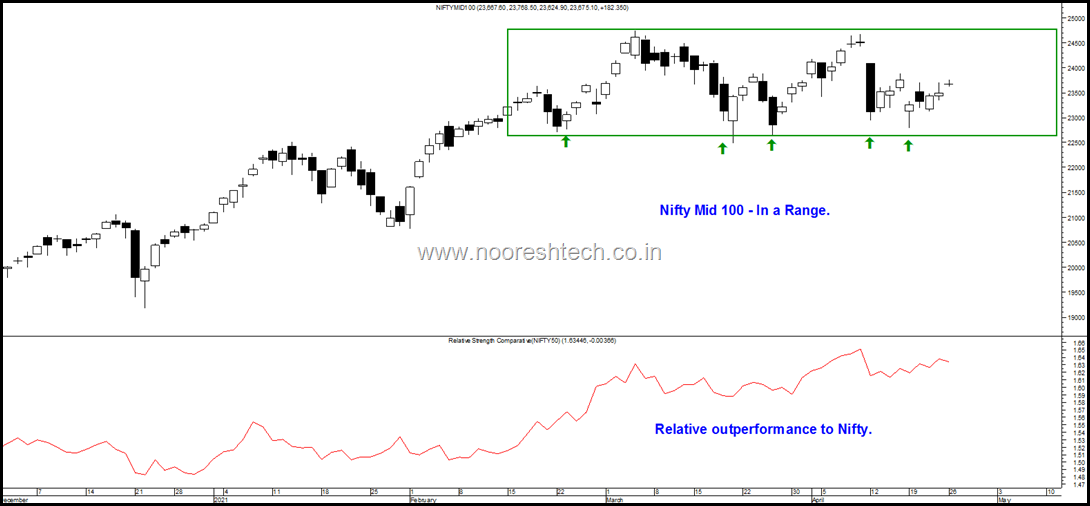

Nifty Midcap 100

- Flatter range with almost 3-5 bottoms around the same zone.

- Relative Outperformance to Nifty

- Stock specific action to continue but could be more selective.

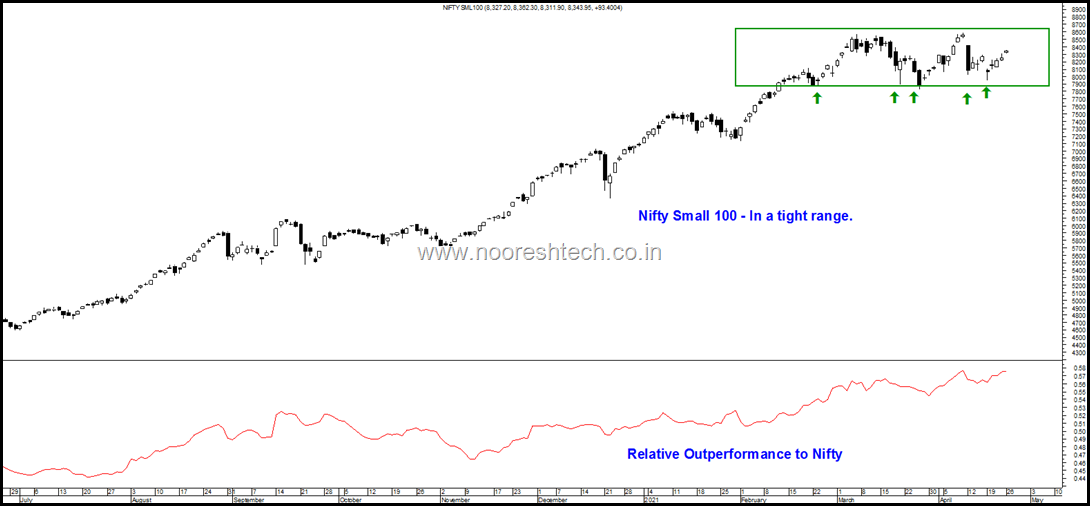

Nifty Smallcap 100

- Flatter and Sideways range with 3-5 bottoms around the same zone.

- Relative Outperformance to Nifty not due to a major upside but lesser fall compared to Nifty.

- Time to be Stock Specific.

Sunday Thoughts on Nifty

- The current market behaviour looks similar to the 2015-2016 period.

- The Index broke out into multi-year highs after 6 years and a strong sentiment on back of Indian Elections. Nifty went from 6300 to 9100. Earnings did not deliver.

- The Rally which started in March-May 2014 lasted for a year, very similar to the current move.

- In 2014-2015 - Nifty at 8700- 9100 was higher than the 2008 highs of 6300. At the same time BSE Smallcap could only go back to 2010 highs.

- Similarly In 2020-2021. Nifty at 14500-15500 is higher than the 2018-2020 highs of 11100-12430. Also a clear higher top and higher bottom formation since March 2020. At the same time BSE Smallcap has only gone back to the highs of 2018.

- BSE Smallcap continued to outperform in 2015 even with a declining Nifty and there were very strong stock specific/sector specific moves. Sectors like Chemicals/Textiles and stock specific cos ( some of the cos we covered ) did really well.

- The Smallcap Divergence became extreme in end of 2015 and we saw a good correction in 2016. That was the next big opportunity.

- We do not expect a similar dip like 2016 but could see an opposite of it after this time correction.

- Post 2015 the earnings did not deliver. Given the low base and post second wave we could expect earnings to deliver between 2021-2023.

- Stock Specific and Sector Specific Moves can continue over the next 1 year.

- We may not see a similar crack like what happened in 2016.

- For the medium term we watch for 14750-14900 and 13600-13800 as trend change zones.

Conclusions

- No two market cycles are exact but at times can be somewhat similar.

- After a strong one year rally we are now into a consolidation and correction zone.

- A good strategy would be to focus on Stocks and Sectors rather than the Market Trend.

- A few sectors/stocks can go up 50-100% with Nifty being in a 5-10% range.

Starting with a new batch of ANALYSE WITH ME from 4th April . Check this video for a quick take https://youtu.be/K92k4V_BAaY

The Post - https://nooreshtech.co.in/analyse-with-me

Fees Rs 6000

Payment Link https://imjo.in/D4cw7m

Ideally, if you do not have a background in Technical Analysis its preferred you go through the Online Technical Analysis Video Course

Online Technical Analysis Video Course https://youtu.be/fJYX1TP0a6I

Fees Rs 6000.

Can buy the course from this link and go through the entire curriculum ( Course Content & Curriculum )

https://www.analyseindia.com/course/onlinetechnicalanalysiscourse/?tab=tab-curriculum

( This has the same no of hours of videos as the Classroom course but comes with a 1 year access.)

April 26, 2021

very good analysis…..Keep up the good work.