Posting a few Interesting Global Charts which could drive a lot of longer term trends. Just putting a few question marks with the charts as I have no clear answers but Price Action going forward would give better indications.

1) The Dollar Index

The Big Chart which is on everyones radar on the World and seems to be driving the flows across different markets.

2003 and 2021 ?

Finally the time for Emerging Markets to outperform Developed Markets. Barely any return in Nifty50 in Dollar Terms – Check this Post - Most Interesting Nifty Chart–Nifty50 USD and BSE Dollex 30.

Remember the last biggest Emerging Market Trend started in 2003-2007 and also coincided with the Commodity Bull Run. 92 and 88 mark to watch for.

The Daily Chart – Holding on to 92 mark.

2) Dow Jones & S&P 500 & Nasdaq 100

Nasdaq 100 – Will it blow out again or go into a much longer pause.

Dow Jones – Consolidating around all time highs.

S&P 500 – Consolidating around all time highs.

3) VIX – Back to the 20s.

Still a bit higher for DJIA VIX but back to the low 20s. Fear Reducing – Will Corona also Start Reducing or another wave ?

India VIX – Back to the 20s.

4) Global Indices

Brazil – breakout and doing well but still below Covid Highs.

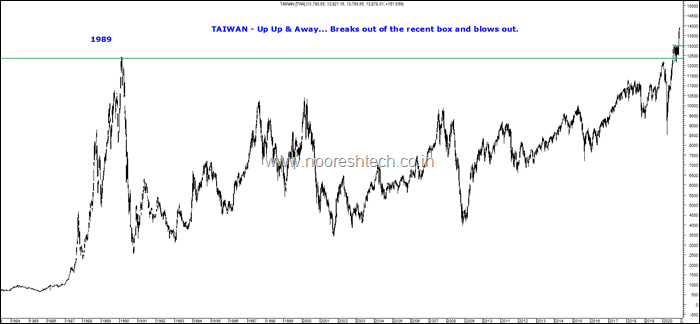

Taiwan – Up Up & Away. Was in a box recently. Breakout done. At a 25-30 year high.

South Korea – near a 2 year high.

Nikkei – 20-25 year highs.

DAX – back at the Resistance.

China – The big 3500 Mark. Back to 4-5 year highs.

Commodities – Gold Copper and Crude

A commodity Cycle doing well with falling dollar etc is also indication of Economic Growth coming back. Are we looking at a few years of Commodities doing well, Inflation coming up, GDP Growth, Flow of Money from Developed to Emerging Market etc ?

There is a thought that Value should outperform Growth when there is Economic Growth. Also cyclicals tend to go berserk in such periods.

Time to look for Value Plays ?

Gold – Losing Momentum and critically placed at 1800-1850

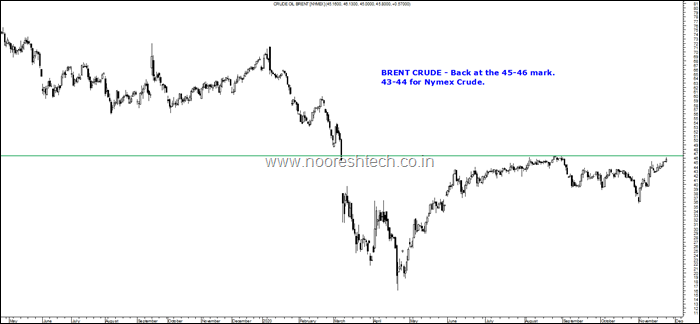

Brent Crude – Taking this instead of NYMEX as this does not show the sub zero reading. 43-44 on Nymex and 45-46 on Crude is a major resistance. Sustaining above could mean a bigger move.

Copper – One of the indicators of Economic Growth has been in a downward or consolidation for a long time. Back to testing 6-7 year highs.

Conclusions

- A lot of global charts are at a point where it seems a lot of big longer tremd resolution can happen.

- 50k crores of FII Flows received in less than a month. Highest ever. Is this just a flash in the Pan or a Structural Shift?

- Emerging Markets reversing the last 10-15 year trend.

- Value versus Growth reversing a 10-15 year trend.

- Commodity – A gone story is making a comeback.

- After 12 years of pumping trillions of dollars are we finally going to see some inflation ?

- Large is Best- Will that change with Economic Growth – SmallCaps/Midcaps to shine again ?

- A lot of answers to above questions seems Yes , but a lot of follow up price action in coming weeks and months will confirm that.

Brief Video on Product Offering – Online Video Course and Analyse with Me -

After receiving a lot of inquiries,Have created a small video explaining the course offerings

Online Technical Analysis Video Course https://youtu.be/fJYX1TP0a6I

Subscription Link - https://imjo.in/jWW5cg Rs 6000 1 year access.

Analyse With Me – A Practical Approach to Technical Analysis https://youtu.be/K92k4V_BAaY

( Do Join as quickly for the Oct-November Batch.) https://imjo.in/M43ejX