Ever since the March bottom the Markets have continued to make higher tops and higher bottoms across the world. All of us have been trying to spot the trend reversal and a big correction which has remained elusive. The last time I looked for a short , got stopped out the next day itself.

Very recently when Nifty dipped to 10900 we looked at how we need to wait for Global Indices to bend to confirm a trend change.

Nifty is close to breaking the momentum if it goes below 10800. Need to watch for a similar trend change in S&P 500 to confirm.

This link - https://nooreshtech.co.in/2020/08/nifty-and-sp-500-copy-paste-moves.html

Nifty reversed from those zones and went back into the trend. Also we looked at how every Index in the world has been almost in a similar trend in this post - Global Indices–Everything is UP. Also this video on the Copy Paste Moves in Dow and Nifty50 Co-Relation

Till now we have been watching very closely and riding the trend and waiting for the trend to bend.

Below we look at the Top Five Charts to watch for a Trend Change confirmation and the Price Zones.

Nifty 50 – The Last Swing Low at 11100.

Holding on to the support line. Last Swing low at 11100 and the Engulfing Bear Candle at 11800 are the two defining points of the short term trend.

Nifty Equal Weight Index – The last Swing low at 11450.

Given the concentrated nature of the Nifty50, we have now started looking at the Nifty50 Equal Weight to confirm the trend change.

S&P 500 – The Leading Indicator of Trend & Momentum always. Watch the 3320-3400 Mark.

This is well into the Highs and now 3400 the last high is the first support to watch for and next the swing lows at 3320.

Dow Jones – The Leading Indicator of Trend & Momentum. Watch the 27400 mark.

The last highs and swing lows around 27400.

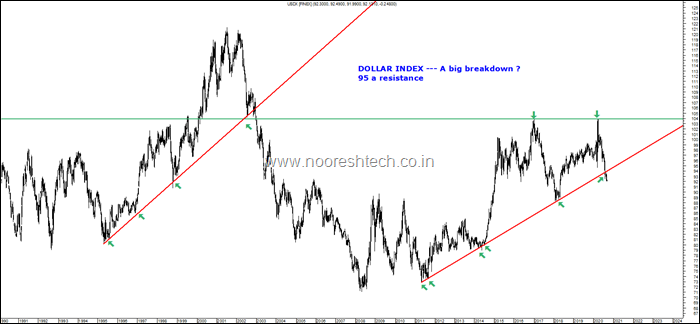

Dollar Index – The Long Term Risk On in Making. Short Term Oversold.

The last Bull market in Emerging Markets got triggered by the big Breakdown in 2002-2003. A similar breakdown on cards in the future?

Short term over sold at current levels.

Would look at above 5 to turn together or most of them to confirm a trend change.

The Other Indian Indices and Global Indices also to look out for the Structure of the Market.

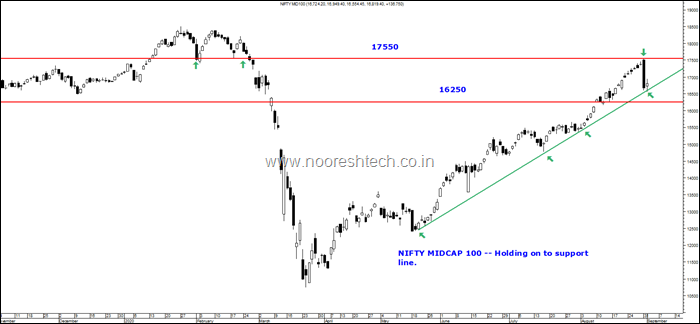

The Midcap 100 Index – Holding on to the Support Lines.

A deep crack from the last breakdown zone. Watch the 16250 and 17550 mark.

Nifty Smallcap 100 – Holding on to the Support.

BSE Smallcap – The Kachra Index of India. A unique index which depicts the bottom 15% of BSE Allcap. Has 700-800 stocks.

Pausing at the 2 year resistance. Longer Term picture improving once it can finally sustain above the 15200-15500 mark. The near term support at 13750 to watch for a bend.

Had recently put this tweet indicating a pause going forward.

https://twitter.com/nooreshtech/status/1296671399919202304

A combination of Midcap and Smallcap Index charts will give hint of the next Big Moves going forward. Find BSE Smallcap Index a good index to co-relate with Nifty.

The Global Indices – Knocking at Resistances.

Some part of the world is knocking at major resistances.

China – At a multi-year resistance. Can it break out or Flop.

Germany – Knocking at the Resistance.

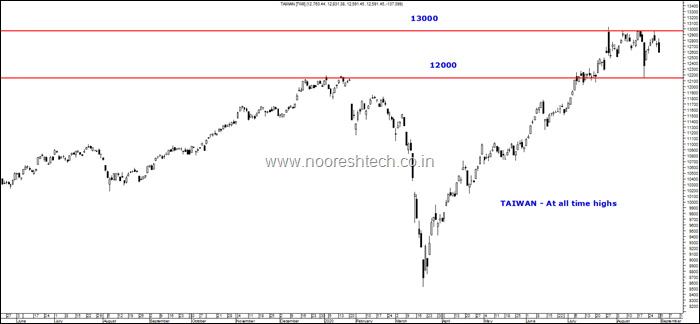

Taiwan – All time highs and now into a range.

Nikkei – Knocking at the Resistance.

Would watch above Global Indices to see the Trend across other Markets.

Conclusion

- We need to simply watch for confirmations across the Top Five Charts to confirm a trend change given the strong co-relation since March Lows.

- The Midcap and Smallcap Indices will also indicate the shift of momentum going forward.

- The Global Indices did not see a 2-3% crack like we saw yesterday.

- Continue to stay alert and avoid over-leveraging given the extent of the move and the multiple resistances. Ride stock specific, sector specific. If its a pause we may see sector Rotation.

Do go through the following Links ![]()

Brief Video on Product Offering – Online Video Course and Analyse with Me -

After receiving a lot of inquiries,Have created a small video explaining the course offerings

Online Technical Analysis Video Course https://youtu.be/fJYX1TP0a6I

Analyse With Me – A Practical Approach to Technical Analysis https://youtu.be/K92k4V_BAaY

Advisory Services

Technical Traders Club https://nooreshtech.co.in/quickgains-premium/technical-traders-club

QuickGains F&O - https://nooreshtech.co.in/quickgains

For any queries whatsapp on 7977801488 or call on 9819225396 ( after market hours )