The number of articles on Favipiravir and Glenmark Pharma have shot through the roof and almost everyone news sites, magazine,business channels have covered it. The message went viral on whatsapp groups.

With almost no knowledge on Medical Terms I will be looking at the topic from a perspective of– 1) Stock Price moves of Glenmark Pharma & 2) Search Trends on Glenmark & Favipiravir.

1) Glenmark Pharmaceuticals

Price Movement

The stock is in futures category, hence no circuit limits.

- Stock price shot up 40% in the day and closed 27% on 22nd June 2020. Added almost a 3000-4000 cr market cap coz of this move.

- Stock price fell 6.7% on 23rd June 2020.

From a low of 160-200 in March the stock has moved up to 500+ but is still down from peaks of 1250. Still below the peaks of 2007 bull market.

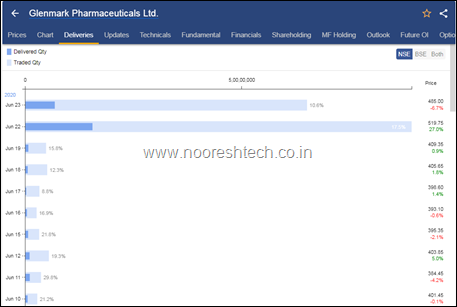

Volume Data

- Generally sees 15- 20% delivery volumes which is normal for it.

- On 22nd June 2020 the volumes were 8.92 cr on NSE against a normal average of 50 lakhs with a delivery percentage of 17.5% and Delivery Volumes of 1.55 cr shares.

- Today it traded a volumes of 6.5 cr shares with a delivery percentage of 10.6% and Delivery Volumes of 69 lakhs.

- Not taking BSE as it was another 10 odd lakhs delivery each day.

Source – web.stockedge.com

The Curious Case of Glenmark Pharma

- The total number of shares of the company are 28.2cr shares. 1.55 cr delivery volumes on 22nd June 2020 means almost 5.5-6% of the company shares in delivery volumes. Add another 2-2.5% today.

- Almost 11-13% of Free Float got delivered on 22nd June 2020 !!

- Even though the company is categorized as a Midcap and SEBI Classification hardly any Mutual Fund owns it apart from HDFC Mutual Fund as of May 2020 – Source – . Also over the years Mutual Fund holding has remained almost low at 2-4% of equity even in Pharma Bull Run.

- FPIs own around 28.51% of the shareholding down from a peak of 36% in 2015. For

- Only one known investor – Ashish Dhawan is seen in the shareholding in last 2 quarters with a 1-1.25% stake.

- For a 10000-15000 crore market cap company its unusual that almost no Mutual Fund owns it.

- The only name in the bulk deal was a FII which sold 18.8 lakh shares on 22nd June 2020.

- It would be interesting to see almost 700-1000 cr value of Glenmark traded was bought by whom.

- The shareholding at the end of the quarter will tell us if Mutual Funds or FIIs bought or it was all Retail !!

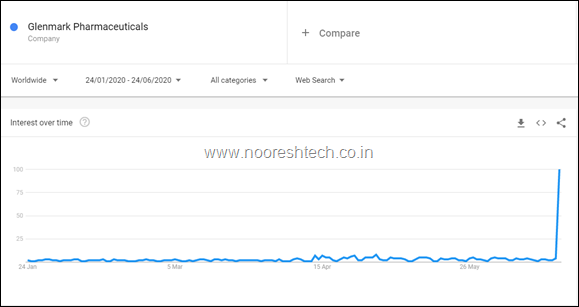

The Search Trends

- The Revenue estimates for Favipiravir drug for Glenmark is not more than a 100 cr or a few 100 crs at max. This led to a 3000-4000 cr market cap gain in a day. A small news article

The Search Trends for Glenmark and Favipiravir have gone through the roof in India and the World. Google Trends for last 5 months.

Favipiravir did see an uptick in March.

Conclusion :

- A quick reading on the net it suggests Favipiravir drug cannot change the fortunes of Glenmark Pharmaceuticals in terms of revenue or profits. So if you do want to buy or sell the stock, do your own research on the total business of the company.

- Just because a company is covered by all news sources does not make it a great buy. Do your own research.

- Even with a 5-6% of the company getting traded in a day and not a buy name in the bulk deals and hardly any Mutual Fund ownership suggests there is no major institutional interest in the company. ( We will know more when the quarterly shareholding pattern comes out. )

- Would be interesting to see who bought the 25-40% pop. Was it retail or institutions. Will wait for the Quarterly shareholding and Mutual Fund Factsheets post current month.

- I have no major view on the stock price but a simple technical take would be the opening and low price of 450 on the announcement day is important. If it does not hold up it makes the technical trend negative. A fresh look technically if it can sustain above the highs of 550-570. But preference would be to do nothing

- No Positions on the stock or understanding of the company just a view based on publicly available price and volume data. Do your own research – Not a recommendation to buy or sell.

DISCLOSURE Nooresh Merani

Securities covered above: Glenmark Pharma

SEBI Registration disclosure - Investment Adviser ( INA000002991)

Financial Interest:

Nooresh Merani and his family/associates/ analysts would not have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

Also read the detailed disclaimer - https://nooreshtech.co.in/disclaimer

June 24, 2020

I think a lot of hype has been created since Friday, 19th June business closing hours and every one was flashing a copy of the Glenmark’s intimation to BSE/NSE on the development on various whatsapp groups. If it is going to generate a revenue of only Rs. 100-150 crores, then, why such hoopla. May be something which the market sees and we don’t.

June 25, 2020

Will GLENMARK TOUCH 600 IN 1 WEEK?

June 26, 2020

I dont think so.