A quick look at Index charts.

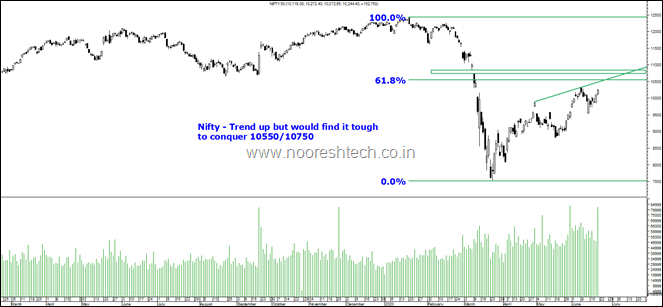

Nifty50

- 61.8% retracement at 10550.

- Last top at 10330 and gaps at 10330/10750.

- Good Volumes on upticks indicates trend is still up.

- Expect some tough time around 10550/10750.

- Time to ride but be alert and cautious. Be Nimble to turn quickly.

Bank Nifty

- Quite a few attempts between 21000-22000 have failed in last few months.

- Crossing and sustaining with momentum required for a further dash to 24k/26k

- No more the leader in the Nifty. Ratio charts show the struggle. Still below 38% retracement.

- The move would still be a quick trade and not something to be excited above in the longer term picture for now.

IndiaVix

- IndiaVix is still high in the 30s.

- Consider this pre-elections 2019 it peaked at 28.

- Price action has been strong but fear still suggests we are in a consolidation!!

- Going into 15-25 will be an indication of covid19 impacts digested.

- IVs will remain high but volatility may not be as high as march 2020. Time to work option strategies.

Nifty Midcap 100

- After a very contracted range for last 2 weeks there is some movement out of the box. Same is the case with smallcap index.

- Quick nimble trades in midcaps/smallcaps. Got to be alert and strict with stops.

Nifty Pharma

- Showing leadership signs by holding on to the breakout.

- The large pharma weights like Sun Pharma and Dr Reddys have not shown momentum but rest all have been in great trends.

- Has been a crazy move in many microcap pharma names. ( be careful)

- Further follow up needed from large names for this trend to start.

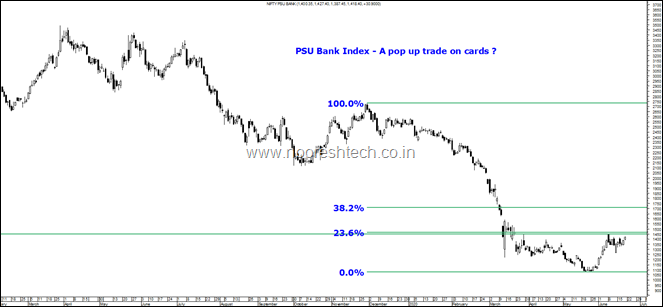

Nifty PSU Banks

- PSU Banks from bad to worse post the Covid crisis.

- Finding it tough to even cross 23.6% retracement.

- Lagging behind a lot. Can see a pop up move of 20% in small psu banks. Strict with stops – Can bank above 110 and Bank Baroda above 50 would confirm that.

Conclusions

- Trend is up in Nifty50 and momentum strong in midcaps and smallcaps.

- Bank Nifty and PSU banks can be on radar for a pop up quick trades but with strict stops and on follow up only.

- A lot of smallcaps/midcaps have seen good price volume actions and on follow ups could be good trades but one needs to keep strict stops and book partial profits as Nifty is getting close to a tough zone.

- If you cannot be nimble-footed this may not be a time to participate.

https://moneycontrol.com/news/business/pro-masters-virtual-join-live-summit-on-june-12-at-5-pm-with-nooresh-merani-on-discover-big-movers-and-losers-using-price-volume-analysis-5388521.html… Link for Recording of - Nooresh Merani on “Discover Big Movers and Losers using Price Volume Analysis” ... Its only for #MoneyControlPro users

SPEAKER AT BEAR SUMMIT 2020

My Topic - The Next Bull - Identifying Bottoming Out Patterns after a Bear Market. For Bear Market Summit 2020. Registration Link – Has interesting set of speakers.

Do Read this post if you have not.

Opportunities in Bear Markets and Consolidations post 1992, 2000, 2008 and 2020.

ONLINE TECHNICAL ANALYSIS COURSE

The Full Course on Technical Analysis is now uploaded and can be bought digitally with 1 year access to the recordings.

The Course is divided into 4 sections

Section 1 – Introduction to Basic Technical Analysis Concepts.

Section 2 – . Technical Analysis Chart Patterns, Indicators, Trendlines.

Section 3 - Practical Technical Analysis – How to use it to invest,trade, find sectors, Full time Trading.

Section 4 – Various Softwares and Utilities.

Bonus – One Webinar for Q&A. Batch of 20 every time. Details to be sent on email.

More than 12 hours of content.

Course Fee = Rs 6000

Can buy the course from this link and go through the entire curriculum ( Course Content & Curriculum )

https://www.analyseindia.com/course/onlinetechnicalanalysiscourse/?tab=tab-curriculum

Whenever we add more videos you will get an e-mail for us.

For any queries or payment confirmation mail to nooreshtech@analyseindia.com or whatsapp on 7977801488

June 25, 2020

Its very useful for Traders and investors