The best recovery in the current move has been in Pharma and FMCG.

This has always been the case in the first recovery after the downleg the defensives do really well. If the view is the current bounce should pause at 50% of the recovery say 10k max , pharma and fmcg are the two sectors to avoid. Even the other defensives like Asian Paints, Pidilite have seen strong recoveries.

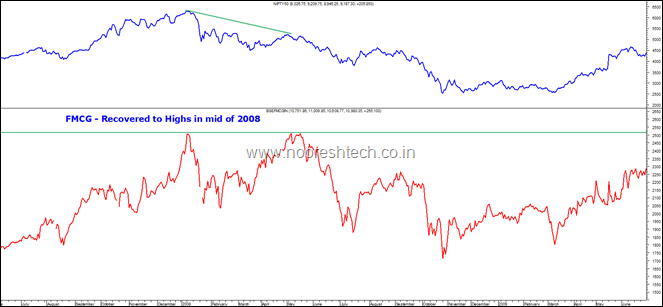

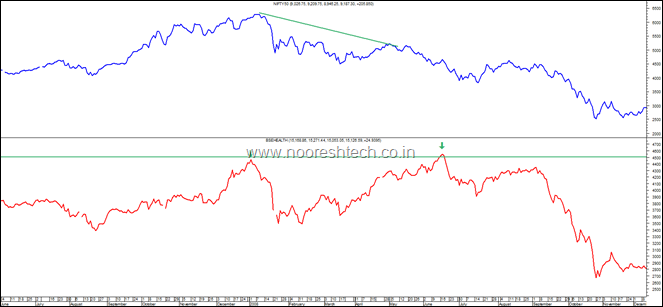

Although it is not right to compare 2008 but in middle of 2008 Pharma and FMCG went on to hit new highs. The next leg of the fall they got hit quite badly. If your view is we may not see a dip back to lower levels then its a different case.

Nifty & FMCG in 2008

Nifty & Pharma in 2008

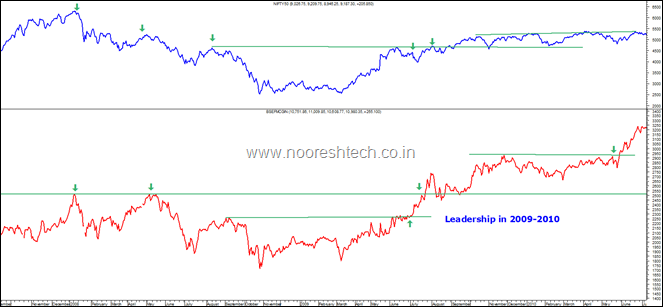

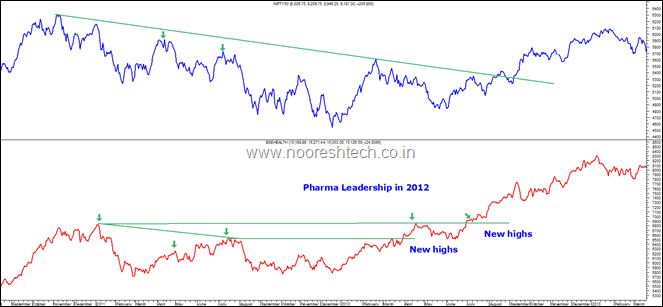

The leadership of the two sectors only got defined clearly in 2009-2012. So one may wait for price action of the sector after the next dip. If it is a leader then it would be the first one to break into new highs.

FMCG – Clear leadership in 2009

Pharma – Clear leadership in 2011-2012