For the last 2 months Nifty has been in a range of 10500-11000 broadly.

Sloping trendline breakouts on either side have given whipsaws.

At the same time the broader markets have continued to drag lower.

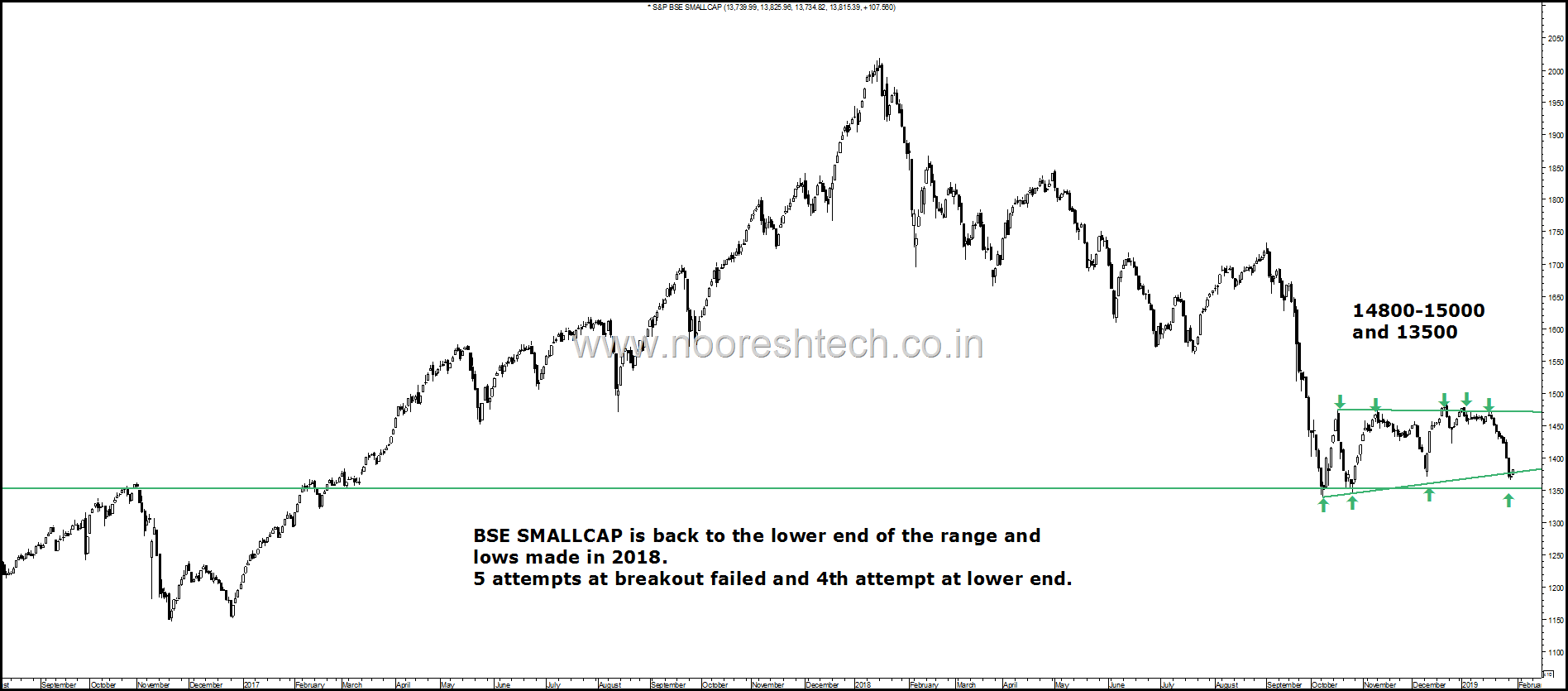

BSE Smallcap Index made 5 attempts at upper end of the range and is now making 4th attempt at the lower end of the range.

This is the index i would keep watching out for a major trend change whenever it crosses 14800-15000.

Even Worldover we are seeing a lot of whipsaws. The only difference is Smallcaps in India have not bounced back.

Taiwan – A double Bottom. Reversal above 10100-10200.

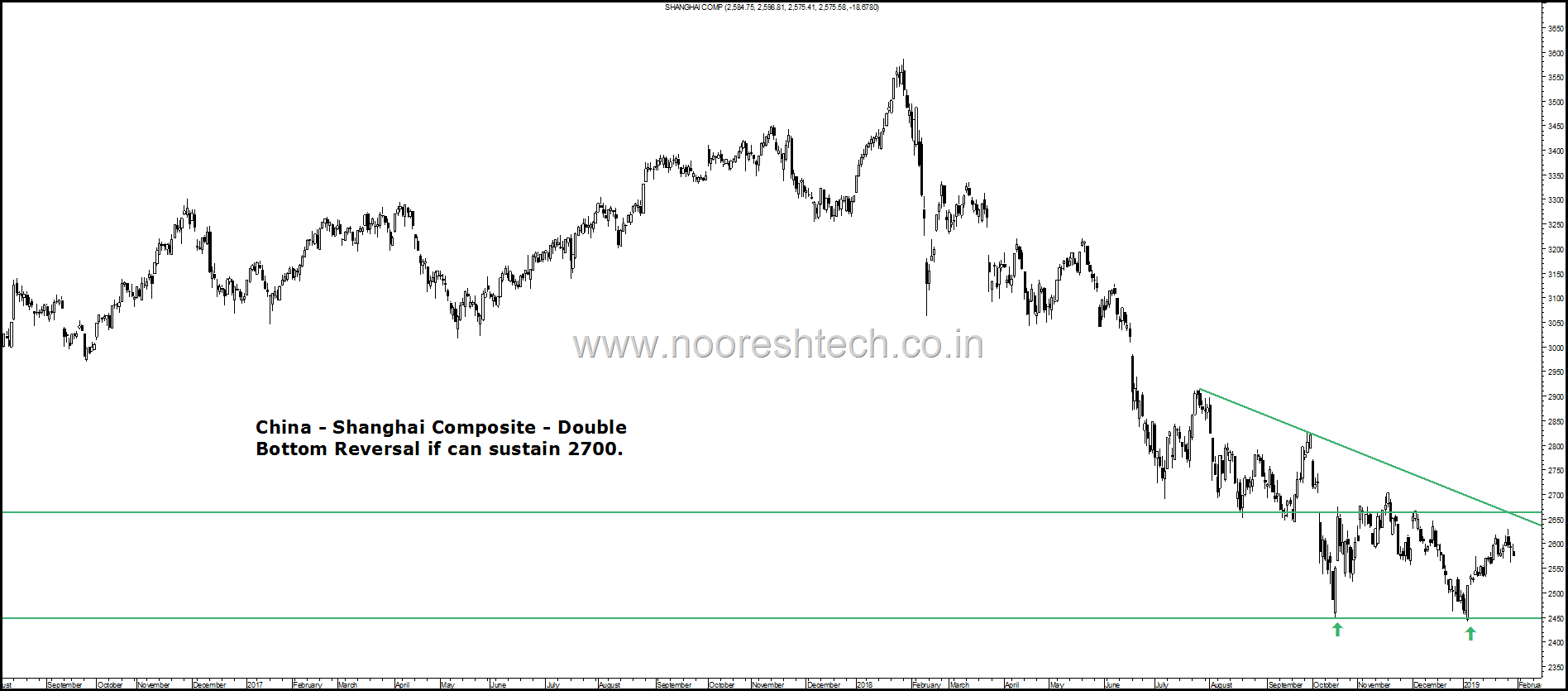

China – Shanghai Composite – Is the tide finally turning for China ?

Double bottom done. A sustained move above 2700 would indicate a major trend change.

S&P 500 – Almost tested the long term trendline. Now back above 2550-2600 breakdown zone.

Russel 2000 – A sharp fall and a sharp recovery. Now back above the breakdown point.

Nikkei – Bounced from the support line and is now just above the previous bottom break. Will it be a whipsaw like other indices ?

Hang Seng – Good base made at 24500 and previous breakout zone. Trendline breakout done. Sustaining 27500 would imply a move to 30-32k.

Dow Jones – The biggie.and a big whipsaw. Now back above the breakdown zone of 23500-24500.

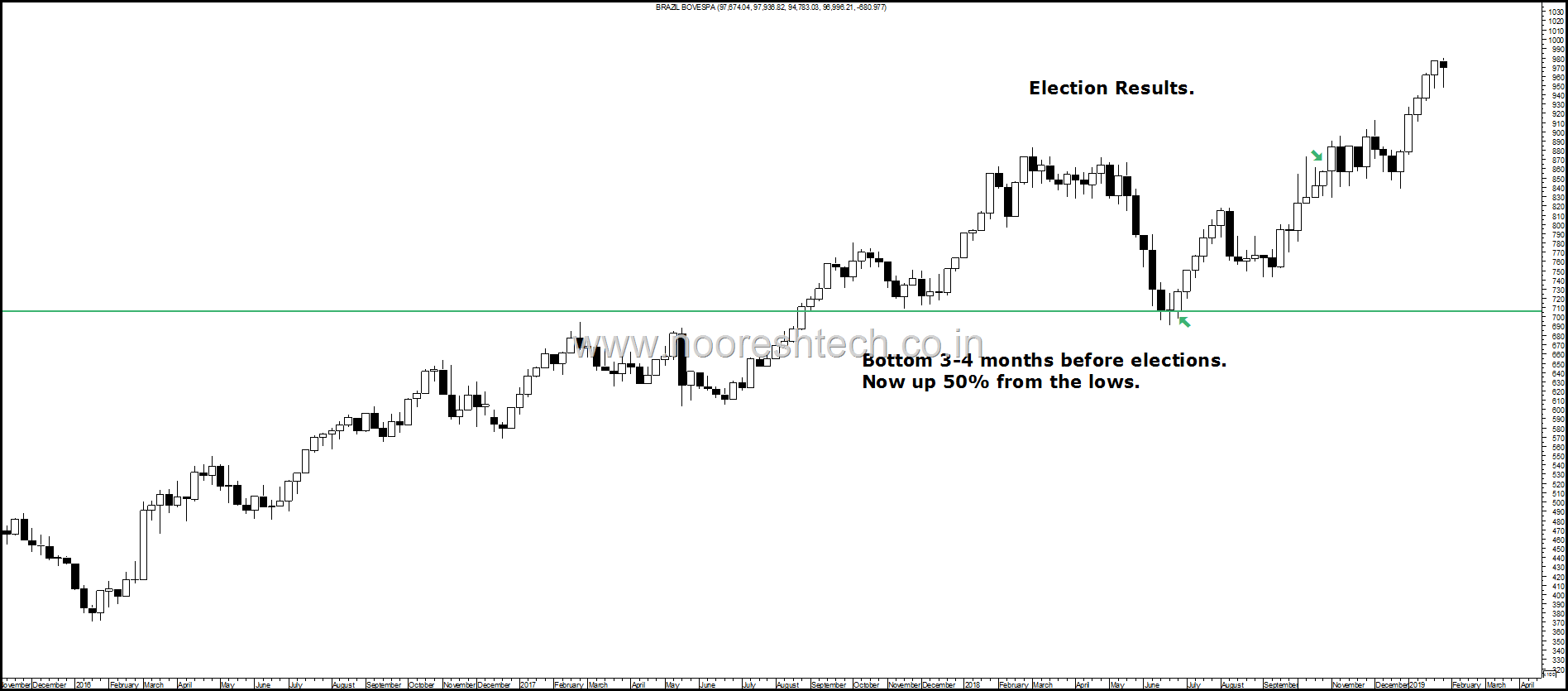

The only Index which has been making new all time highs is Brazil. After the election results.

Brazil – Index made a low 3-4 months before the elections. The rally since then has been 50%

Conclusion -

Range bound moves do not stay for a long period of time and it will give a trend change over the next few weeks/months. A sideways market is much more tougher to digest as there are a lot of whipsaws and stoplosses for traders and for investors every time there is a hope for recovery or opportunity the market turns.Last time we saw such a divergence of Nifty with broader market was in 2013.

Who would have thought Smallcaps would manage a major recovery in 2013. But the smallcap Index went up almost 4x from those lows. We are now down 30-35% from on the Smallcap Indices from highs of 2018.

Do read this article - https://nooreshtech.co.in/2018/09/smallcap-index-cycles-2005-2018-its-darkest-before-dawn.html

Technical Analysis Training Mumbai

Date:

2nd and 3rd February

Timings:

9.30 am to 6 pm

Venue :

Hotel Karl Residency

36, Lallubhai Park Road

Andheri (W), Mumbai, 400058

Maharashtra – (India)

Fees

Rs 16520 ( 14000 + 9% CGST and 9% SGST ) ( No Discounts )

Registration and Payment Link

https://www.instamojo.com/analyseindia/technical-analysis-training-mumbai-2nd-and-3/