In the last few sessions Nifty is down 1% from the peak but the Smallcap Index is down 5% from the peak.

Although the signal which makes me more scared is if Nifty goes up X% and Smallcap Index goes up 3X%

Since the bottom in Demonetization the Nifty is up 18-20% and Smallcap Index is up a good 30% or more.

The above reaction suggests we may now see more volatility in Smallcaps and one needs to be careful if using leverage or speculating without a good discipline / risk management in Smallcaps. Going ahead even the rally in smallcaps will be much more selective.

So if you have bought a lot of microcaps with no research then its a time to be careful.

Timepass Observations.

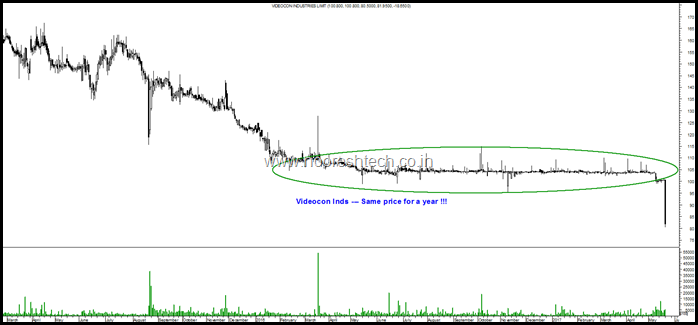

Very recently I had tweeted about a chart – Videocon Inds

#VideoconInds - How can a stock trade at same price 100 for a year 🙂 pic.twitter.com/N8wTN57HmT

— Nooresh Merani (@nooreshtech) May 8, 2017

The chart has now finally broken down

This action looks very similar to what happened with Bhushan Steel

Generally i avoid posting breakdown as there is no way to profit from it …