This is very common with a lot of retail investors. Trying to buy stocks discussed on business channels/ blogs/ train talks and what not.

Either they sell out on the first dip after the euphoria and miss out on the best multi-bagger or they hold something so long till it totally erodes its value.

This is a very old slide in one of my webinars 🙂

Although in a bull market buying something being talked of a lot can make a lot of money if you exit well ( thats damn difficult). .

There are many examples of previous bull market RNRL went up 10 times, RCOM was 7th highest weight in Nifty, Punj Lloyd was the next L&T and Suzlon was in Nifty. There will be 100s of such names.

Do your own research or you will be in the cycle for a long time.

A better way is to do a little bit of self-learning on fundamentals and technicals. Above all use common sense.

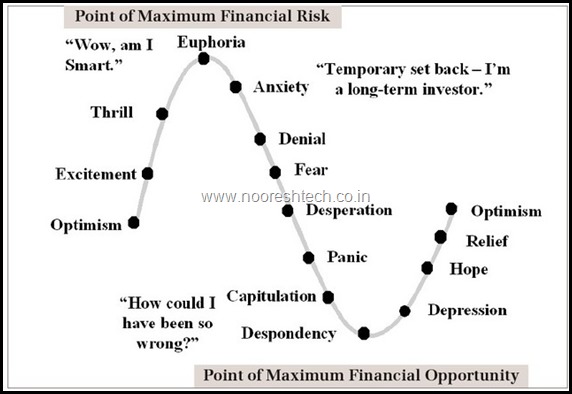

This is another image which is of a lot of help.

Equity Sentiment Cycle - Fear and Greed.

So where do you think are we ?

( Will post the results in next post. It would be interesting. Do fill and pass it on. )

Please fill the poll.

December 25, 2015

We are at the excitement stage of market cycle…