In my previous post - Proprietary Investors Conference – Edelweiss and Kotak Notes – Kenneth Andrade’s Talk and More had mentioned about I do have a view on the Broking Industry and will write a post on it. But instead of writing just on broking trying to add some more titbits and make it a less boring post.

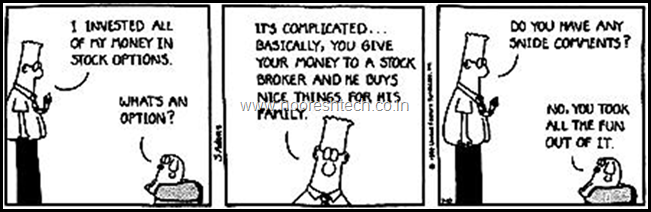

In this article I ll be talking about Financial Crimes.

What is a Financial Crime?

A financial act of negligence by an individual which leads to a loss or opportunity loss in his Financials.

I am not the best Guy to talk about Financial Crimes in Huge Savings/Current Account , High Brokerage, MF Distributors, Insurance.

Let me first tell you that I have never tried to understand Retail Broking as a business. Funny part is since 2006-2011 I used to operate from a sub broking office of my mentor - N S Fidai. We also tried setting up a Broking Master Franchise which fortunately we closed in 6-12 months as well as the sub broking outfit. But all through I never really made an attempt to understand broking as a business or otherwise.

If thats not enough I do not really understand Banking as well even though my Dad retired after working in a Bank for 25 + years. I also ended up messing up a couple of withdrawal cheques from the broker in wrong bank accounts or something and the amount landing in suspense account in a Bank. Luckily bank called in 2008-2009 and my leverage trading account turned to profit from drawdown not realizing I had pulled out my risk capital. So I am still laughed upon in the family of bankers ( my dad , my mama n mentor and even in laws are ex bankers). I try to put the blame on my focus on Advisory Business and Equity Account but does not help.

I was used to keeping a lot of money in my Savings/Current Account. Never have had adequate Insurance but now i do have Term Insurance. Did Invest in the worst Tax Saving Mutual Fund. ( luckily it was small as always been a direct equity).

But in the last few years have tried to improve and reduce the Financial Crimes I commit. ( Not counting ones i do in equity investment/trading.)

In this year I did attend - "Design your Financial Life" by Manish Chauhan and Nandish Desai of www.Jagoinvestor.com . That is where i heard Nandish say - " It should be a Crime to keep lakhs of rupess in a Savings Account."

Thats how the phrase Financial Crimes. If you are looking for Personal Finance then do look into www.jagoinvestor.com ( Manish is an old friend and an amazing financial planner).

The reason am telling you my story is there are many Financial Crimes we commit and pass the blame on to sad excuses like - Job se time kaha milta hai etc. The incidence of such financial crimes are more from the people in the financial industry itself.

There are somethings which you can change without much of a Hassle. I will just mention the crimes. You all can find a solution. Anyways if you dont your Balance Sheet is getting penalized for it.

Also it does not take much time to make a huge saving by avoiding Financial Crimes.

1) Huge Savings/Current Account Balances.

This is the most common mistake by everyone because of lethargy and nothing else. There are many possible fixed income possibilities in shorter durations and very liquid.

2) Mutual Fund Investments through Distributors.

A lot of people do buy Mutual Funds through intermediaries/banks without even knowing that they are paying a good commission for it. The crime part in it is that commissions continue for as long as you are invested. The distributor deserves a commission if he is giving you good advice and will be hanholding you through good and bad times. But there is always an alternative for paying through Advisory and going direct. But anyone else who does not give you advise does not deserve a % cut in your investments.

There is something called Direct Plans of Mutual Funds. I leave that fior you to google it or find a good Investment Adviser.

3) Insurance

I believe Bad Insurance is better than No Insurance but it does not imply you keep sticking it on to terrible Insurance policies suggested by your friendly neighbour/relative.

Apart from that I had a case of a senior citizen couple being fooled into a high commission ULIP in 2007-2008. I get the fact they were old and not very knowledgeable and could be fooled but if you are still hanging on to those terrible policies or buying a new one then its a crime and your bank account should be penalized for it.

The simplest form of insurance is Term Insurance. There are quite a few articles on www.jagoinvestor.com and www.subramoney.com for the same.

4) Only Fixed Income/Real Estate and No Equity

I continue to believe Equity will be a preferred asset over the next decade in relative comparison to Real Estate/Fixed Income. Although it was not much of a crime in last 10-20 years because we had a risk free return zone of 6.5-15% over the time frame and Real Estate has done well too.

But if you have zero or low allocation to equity in this decade it will be a Big Financial Crime which will keep you jailed into a Job or Business and never allow you to retire unless you have inherited an empire or created one.

We are slowly shifting into a low interest economy as well as I believe Real Estate may underperform or perform inlin with Fixed Income in coming decade.

There is a huge difference in 5% tax free return and 10% tax free return in Retirement.

One big challenge is one cannot gift Mutual Funds/ Shares as Birthday Gifts/ Marriage Gifts and hopefully someday it will be Possible.

But till then I have started giving money as birthday gift to my nephew and friends kids with a sole purpose their supposed to buy Shares/Mutual Funds to be not sold till they are 10/15/20 years old. Even if my stock / mutual fund selection is bad it will not hurt as its gift but if it is good it might make a little difference and possibly create a culture of equity Investing. I do also suggest if i give X the friend/relative can put 5X or 10X of that in Equity or MF.

Would love some inputs on this and creative ideas.

5) High Brokerage

This is the biggest crime a lot of Investors and traders do.

Over the years Investors/Traders may have not really made money out of Trading and Investment but have been successful in creating Ultra Wealthy Brokers.

I was surprised to see that the Bank I had my first trading account which i closed ages back still charges 0.55-0.75% Brokerage for Delivery Transactions. Now thats a Financial Crime because even if you click on some link or call up the relationship manager it can change from 0.75 to 0.55 to 0.25 also.

Unless your Broker is adding a lot of Value to you in terms of Research/Customer Service/Technology or in any other format he does not deserve to take a big % cut every time you trade and Invest.

At the same time your local broker if he is helpful in call and trade , accesibility , tracking your trades, managing all family accounts and more benefits it would be fine to pay him some brokerage but if you are doing your own trades/investments without any interaction with the broker its a crime that you pay him a % cut in your investments/trades.

Discount Broking in India

If you are a trader/investor - I would suggest you look into your back office statement and see how much amount you paid as brokerage and stt. You would know there are two people getting rich by your trading - The broker and the government. Now you cannot bargain with the government but you can with the broker or find a discount broker.

For example you have 10 lakhs portfolio and you just buy and not sell it also for next 1 year.

The amount of brokerage you pay if you are charged 0.25% is around 2500 rs. Now consider you have done say 20 buy transactions it would be a brokerage of only 800 Rs. Thats a huge saving !!

The difference is a full service broker charges 0.25% on the value of transaction and a Discount broker charges Rs 20.

There is easily a savings of 50-98% of brokerage if you work with a Discount Broker.

There are some amazing discount brokers in India who are changing the way the Industry will function and maybe over the next decade the model of broking could itself change.

There are many Discount Brokers and various options available in terms of Fixed Brokerage plans and etc.

Before that let me just write a few pointers to be careful.

- Do not trade because the brokerage is low or zero. This leads to over trading.

- If you are more a call and trade and talk a lot with your broker it would not be easy to shift to a discount broker.

- The paperwork in opening an account has reduced big time as well as transferring and withdrawing money is easy. So dont be scared.

- Opening a Discount Broking does not cost much. Open it and use it as you get comfortable.

- If you are a Full Time Trader/Investor than its a crime to not have a Discount Broking Account.

- Broking is now very well regulated and majority of them are pretty reliable whether they are Full Service or Discount.

Discount Broking Alternatives in India

There are many alternatives starting from Zerodha, Indian Trading League ( Samco) , Tradejini , RKSV , SAS Online etc.

I am not much of a technology user in terms of broking or a customer service user of broking so its not nice for me to evaluate the capabilities of the Broking platforms of the above brokers.

But fortunately I can speak about Zerodha and Indian Trading League ( Samco) as I have met the owners.

Disclosure - I am not an associate of any of the Brokers and this is not a Paid Post.

I wont mind a miniscule % shareholding in the companies above 🙂 however small that is. If only they were interested.

Zerodha

The largest discount broker in India is Zerodha and think has almost 70k clients across India.

I met Nithin Kamath in September 2013 and at that time was working on an idea of profiling interesting people in various industries which did not work out but have a copy of the interview in my mail.

I was very impressed by his thought process and the company he had built. I would suggest you read through this interview below taken in September 2013. I like the fact that Zerodha team has worked on improving their technology over the last 2 years and a lot of the ideas have culminated into some amazing stuff for traders/investors.

In the last couple of years Zerodha has also created some amazing trading tools like Pi, Kite and varsity module. Suggest you check the varsity module even if you do not intend to have an account with them.

Now recently they have even scrapped the fee for Delivery based Cash Trades .

I hope to see much more new stuff from Zerodha given the capabilities of Nithin and his team.

2) Indian Trading League - Samco Securities

I have met Jimeet Modi even before the Indian Trading League and is a close friend of one of my good friends.

One of the few old brokers who have taken the step towards the new paradigm in broking - Discount Broking. Now thats a big shift from brokers who have been around 2 decades. That is one reason and another is they have

They do have some prizes for Weekly/Monthly Winners. You can check for more details here. https://www.indiantradingleague.com/

Apart from the above there are many others like Tradejini, RKSV , SAS Online and so on. Many have customized plans of fixed brokerage etc.

Retail Broking is going to see major shift in coming years but at the same time Institutional Broking, Equity Research, Technical Research, Financial Restructuring, Consultants and Wealth Management Services etc done professionally will be an interesting space. Will write about that space in next article.

Many of us tend to look for discount coupons/ online offers on e-commerce websites to save a few hundred bucks but are not interested to save thousands/ lakhs of savings in brokerage and other financial crimes like savings account/ insurance/ mf commissions.

So go ahead and start reducing your financial crimes and save some money.

From the savings above you can definitely subscribe to our advisory services and technical analysis training programs. 🙂 for a long period of time. We will honestly try that its not a financial crime to do so:)

December 19, 2015

Really Very Intresting Post..I hope concept of discount broking will change the world in this field..I’m already a client of RKSV Securities and really satisfied with their service..

January 5, 2016

great article!! keep it up