This is an interesting observation and remind me back of the days. Had started blogging in 2004-2005 with orkut and then this blog.

This is the chart

Nifty will it bottom at 7500-7600 or even go to what people talk about 7200. I dont know but my bet is 7500-7600 so am invested totally.

This is my old post in 2006

https://nooreshtech.co.in/2006/06/sensex-bounce-from-8800-8950-range.html

This could be wishful thinking.

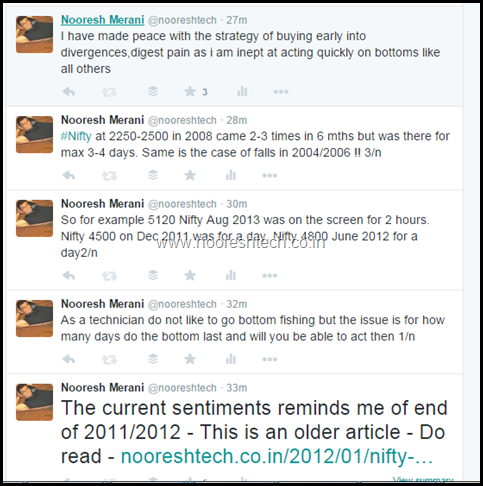

This set of tweets will show my strategy as to why am totally invested today. Will leverage either in extreme panic or on momentum reversal.

The big risk to this strategy is what after an interim bounce this is not Oversold and a Correction in a Bull Market ? What is this is 2008.

This is what helped me decide in 2008. It did hurt but did not get killed.

Conclusion -

If you have faith in the medium to long term trend - Buy and Hold.

Be ready to digest interim pain. Not all stocks will bottom when Nifty does and not all will make new lows. So spread out your cash deployment and also be ready to deploy rest on reversal.

Also review after 3-6 month.

September 5, 2015

Email me new post

September 5, 2015

Hi Vitesh,

Do you offer Free technical analysis for stocks? I am currently using http://www.nsebsecharts.com for technical analysis and need your suggestions.

September 6, 2015

Dear Nooresh, I sincerely thank you for your amazing technical analysis of Nifty since 2004. I was really looking for a great technical analyst like you, and very happy I found you through Google and even downloaded your app.

Dear Nooresh, I was always worried about one thing, i.e. the deadly 8 year cycle !!

We had index peaking in April 1992, March 2000 and January 2008, all followed by a bear matket that lasted long, shortest being may be after 2008, which was 15-16 months.

So, my fear of bear market starting in 2016 !!

But, fundamentally, PE ratio of Nifty in 2000 March was a little over 27 !! And in 2008 January, PE ratio of Nifty was a little over 28 !!

And today PE ratio of Nifty at 7650, is just a little over 21 !! At 9117, March 2015 peak, too we were at PE 25, high, but not like PEAK levels of previous bull runs.

Also, No Bull Market has ever ended without euphoria !! Euphoria that involves huge retail participation. But that was not seen here. Hence, it make me happy as well as to easy to believe your hypothesis that 2015=2006 !!

Thanks a lot for your wonderful work since such a long time, which I discovered just now.

As I have downloaded your wonderful app, I will stay abreast with your frequent views now.

Best Regards