Bse Small Cap Index

-> The index is still down 20% from the highs of 2008 and there are many stocks which are still down 60-95% from the highs of 2008.

-> The highs of 2010 are still giving a lot of resistance and 3 attempts in last few months have failed.

-> On the near term charts we have made triple bottoms around 10200

-> At the same time there are triple tops around 11300-11500.

-> Doubt the index can stay in this range for many months.

-> Next few months of consolidation is a good time to again look for stock specific ideas with quite a few smallcaps down 10-50% from recent highs.

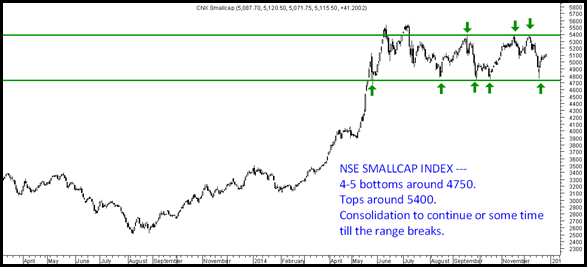

CNX Smallcap Index

-> Post elections the index has been in a range of 4700-4800 on lower side and 5400-5500.

-> There are almost 4-5 attempts on both the side.

-> Any range breakout from this can give a good trending move.

-> Given the trend is up will wait for a confirmation above 5400.

Strategy

Maintain the long term bullish stance on Indian Equity Markets and consider the current consolidation as a good opportunity to increase allocation to equities and be on the hunt for stock specific ideas.

No stock specific updates for now.

Wish you all a Happy New Year !!!

Technical Analysis Training – Hyderabad- January 17-18 – PAY AS YOU WANT