We at Analyse India came out with a report called “ Happy New Financial Year – Five stock picks for FY13 ” on 1st April 2012 in which the 3rd stock out of the five stocks we mentioned was Tech Mahindra and the following is an excerpt from that report:

3. Tech Mahindra

As you see in this chart the stock has broken out of 5 year old Red Trendline on weekly closing basis and that too with huge vols ( highest in last 12 months) giving first signs of trend change. Stock has also been in a green parallel channel of 300 points range since last 2 years. The confirmation of trend change comes above 770-800 range if stock breaks out of this parallel channel then it can head to 1100-1150 in

medium term

Investors can Buy Techm EITHER on dips to 650-670 range with stoploss

of 580 on closing basis OR wait for confirmation above 770-800 range for

targets 1100-1150 in medium term

The stock was recommended at 650-670 levels, yesterday it made a high around 1040 levels and is heading towards 1100-1150 targets given in the report. Investors can look to book part profit at current levels of 1030-1050 and keep trailing their stoploss for final targets 1100-1150.

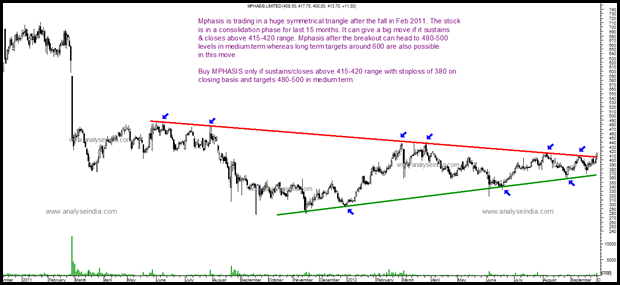

MPHASIS

Mphasis is trading in a huge symmetrical triangle after the fall in Feb 2011. The stock is in a consolidation phase for last 15 months. It can give a big move if it sustains & closes above 415-420 range. Mphasis after the breakout can head to 480-500 levels in medium term whereas long term targets around 600 are also possible in this move.

Buy Mphasis only if sustains/closes above 415-420 range with stoploss of 380 on

closing basis and targets 480-500 in medium term.

Now we feel Mphasis is giving same signs of breakout that Tech Mahindra did and this is the comparison of both the stocks:

Comparison – Tech Mahindra vs Mphasis

| Tech Mahindra | Mphasis | |

| 1. Topped Out | At 1150 level in Jan 2010 | At 700 level in Jan 2011 |

| 2. The Big Fall | Corrected 46% from the highs | Corrected 47% from the highs |

| 3. Consolidation Period | 22 months | 15 months |

| 4. Breakout Confirmation | Above 780-800 range | Above 415-420 range |

| 5. Targets | Achieved at 1030-1050 levels | Expected at 550-600 levels |

| 6. Sector | Information Technology | Information Technology |

Regards

Ankit Chaudhary

Technical Analyst & Derivatives’ Strategist

Analyse India

To subscribe to our services & for other enquiries call Ankit at 09899899989

October 3, 2012

Dear Nooresh,

As usual your targets are spot on. Hinduja did move today 10%, i am holding BGR, Benga Asam, Andrew yule (your old fev since last 2 years) Nesco. please advice entry/exit targets for these stocks.

I know you have many fans, i am one among them, Will stay for long.

appreaciate a bunch.

-Bhanu

October 3, 2012

Hinduja keep for some time as it has broken out on long term charts finally. 500-550 to book partially, Bengal and Assam keep holding patiently, Andrew Yule can wait for a couple of months if does not participate shift. NESCO is a must hold for next 2 years. 🙂 ( Core portfolio pick )

October 4, 2012

Hi Nooresh

wats ur view on mcnally bharat for long term?

October 6, 2012

Looks good for long term . Basing out buy on dips to 100

October 4, 2012

hi Nooresh

wats ur view on mcnally bharat for long term?

October 5, 2012

BUY MPHASIS ON YOUR ADVISE.

CAN HOLD FOR 1 MONTH….

DOWN ALMOST 20RS FROM RECO PRICE.

WHAT TO DO.

October 6, 2012

Keep a stoploss below 380 for medium term view. Short term stoploss of 395 on closing basis.

Stock got impacted by bad results declared by HP

October 6, 2012

Hi Nooresh,

Whats your view on Jayshreetea i have 500 shares booked for 92 what do i do?

October 8, 2012

Hold for a mth

October 15, 2012

hi

October 16, 2012

hi Nooresh,

yesterday mphasis closed at 394.5, still can we hold the stock the stock….

October 16, 2012

Hold with a closing stoploss of 380-385.

Disclosure. adding to position bought at 410-415 at 395.