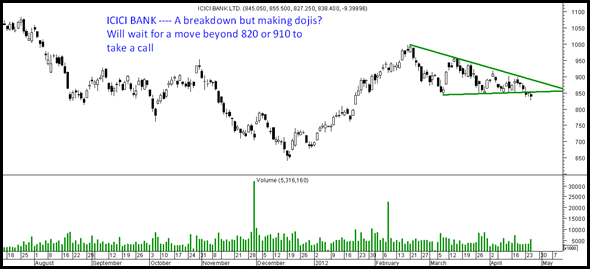

Earlier we were looking for a price action above 900-910 or a move beyond 840 on downside. There is price action below 840 but it formed a doji for last couple of days. No signs of momentum seen on the downside too.

Axis Bank --- Again near to supports but will it break or reverse. Too early to call.

BPCL – 700-710 seems a resistance. Is diesel hike on cards.

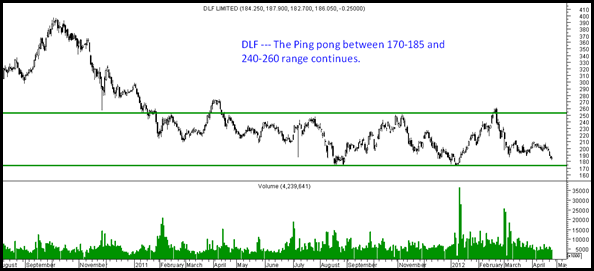

DLF – The ping pong continues between 170-190 to 240-260 bands on either side.

Hero Motocorp --- The stock looks excellent on the long term basis. Previous tops 2250-2270 remain a resistance which if crossed can give a jump. Only concern stoploss is a bit deep.

Strategy: The last few weeks have been terrible in terms of market behaviour with no clear direction it seems that now its a time to just sit back and wait for clarity on trending trades. Stick to small and quick trades. Buy the dips to book on jumps.

April 26, 2012

Hi Nooresh,

S&P has downgraded India and few stocks like NTPC, Infosys, Wipro, etc. What’s your take on this? Do you think we are in economic slowdown?

April 27, 2012

S&P i wont give much weightage coz they are like a magazine which is few months late and till then the price has already factored in.

April 27, 2012

Sir,

Any take on IRB Infra and Lanco Infra?

The stock has been a bot subdued post the budget in March

Thanks!

April 27, 2012

Not tracking IRB. Lanco will take its own time to move but looks interesting.

May 1, 2012

sir wats ur take on DLF . is it making triple bottom at 172? or is it going to break ?