DR REDDYS ------ This is a stock which has been mentioned for quite a few times as the best defensive picks in the pharma sector along with lupin and sun pharma.

Short term one can expect 1850 and much higher in the medium term. A positional stop at 1650.

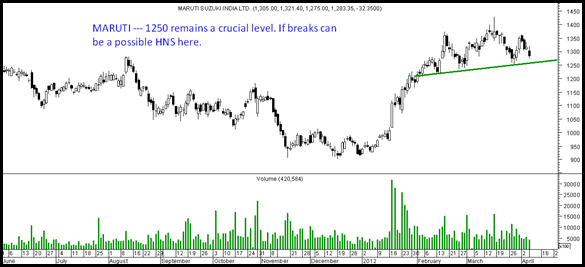

MARUTI – Does seem like a Head and Shoulders Pattern but we dont see such classical patterns workout generally. But will keep a watch on the 1250 mark to break for some quick day trade.

SBI --- We had earlier taken a very positive stance on the stock at 1800 and lower with long term view. We may now review the same on sharp dips to 1950-2050 for a trading pullback.

Meanwhile we have launched a new plan which is best suited for Investors with a medium to long term outlook and a passive / conservative approach to investing.

ANALYSE WEALTHWYSE —- Check the link for more details.

The consultancy charges are Rs. 9,999/- inclusive of all taxes & charges for 1 year.

We had a similar portfolio in August 2011 which stands around 23-25% gains. We had a much conservative approach in it as booked partial profits a bit too early but majority of the stocks have jumped 50% + also from recommended levels.

Happy Investing,

Nooresh Merani

09819225396 ( after market hours only )

April 10, 2012

Hi Nooresh Sir,

Can i Buy NESCO again around 630 rs if it comes?

Wat abt godrej ind ? at wat level one can enter?

April 11, 2012

Hi Smit,

My views have been pretty clear on the above two as long term bets