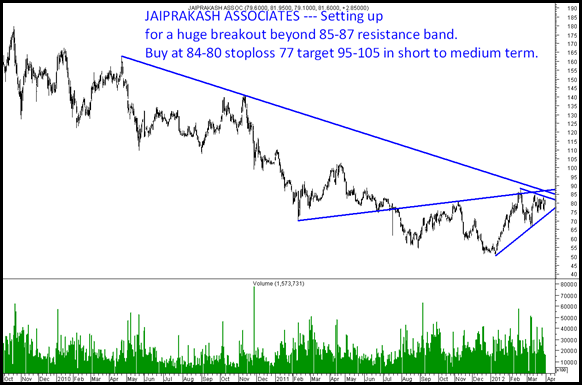

Jaiprakash Associates --- Initiated a buy 83-84 with a stoploss of 80 and a target of 92-95 in short term and 105 in medium term.

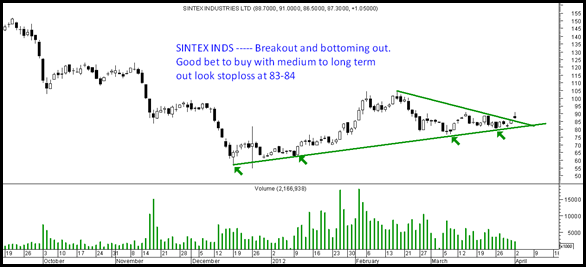

Sintex Inds --- This is one of the favorites with a long term view. Have a buy in our model portfolio at 80 levels with long term view. In the short term it seems like a breakout and one can buy with a stoploss if closes below 83-84 and a move to 91-100 in short term.

City Union Bank --- The stock has been in band of 40-50 for a very long time now. Watchout for a move beyond 50 to see a huge move with a small pause at 53-55.

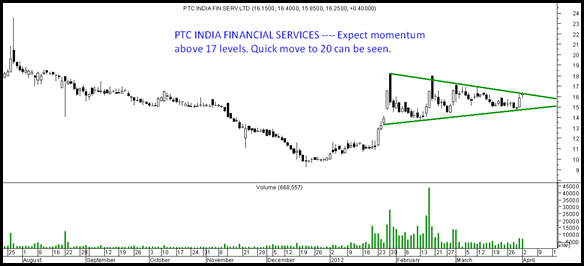

PTC India Financial Services --- The stock is on radar of shrewd investors and has been on our trading radar at 11 and 14-15. Recently added more positions at 15-16. Sustained closing above 17 will give a quick move to 20.

PTC India ---- The stock is on verge of a huge trend change though reversal signals came earlier. Huge price and volume breakout with positive news one can expect the stock to head up to 80-100 in the long term. Buy on dips. recently initiated a buy around 60.

Happy Investing,

Nooresh Merani

April 3, 2012

Even I was watching City Union for quite a long time, bought Today morning after your reco, Lets see how it moves. Great calls

Thanks

April 9, 2012

Hello Nooresh, how are you doing? Any thing to panic on PTC and JP Associates, off late they are coming down on daily basis… does it remain a hold or sell off…

regards

Dhiraj Mark

April 10, 2012

PTC remains a good bet and one can add around 58-60 levels in dips. We booked out in our trading calls.

Jaiprakash Associates gave a good breakout will keep a stoploss of 80 on closing basis.

April 9, 2012

Sir, any views on GIC housing finance.. i think its making descending triangle formation which will break out above 92 on closing basis..