A quick conclusion of the analysis on BSE Midcap Index

Although the benchmark indices Nifty and Sensex did go back to touch the 2008 highs the midcap and small cap indices came nowhere close to the 2008 levels. Currently the index is down 38% from 2008 highs whereas Sensex and Nifty are down 20-22% from 2008 highs.

From the recent peaks of Nov 2010 the index is down 27% as well but is just above the February lows.

With a severe under-performance in the midcap index it suggests that the current rally till 21k/6.3k Sensex/Nifty was in no ways a euphoric rally and the current downmove remains a correction and we might be in the last leg of it. Short Term supports are placed at 5900-6100 and every dip till those levels would be an interesting time to look for selective buying.

Surprisingly the index is closer to the peaks of May 2006 and Feb 2007. The similar peaks for Sensex were at 12700 and 14700. This indicates Midcaps are already at levels equivalent to 13-15k Sensex.

The relative resilience to the index fall suggests there is no panic in the broader segment and we suggest the current dip is a good opportunity to look for quality midcaps.

GVK Power, Lanco Infra, NCC Limited , IRB Infra and Jaiprakash Associates ( index ) are in the process of making long term bottoming out formations and any sharp fall in them can be used for slow buying.

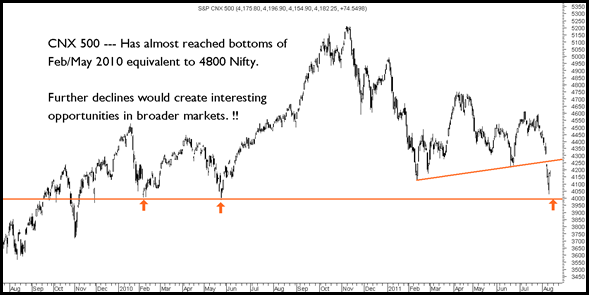

Some more index charts

Happy Investing,

Nooresh Merani

August 11, 2011

hey Nooresh,

images are not visible…is just me or for everybody..

thanks again!

August 11, 2011

Dear Nooresh,

What are your views on buying Bharati Shipyard @CMP Rs100 for a 12 month target of Rs.150. Would really appreciate your respected views.

thanks,

Luis.

August 17, 2011

Hi Luis,

I dont have a fundamental view on the above stock. Technically no reversal signs yet

August 16, 2011

Nooresh,

Could you please tell me Lanco Infra any stop loss need to consider.I have started buying slowly (around 750@18.25rs) . Thanks for your valuable input

Ravi

August 17, 2011

Hi Pravee,

One needs to be very slow and keep a view of 1-2 years and not expect any fireworks. This should not be a core portfolio but a small part of it. Not a trading call !

August 18, 2011

hi Nooresh,

can I average hitech plast at CMP 78?