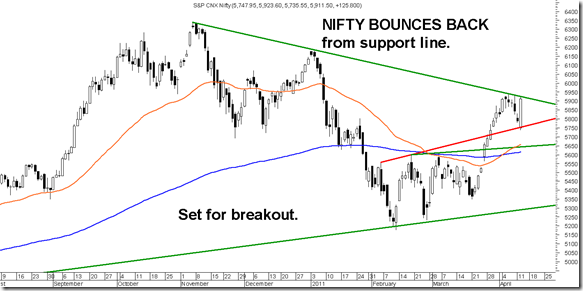

In the last post had mentioned Nifty headed to 5750-5650. We were expecting support around 5750. Although market did touch 5735 in the morning trade but it zoomed back sharply above 5900.

The trendline resistance should now be broken out and index may ideally head to 6050-6100 levels. The FII figures ( not a great believer of that data) were not at all positive. Is it possibly short covering? if that is the case crossing 5950 would lead to further panic covering to 6050-6100.

The move is a bit over stretched but may stall around 6050-6100 or a maximum of 6180. Index traders may look to review at 6100 and how market reacts around that point.

Stocks to Watchout for:

Technical Analysis Training Programs :

PUNE - APRIL 23-24 ( Limited Seats )

MUMBAI – APRIL 30-1 May ( Last few seats Left )

For more call Kazim 09821237002 or Asif 09833666151 or mail to analyseindia@analyseindia.com

Cheers,

Nooresh

April 17, 2011

Hi Nooresh,

Copper and Nickel have retraced their last down move leg in faster time indicating change of trend and now they are falling back to retest their lows and i feel copper 411-412 will hold and on nickel 1120-1122 will hold and fresh up move will start any time soon by looking at the oversold situation in hourly n daily chart. I see nickel heading to 1200 and copper to 430+ levels.. copper and nickel long term trend is still on the positive side.. Whats your take on both ?????