The latest update on Crude Technical View was posted on

https://www.analyseindia.com/analyseindia/testPager.jsp

Keep reading the above link and further updates on Analyse India Website for more information – www.analyseindia.com

It has all the details about our services too.

RELIANCE INDS :

Needs to cross 1060 to head to 1100 odd.

Supports now placed at 1010.

ACC :

Small breakout but may face resistance at 1045-1050

AXIS BANK :

The stock has not been able to clear beyond 1345 in the past 3-4 attempts. Will RBI meet help it or will take yet another hit from the same level.

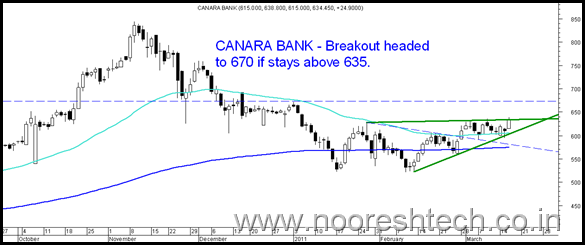

CANARA BANK :

Almost a breakout ! Sustaining above 635 can take it to 670 +

Random Thoughts:

Many of the PSU banks and private banks have seen some buying in last two sessions as well as are well placed technically.

Is the market expecting a lesser cut from RBI ? or is the rate cycle nearing an end?

Difficult to take a guess but charts give a positive bias.

Technical Analysis Training

Mumbai March 26-27 ( Few seats left )

April end Kolkata

mail to analyseindia@analyseindia.com or call Kazim 09821237002 Asif 09833666151

March 18, 2011

hello nooresh

what is your view on modison metals and jmc projects over the next 3 months???

March 18, 2011

Hi Zulfikar,

Modison is a funda play. JMC i dont track closely now

March 18, 2011

Hello,

We would like to contact you or a blogging engagement. Please let us know your contact details or drop a mail to

xeragoindia@gmail.com.

Thanks,

Ram

March 18, 2011

Sir

pls let me know ur view on SESAGOA

i have 500 SESAgoa with avg rate 285 shall hold it or sell

pls

March 18, 2011

Hi Anju,

M not tracking the stock closely

March 18, 2011

HI NOORESH. THE OPTIONS POSITION INDICATES HIGHEST OPEN INTREST IN 5500 CE AND 5400 PE. CAN THE NIFTY POSSIBLY BE IN THE 5400-5500 RANGE TILL ON EEXPIRY??

March 19, 2011

DEAR Nooresh,

May This Holi Come With Full of Happiness Like Colors of this Festival…..