In the last few months this has been the consistent question which i have been asked innumerable times through various mails, chats, calls etc.

The last i gave a trade was at 300 which we got only a move to 320 and exitted at 310 because of no follow up buying seen. But in the last few weeks i have consistently maintained to avoid and i dont see anything interesting in Bharti as of now.

Lets look into the technical picture

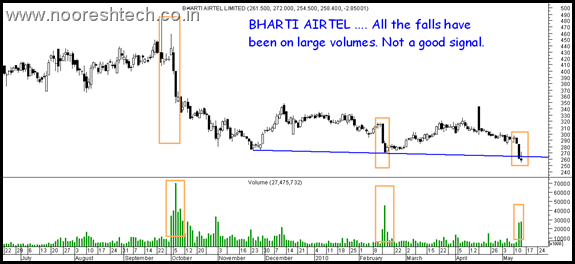

Bharti Airtel Daily Chart:

Although it seems the stock has given a breakdown in extreme short term the bigger concern is the large volumes with every drop in the stock.

Bharti Airtel Monthly Chart

The only interesting part here is the 61.8% retracement of the entire rally from 2003 to 2008 comes to 230-240 and the October lows come to 241. Although i am not a major believer of the telecom story but if people do want to take an exposure then 230 could be a good stop loss.

Buying zone could be in parts from current levels to 240. The assumption here is the stock would not break supports of 230 which if broken god knows where the stock can go.

Bounce targets should be 290-320.

Investors are advised to do adequate research before taking an exposure. This is not a buy or sell recommendation on the stock but just a view.

May 13, 2010

any view on RCOM..??

May 13, 2010

Rcom also looks more sideways

May 13, 2010

Hi Nooresh,

I completely agree with you on not to take position in Telecom stocks now. Telecom companies are bidding higher & higher on 3G Spectrum, i am surprised how will they offer “affordable” 3G services to us ? and if they do, how much time will take to recover spectrum fees paid by them?

May 13, 2010

Hi Pritesh,

Yes somehow its a feeling that they r turning into a FMCG type of story no more Y-O-Y growth which is growing superbly. For now FMCG looks more interesting then telecom it seems.

Lets c how it pans out.

Cheers,

Nooresh

May 13, 2010

The chart has given sell signal on 20-04-2010. I think the telecom sector stocks are going down the same way as sugar stocks re performing. It is better not to touch the stock in near future. Happy Investing !

May 13, 2010

Yes Siddhesh the sell signal came many a times.

Its just that people needed a view so to answer them in one shot its easier to post 🙂 … I also do not believe the story as i have said.

Cheers,

Nooresh

May 14, 2010

nooresh , thanX 4 bharti….

DOSTO! AAP SAB SHAYAD MERE SE BEHTAR MARKET JANTE HONGE… ISLIYE KUCH CHAND SWAL MERE MAN ME HAI… SHAYD AAP KE PASS USKA JAWAB HO…….

* KYA 3G MAMLEME GVT NE ANTIM NIRNATY LE LIYA HAI..??

* KYA INDIAN TELECOM COMP NI KO YAH BAT SAMAJH ME NAI AA RAHI KI WOH BAHOT JYADA DAM CHUKA NE JA RAHI HAI…?

*KYA TELI COM SECOR MAIN ENTRY FMGC SECTORE KI JITNI EASY HO CHUKI HAI…?

*KYA KOI SALOSAL EK HI SABOO YAH SHAMPOO ISTAMAL KARTA HAI LIK TELECOM NETWORK…?

*KYA FMCG SECTORE MAIN KOI VALU ADD SERV OR PRODUCT HOTE HAI JOH UNKI BOTTOM LINE PE ASAR KARE..?

*

May 14, 2010

Hi Dev,

M not a fundamental analyst but ye mera personal view hai ki Telecom is no more a great story wat it was before.

The whole point is Bharti 30 to 300 in 4 yrs type story no more. It may give price growth like FMCG which is consistent.

May 14, 2010

Hi Nooresh

While RCOM collapsed, bharti held 300 levels for quite a while till the policy muddle pushed it to 260. It is still holding 260 levels. Policy tinkering would help it recover and more muddling will push it down. But Telecom as a sector cannot be mismanaged for long. Definitely there will be policy incentives and if so, Bharti will be the first beneficiary.

Could be a long term accumulate or buy. But dont look for quick exits

May 16, 2010

RCOM IS BEST BET. AS THEY ARE BIGGEST CHEATERS IN THE WORLD. BUY RCOM AND EARN MONEY.