The presentation can be downloaded from the links below or go through the entire post.

Sensex at 16.6k Time to be optimistic – - Powerpoint Show

Sensex at 16k-16.6k , Time to be Optimistic not Scared.- PDF format

The presentation in a post for people who dont like to download 🙂

Sensex Falls – 12% roughly

15900 is almost 12% from the top of 18k which should be the worst case scenario.

Sensex absolute price wise – 2k points

15900 is almost 2k points from the top which should be the worst case scenario.

Timewise concerns on the pattern.

As per time analysis we can give a leeway of next 3 sessions for a strong bottom to be formed in 15.9k-16.4k zone.

Sensex downward channel

Downward channel suggests a bounce in next couple of days from 16200-16400 ideally. But we need to cross 16900 to give a turnaround signal.

200 dema/ Trendlines

200 dema has been touched today. Downward trendlines give

Supports at 16250/16000 roughly. So a strong bounce can be expected from these lows. Break below 15900 really changes the chart formation to weak one.

Parallel Channels

Have been able to exactly spot the last 3 bottom turnarounds using parallel channels. So again the bet lies on 16k holding up which is the channel support. ( seen in red and previous ones in other colors)

Global Indices

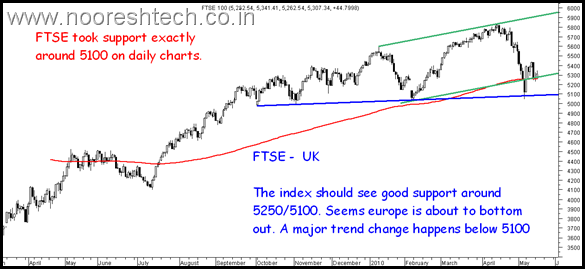

Global Indices – FTSE Update

Global Indices- Dax

Dow Jones – 9800/10200 important supports

As had mentioned earlier Dow would take a pause from 11200-11400 but the correction was faster to 9800. Till it doesnot break 9800 the medium term remains positive. 10200 a level to watch for short term.

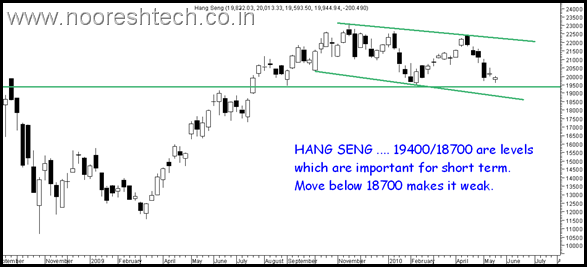

Asian Indices- Hang Seng ( weekly chart)

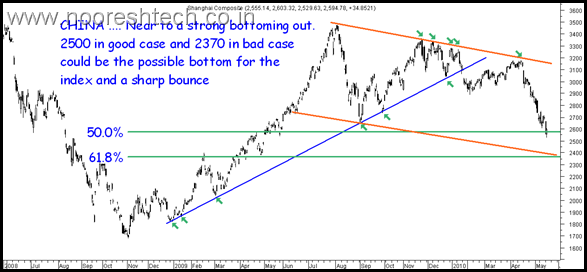

Asian Indices – China

Crude- Bottom out around

Although technically a prefer to catch momentum or turnarounds after confirmatory moves then to try predict precise moves of the market. But an attempt can be made to graphically show it to make it simpler.

The following chart is just an attempt to graphically pull up the probable scenarios for the next 1-3 months.

Even if one is bearish I would expect a bounce back to first set in from 16k levels. And if one is bullish then before going to 18500 it has to first touch 17k in between. So a bounce back trade is definitely low risk high returns

Sensex probable moves –: Bullish – Green , Bearish – Red , Low risk trade – Orange

Please pass it to others so we can get more comments on the above view.

Analyse India

Website : www.analyseindia.com

Daily Blog: nooreshtech.co.in

Mail : analyseindia@gmail.com

Call: Advisory – 0983366151

Training – 09821237002

Nooresh – 09819225396

May 20, 2010

Great work Sir Jiiiiii,,, It will help to all traders and investors in market,, Thanx alot for this.

May 20, 2010

dear sir.plz sed me intardey colls.

thanks

May 20, 2010

Hi Nooresh,

I agree with Mr.Mukesh Chaturvedi, Really Great Work.

I really appreciate your skill to describe chart in such a way that anybody can understand it easily.

I am also optimistic about market. let’s wait & watch. Hope for up move from here. SGX Nifty is down 72 points now ( 8.57 pm).

Thanks for detailed report.

May 20, 2010

hi nooresh sir,

its reallly a great work………..and this article clearly shows how much time it took to prepare it…..

but some people see wit blind eyes and comment on it…….

i would advice them to wipe up there eyes so tht it can be clear to them

May 20, 2010

Dear Nooresh,

Good and deliberate analysis. Keep it up.

Thanks

May 21, 2010

Dear Nooresh

Hope you are right again. Fingers crossed !!

May 21, 2010

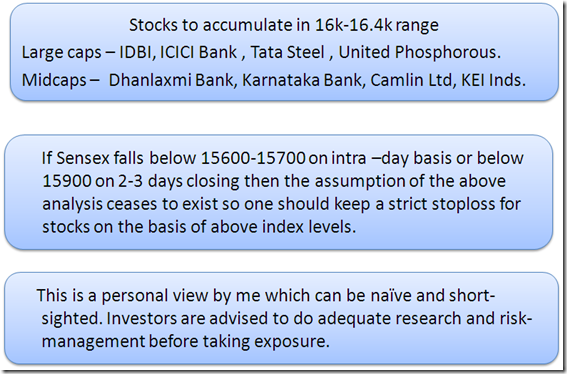

Really good work. Each & everything is clearly explained with technical base. Also you have recommended stocks to bought at 16k to 16400 level.

Am sure, all the followers would be beneficial this time too!

May 24, 2010

Hi Asawari,

Yes given my views as clear and simple. Lets see how it pans out 🙂

May 21, 2010

Dear sir,

Please share your views from long term perspective on Development Credit Bank Ltd. and ICICI Bank respectively. I am currently holding ICICI Bank @ 950 and wish to enter Development Credit Bank.

Thanks,

Puneet Khandelwal

May 24, 2010

Hi Puneet,

I remain positive on both. Prefer DCB around 43-40 levels.

May 21, 2010

Hi Nooresh,

Really great work on this presentation. It will be of great help for Investors.

May 24, 2010

Hi Krunal.

Thanks for the appreciation hope market does the same 🙂

Cheers,

Nooresh

May 22, 2010

Hi Nooresh nice work again.You keep doing it with so much ease.I will support the “Highly Probable Scenario” i.e. pull back to 17300-17400 levels if not more.The reasons being in last six months we have not made any headway on the upside inspite of money flowing in. Also we may be retracing whole rise from 2539 to 5399 i.e.2860 on Nifty.The current bottom made on thursday 20.05.2010 shows a fall of roughly 491 points on Nifty from 5399 to 4908.We should retrace this fall to about 5020-5050 levels at least i.e. a rise of 112 – 142 points.I personally have bought futures 4 lots at opening on friday will hold till the same as per the highly probable scenario. I hope you come refreshed after a well deserved break after this weekend. I always keep looking at Analyse India as a “Shining Lighthouse” in this stormy world of stock market who is on a mission to educate investors with their honest views.Bravo! Kudos to you and your team for their sincere efforts.

May 24, 2010

Hi Kirtan,

Thanks for the kind words.

Yes even i expect 17k + levels pretty soon. Keep trailing stoploss and ride 🙂 the lots.

Cheers

Nooresh

July 12, 2010

Very good analysis.

July 13, 2010

Thanks Sumit 🙂