The level of 8500 on closing seems to be in danger now as Sensex has dipped below the 8600-8640 level which was holding in the last few dips as seen in the chart.

On a sustained closing basis 8500 remains important. On the short term 8300/7700 are immediate supports once it starts sustaining below 8600. Will look into long term charts in the coming posts.

In the last few major sell-offs the volumes were heavier in the index and index heavies but we are not seeing such volumes this time around. Also the price action would be bigger ( %terms ) and in smaller amount of time. This indicates the drift could be slower towards the lower zones till we dont see above observations being met.

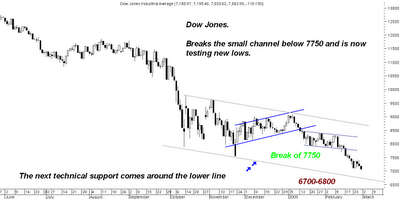

Dow Jones :

In the last update had discussed that a break below 7750 would test the low of 7400 and odd and the next level is around 6700-6900 which is the downwards sloping channel. There should be some recovery from 6700-6800 or little lower then that back to 7k-7.4k roughly.

On the long term charts sustaining below 6400 there are no meaningful supports technically. The index has lost quite a bit in the last few weeks so bounce is highly probable from the supports.

Best Regards,

Nooresh

09819225396

noorrock2002@gmail.com , meraninooresh@yahoo.com