Fear of the Unkown...

Long Term Technical Chart and View :

There were lot many supports got broken in the past few weeks without a decent bounce and indicators are at lowest ever zones. So in the short term lot of technical expectations have not been met for example a bounce from 11k or 9.5k ( we went wrong at 11k and dint get a chance to rectify so waiting with rest cash ). Suddenly the basic fundamentals or value investing have gone for a toss with stocks quoting at 1/4th of book value in P/E the earnings is a ?. Economists/experts predicting a doom 2-5 years back are suddenly jumping after being wrong till now , experts who predicted a big run 2-4 years back are in the background and the cycle continues.

Recession / Slowdown / collapse /depression /crisis / bear hug /cycle etc and there are lot of questions and no answers ...............FEAR of THE UNKNOWN ....

I am a young technical chap and technical analysis is the only tool i have to make some interpretations/projections which may or may not go well but the endeavour to do so continues.... So lets look into the long term chart .

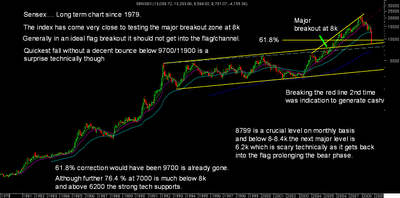

Sensex Long term Chart :

1) As we see on the long term chart a major breakout confirmation took place at 8k. The 13 year range of 3k-6k broke but the major channel breakout took place after a couple of tries at the higher end. This was the point at 8k we came out with the 13 year bull cycle and big tgts which not many could think of .We have already seen the best 3 + years .

2) An ideal correction of such a major bull wave should have been 50/61.8 % at 11900/9700. These levels have been broken for now and the next level comes to 76.4 % which is not that significant as it goes below into the channel.

3) The previous falls in 1992 and 2000 were in the extent of 57-58 % . So taking similar calculations 57-58 % dip would be 8900-9100. So if its following the same cycle then a 3-5 % deviation on closing basis can be taken,

4) If we see the long term charts the 13 year flag/channel breakout is a major one and ideally the prices should not test the channel again ( so i was expecting 11k to hold ) . The pattern would get negated if we see a monthly close inside the channel and we could see a very prolonged sideways movement and dent the prospects of a bigger bull run or the 13 yr cycle . This has been the reason for my view that we may not see a sustaining monthly close below 8k-8.8k. Some sessions below could be seen in such highly volatile scenario. Say 5-25 sessions below this level would negate the strong breakout and its a very long term call so need to wait for confirmation.

5) Although support levels of 12500, 11200 broke of quickly and on brink of sustaining below 8800 what could be next. This is where it gets tricky as the next logical support would be 7600 ( not major or strong ) and 6200-5900 ( most strong after 8800 ) . The lower level of 6200 is scary as it confirms the negation of the long term breakout and a very very long sideways move.

6) Concluding the technical observations i continue to mention a sustained weekly/monthly closing below 8800 is not what i am looking at as it scares me technically and below that we may have to worry about lot more assets , work etc as the Sensex could go to 6k or lower technically. Its a personal view point that there could be lot of trouble if such a thing has to occur and i would remain positive in the long run for big tgts till 8000-8800 remains on monthly basis.

The current market movements have negated lot of possible technical expectations and comparisons to historical patterns havent been fruitful. The basic assumption of technical analysis is History is repeated and if we have a major recession or new history made then technical projections may not be the best guide.

Market Observations and Thoughts ( Few lines would be there in this section now onwards which is not a recommendation but a view which is speculative , take your own call )

Some of the sentences which i read from experts,economists,gurus seem to confuse me more.

The bear phase may last for 12-18 months...... ( same line for last 6 mths when did the bear phase start so at least i know the end ).

I said it USA is going to be doomed in 2006 itself ( went wrong on 30 % upside for 2 -2 1/2 years and now right 20 % downside in last 3 mths).

Suddenly there are lots of depression theories over the media , doomsdayers in every corner of the world and being repeated day-after day. At the same time there would be a contra view of the best opportunity of a decade etc etc. Media is not supposed to be right but to be at it !!! ...

This is a very new wave of fall , panic or an unknown thing which according to the oldies of the market has never been seen before. Sentiments and panics can really do weird things in the market so best thing to do now would be to silently watch the next 1-4 weeks or take smaller exposures only with a 2-3 year view if you have not been stuck at sub 12k levels.

For the 20k levels many stocks may have gone down by 60-90 % and in such a scenario pulling out residual money would not make much of a difference unless there is a desperate need or over-leverage. So wait and watch for the next few weeks any further falls would not make a major difference as not much has been left in the value.

Best Regards,

Nooresh

09819225396