Sensex Technical View :

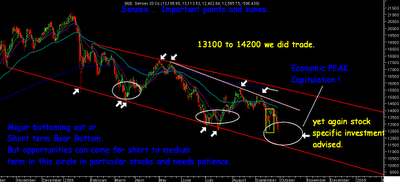

12500 gets into danger and this would imply that markets are well headed towards the 11500 -11900 zone. Few days back when we dipped to 12558 had posted the above chart where in i have depicted the support zones on lower side which creates good opportunities for investment gains in bear rallies. All through Jan to September now the support levels have been shown consistently and used to make good of the bear rallies !!!.

12500 gets into danger and this would imply that markets are well headed towards the 11500 -11900 zone. Few days back when we dipped to 12558 had posted the above chart where in i have depicted the support zones on lower side which creates good opportunities for investment gains in bear rallies. All through Jan to September now the support levels have been shown consistently and used to make good of the bear rallies !!!.

Now getting into exact levels which may be difficult as trendlines keep on sloping and have diff points but roughly the range of the trendline range comes to 11500-11200 for the entire duration of October. The long term fibonacci level comes to 11900 . So ideally the zone of 12500-11200/500 will be the oval which could provide excellent stock specific opportunities for investment.

With a good gap down action as per global cues investors can start buying yet again at 11900 or roundabouts and go staggered and can take upto 80 % of exposure till 11200-11500 with a medium term view but we may end up getting stock specific bounces sooner also.

Market Observations and Thoughts :

The most frequent question i have been asked today. Should i sell all ? Is it time to exit ? I have FDs with ICICI?ATM lines ? Can market go to 9k-10k? Dow gone,what tomorrow ? .

The most frequent question i have been asked today. Should i sell all ? Is it time to exit ? I have FDs with ICICI?ATM lines ? Can market go to 9k-10k? Dow gone,what tomorrow ? .

And for a matter of fact in the last few months i havent made an aggressive buying call in any stocks and been very conservative and critical on many stocks. But suddenly at 12500 or lower it makes it difficult for me to answer such questions.

When i was being critical of money management , reducing exposures, exitting positions/investments at 18900/17k/16k not many people asked me these questions but rather were asking me what to buy. !!! . Those who did were able to make good gains in the rallies from 12500 to 15500 in many stocks and are now in a position again to shop at 11500-11900 and remain invested with patience.

I may term this as the final capitulation signs coz lot many who were stuck at 20k-21k levels remained hopeful till 12500 !!! are suddenly feeling the pain although now lot many midcap/large cap stocks which form the major part of the investors portfolio are available at 6k-8k index. The index can be deceptive !!!.

One important line i make of it is ----- " The lay investor doesnt sell in LOSS but he sells only in PANIC or DESPAIR"

So i would expect lot many lay investors to be out of the market in this month finally and hoping for 9k index. There might be mutual fund redemptions but this creates an ideal scenario for a final capitulation and economic peak out.

Some days back i had discussed investors who can deploy cash should be ready to keep it and go with a fresh bent of mind now and dont look to average duds but buy fresh investments with fundamental reasons keeping in current point of view. Real Estate had a great reason to be bought 2 yrs back but not necessarily now.

HIGH RISK MONEY MANAGEMENT OPTION-

One of the risky thing to do Leverage trading which i have consistently avoided can be used now but i would suggest this for investors those who have followed our view at 17k/16k to exit and using the bear rallies to great use. Leverage positions if used effectively can generate better returns.

One of the risky thing to do Leverage trading which i have consistently avoided can be used now but i would suggest this for investors those who have followed our view at 17k/16k to exit and using the bear rallies to great use. Leverage positions if used effectively can generate better returns.

Investors can take positions in Futures contracts as lot many stocks have seen deep correction and with smaller lot sizes building a position is easier. Ideally one would need to put up around 30 -35 % margin so one can allocate around 50-60 % of the intended money to safeguard a margin pressure and if a good pick is made it may not drop more then 15-20 % from current panic levels. This will give a higher leverage option but good discipline would be to convert to delivery by selling dud portfolio stocks on rise or by putting up cash as personal investment increases. But do make it a point u dont go over board !! as this is only for medium term investors who are patient enough and have a decent portfolio size.

Stocks to watchout for :

For last so many months many readers have been asking me to present a list of stocks which can be bought for 1-2 years but have consistently refrained from doing so as the last signs of capitulation were yet to be seen and lot many stocks were for a short term gain. And my comfort level is finally increasing for long term NOW.

I would like to put it this way a list of stocks which i like that could give 30-70 % returns or higher but time-frame is a secondary constraint as its not necessary to hold for a year tgt but for a price tgt. Go with a gain point of view and accumulate the following stocks. These are some of my picks and not necessary to highly outperform too so investors please do your own research and good money management. Will be adding further stocks to the list , right now taking a diversified portfolio .

1) SBI -- Large cap PSU Banking

The stock remains a favorite but preferred buying price 1320/1250/1150 which are accumulation levels.

The stock remains a favorite but preferred buying price 1320/1250/1150 which are accumulation levels.

2) IDFC -- Finance

The stock continues to fall rapidly but remains a good pick but dont expect it to outperform much in short term but in the longer run could be a great bet. Preferred buying prices 68/60.

The stock continues to fall rapidly but remains a good pick but dont expect it to outperform much in short term but in the longer run could be a great bet. Preferred buying prices 68/60.

3) Canara Bank/Andhra Bank/Dena Bank/Allahabad small PSU banks.

The price to book values , dividend yield look interesting and are a comfort on downside and best time would be to buy tomorrow if these banks are available 8-10 % down from todays price. May not outperform significantly but give good stability to a portfolio.

The price to book values , dividend yield look interesting and are a comfort on downside and best time would be to buy tomorrow if these banks are available 8-10 % down from todays price. May not outperform significantly but give good stability to a portfolio.

4) Glenmark Pharma.--- Pharma Bet

The stock remains to be the best bet in pharma space although has not corrected much but can be bought at 480/430-400 with a stop of 390. The stop loss is mentioned only because of a technical bias as it has not corrected a lot.

The stock remains to be the best bet in pharma space although has not corrected much but can be bought at 480/430-400 with a stop of 390. The stop loss is mentioned only because of a technical bias as it has not corrected a lot.

5) IFCI --- Finance Value Bet

Yes one of my favorite stocks which i had recommended at 12-15 when not many were talking about it. Because of the highly speculative nature of the stock and liquidity concerns in the market the stock has come down heavily to 30 levels whereas at a point of time there were bidders ready to buy it at 100-110. Buy price 36/32/29 . Continue to hold the stock even if it goes down a bit in panics as recovery could also be faster.

Yes one of my favorite stocks which i had recommended at 12-15 when not many were talking about it. Because of the highly speculative nature of the stock and liquidity concerns in the market the stock has come down heavily to 30 levels whereas at a point of time there were bidders ready to buy it at 100-110. Buy price 36/32/29 . Continue to hold the stock even if it goes down a bit in panics as recovery could also be faster.

6) Kalpana Inds /Sakthi Sugars/Renuka Sugars /Chamble fert . --- Small cap bets

Both the stocks have come down to very attractive levels with not much of a fundamental change. Investors can buy some at cmp or lower and on every 5-7 % decline with a medium term view. Excellent fundamentals and growth expected only current market conditions giving it a concern be patient.

Both the stocks have come down to very attractive levels with not much of a fundamental change. Investors can buy some at cmp or lower and on every 5-7 % decline with a medium term view. Excellent fundamentals and growth expected only current market conditions giving it a concern be patient.

7) RCOM/GTL infra. -Telecom space

Good bets in the telecom sector at 330 and 33 are definitely a buy on every decline with a slightly longer term view as the stock may take time to revive.

Good bets in the telecom sector at 330 and 33 are definitely a buy on every decline with a slightly longer term view as the stock may take time to revive.

Its better to pay a fractional % ge of ur investment for a little professional and disciplined approach to investing and trading to generate gains with lesse risk then erode the portfolio without any help or rather learn the process of technical analysis and be independent in your decisions . We can help you in both of it by stock specific advice or training course . Check https://analyseindia.blogspot.com for more details or mail to noorrock2002@gmail.com .

Best Regards,