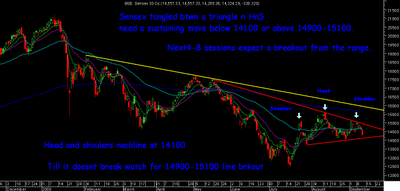

SENSEX CHART N VIEW:

As we had seen in our previous messages that 15100 is a crucial level . The trendline as shown continues to hit Sensex on upside. The line now comes around 14900 .

On the other hand the downline shown is coming around 14100. Till Sensex doesnt give a sustained move below or above the two levels traders can wait to take a call as its a very small range.

For the patterns seen technically it can either be termed a triangle or a head and shoulders. But in both the cases we would need a confirmation of breakout .

Possible scenarios :

1) Sensex moves above 14900-15100:

If a breakout above 15100 takes place we can see a quick move to 15500/15800/16400 . On the time front we could see the current corrective move for fall from 17500 to 12500 can last 50 + sessions . So the breakout could see a upmove till end of Sept or later before cooling off.

2) Sensex breaks below 14100 .

If a sustained move is seen below 14100 the further supports are at 13700/13300/12800. As it would be a confirmation of head and shoulder pattern the indices could go close to 13k.

Technically such a move is in the offing in next 4-8 sessions and we would see a breakout soon on either side. Rather then taking a positive or negative bias would be better to let markets decide their next move. 🙂 and act accordingly with the levels.

Sensex and Tata Steel Charts n View.

For quite some we have been discussing on Tata steel and a possible weakness sicnce 580-600 . The stock has slowly drifted to 520 levels . Technically for last few bottoms have been around the trendline shown . The trend remains weak but there could be a possible bounce back from this zone of 520 . Bottom fishers can keep a stop of 500 and play a bounce to 550-580. On a break below this level it can go till 450-470 which could be a good price for investment.

To subscribe to exclusive newsletters and recommendations check https://analyseindia.blogspot.com for details.

Best Regards,

Nooresh

09819225396