Its been a long time since i have written my views either on bse nse community on orkut

or on my blog.

Well i was off to pollachi , coimbatore for hexaware training for a month and just returned a week back.

So basically hav been isolated frm the ticker or market buzz thus i believe my current view is gonna be purely technical as it is mostly.

To start of with before leaving for hexa training i had made a post arnd 1st week of July

The view was that people shud be booking profits or selling arnd 11050 and please dont buy as i dont see anything more in the rally above 11200.

And after that we would see a pullback which wont be as violent as before and would be the right time to enter good stocks.

some of my favourites at that time were and still are Prajay engg( always my favourite i still say that all time frames), ramco sytems, can fin homes , Prime textiles and some more which were available cheaply later.

Current view.

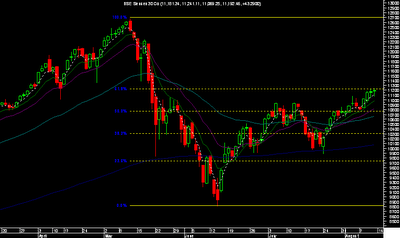

At the current position the Sensex has retraced arnd 61.8 % from the bottom of 8799 and the top of 12671 . This is always a crucial point as i hav always said in my previous posts about the fibonacci levels.

But can this be considered the intermediate top from which we can see a pullback. I would say there is some more steam left or quick trading opportunities coz the same analysis on Nifty shows a retracement to 3325 -3330 levels another 50 points from here so arnd 200 odd points on the sensex i.e in the range of 11400 - 11650 should be the limit to this rally. Above 11400 -11650 ( volume exuberance limit) the rally would be unsustainable momentum which can propel the sensex to intra day higher levels but waiting would be better then jumping coz the rally can take a very violent dip in that case. Also many small n mid cap stocks had given good breakouts on wed - thursday but dint hav the time to rit much.

.Coz there are still some fresh breakouts which i hav just walked thru.So if i am able to check the whole data mit come up wid some more interesting stocks .

If i do find then would be posting them on orkut community or this blog so ppl can keep a track.

gy at this point . Sell till 11400-11650 as we did in previous top arnd 10940 a little shy of my zone of 11050.

There should be a pullback to arnd 10700 levels for a good sluggish movement before the actual rally which shud start in the later part of the year.

My personal view:

Start gathering money for the next rally so u can be a part of it. So start looking for opportunities in good stocks which u were not able to pick in the current dip which i

said would be the best time.

Only thing now is u may not be able to get at similar prices but even a 15-20% drop in select

good stocks from current levels should be a good bargain so start systematic investment in good stocks.

TargetS:

Well after the pullback till 10700 i see a short to medium target of 12100 in another 2-3 mths well analysing time wise moment is never correct but this is what it seems to me.

These are my personal views and may or may not be the best judgement. There are many more things to write and think on this topic but all cant be written. So make ur own decisions.

Nooresh Merani

noorrock2002@yahoo.com

noorrock2002@gmail.com.