This seems a very late post on the LTCG Tax which was introduced in the 2018 budget but our digging started post the Tax Proposals in 2019 budget.

The Super Rich Tax of 12000 cr is a very small number in the whole Budget. We may be losing the plot in taxation.

“The Tax Department job is to maximize Revenue and not morally decide which form of Income is Noble. Being morally and socially right but losing Tax Revenues is a double whammy.”

Disclosure – The post is purely based on public data.

Taxing Genuine Investors to get a best case 3000-5000 cr of Tax Revenue and Losing 15 lakh crore Market Cap but not catching and penalizing Tax Evaders/Money Launderers does not seem Morally or Revenue Right.

Read the post below for the details.

The pdf can be read here -

The Long Form Post

Starting with the Budget Speech of 2018

Rationalisation of Long Term Capital Gains (LTCG)

155. Madam Speaker, currently, long term capital gains arising from transfer of listed equity shares, units of equity oriented fund and unit of a business trust are exempt from tax. With the reforms introduced by the Government and incentives given so far, the equity market has become buoyant. The total amount of exempted capital gains from listed shares and units is around `3,67,000 crores as per returns filed for A.Y.17-18. Major part of this gain has accrued to corporates and LLPs. This has also created a bias against manufacturing, leading to more business surpluses being invested in financial assets. The return on investment in equity is already quite attractive even without tax exemption. There is therefore a strong case for bringing long term capital gains from listed equities in the tax net. However, recognising the fact that vibrant equity market is essential for economic growth, I propose only a modest change in the present regime.

I propose to tax such long term capital gains exceeding `1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January, 2018 will be grandfathered. For example, if an equity share is purchased six months before 31st January, 2018 at `100/- and the highest price quoted on 31st January, 2018 in respect of this share is `120/-, there will be no tax on the gain of `20/- if this share is sold after one year from the date of purchase. However, any gain in excess of `20 earned after 31st January, 2018 will be taxed at 10% if this share is sold after 31st July, 2018. The gains from equity share held up to one year will remain short term capital gain and will continue to be taxed at the rate of 15%. Further,

I also propose to introduce a tax on distributed income by equity oriented mutual fund at the rate of 10%. This will provide level playing field across growth oriented funds and dividend distributing funds. In view of grandfathering, this change in capital gain tax will bring marginal revenue gain of about `20,000 crores in the first year. The revenues in subsequent years may be more.

Finance Minister explaining LTCG on IndiaTV

- Video on ET Now – Finance Minister explaining for LTCG

- Keeping low taxes when we need money for Social Schemes !!

Clarification by Finance Secretary

- Finance Secretary – Commentary on why Markets fell on Budget

- Finance Secretary – 20k crores in 2019 and 40k crores in 2020.

The Big Statement is

3.67 Lakh Crores of Exempted LTCG Tax and 20k crores expected in tax revenue in 2019 and 40k crores in 2020.

The data by Direct Taxes as per Income Tax of India Website.

Data Source - https://www.incometaxindia.gov.in/Pages/Direct-Taxes-Data.aspx (This data made public from April 2016.)

The Budget came out in February 2018. Till that time the data for A.Y 2017-2018 was not available. The last available data would be till A.Y 2016-2017.

All Tax Payers – Range of Long Term Capital Gains Tax

|

Assesment Year |

Long Term Capital Gains ( cr ) |

|

2012-2013 |

80622 |

|

2013-2014 |

49154 |

|

2014-2015 |

64521 |

|

2015-2016 |

84850 |

|

2016-2017 |

94356 |

|

Total |

373503 |

The earlier version of LTCG Tax for Assesment Year 2012-2013 mentions a number of 70,121 cr instead of 80,622 cr.

This also totals down to 3,63,002 cr.

So sum total for 5 years comes in the range of 3.63 cr to 3.73 lakh cr

LTCG Tax is applicable across various asset classes but only Equity was exempt from taxation.

Let us consider the Government had the data for Assessment Year 2017-2018 (implying tax revenue for FY 2017).

This number as per the website is 1.33 lakh crores also does not match the 3.67 lakh crores mentioned in the Budget.

Adding up the last 5 years from A.Y 2012-2013 to A.Y 2016-2017 the number comes to 3.63 – 3.73 lakh cr. This is the only way the numbers match!!

What does this mean?

- The data on Income Tax India website for Long Term Capital Gains is only for other asset classes which are taxed

- Or the budget used a cumulative data of 5 years and mentioned it as 1 year?

- Or the data used in the budget for Long Term Capital Gains for Equity is from the Income Tax and other agencies but it is not available on any public website.

Assuming that the data is not available for LTCG exemption every year we can only try to invert and check if the future estimates of 20k and 40k crores yearly collection from LTCG is possible or not.

We also try to invert the 3.67 lakh crores number.

Invert , Invert , Invert !!

Part 1 – LTCG – Can it generate 20000 cr or 40000 cr in near Future ?

- One way to check would be if the Budget has the Long Term Capital Gains Tax revenue number as Real Estate, Debt Funds, Gold are not exempted. But the Budget document does not have this bifurcation.

- The other way would be to see Performance of Benchmark Index , Total Market Capitalization, Trading Volumes, Shareholding etc.

How much LTCG Tax can the government get ?

As per the statements of FM and Finance Secretary the expectation was 20,000 cr in 1st year and 40,000 cr in 2nd year.

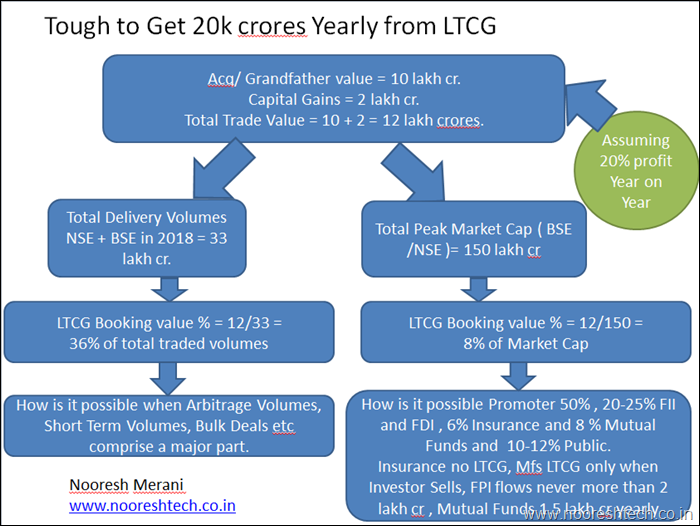

LTCG Revenue doesn’t add up. ( Pictoral Explanation.)

LTCG Revenue doesn’t add up. ( Detailed Explanation.)

Total Turnover of BSE + NSE

|

Year |

Total Turnover( BSE + NSE ) cr |

Del Turnover @ 40% |

Market Cap ( Cr ) |

|

2018-2019 |

93,64,707 |

37,45,883 |

1,50,43,275 |

|

2017-2018 |

83,17,794 |

33,27,118 |

1,40,44,152 |

|

2016-2017 |

60,54,174 |

24,21,669 |

1,19,78,421 |

|

2015-2016 |

49,77,072 |

19,90,829 |

93,10,471 |

|

2014-2015 |

51,84,499 |

20,73,800 |

99,30,122 |

|

2013-2014 |

33,30,152 |

13,32,061 |

72,77,720 |

The 10 year average delivery volume is around 40% so taking that number. (It hit 35% in 2019)

LTCG Tax

LTCG transaction will have Acquisition/Grandfather Value + Capital Gain = Sell Value.

Acquisition Value could be say from Grandfathering date or buying post Feb 2018.

|

GF Value ( cr) |

Selling Value ( cr ) |

%ge Move |

Capital Gains ( cr ) |

Tax ( cr ) |

|

10,00,000 |

1100000 |

10% |

1,00,000 |

10000 |

|

10,00,000 |

1200000 |

20% |

2,00,000 |

20000 |

|

10,00,000 |

1300000 |

30% |

3,00,000 |

30000 |

|

10,00,000 |

1400000 |

40% |

4,00,000 |

40000 |

|

10,00,000 |

1500000 |

50% |

5,00,000 |

50000 |

We are being logical here and eliminating 10-100 times made in Long term as done in Money Laundering stocks.

How much would this volumes be as a percentage of Yearly Volumes and %ge of Market Cap.

|

Volumes to be traded |

Max Del Vols ( Cr ) |

20% above Peak ( cr) |

%ge Yearly Vol |

% of Mkt Cap |

|

1100000 |

35,00,000 |

1,80,00,000 |

31.43 |

6.11 |

|

1200000 |

35,00,000 |

1,80,00,000 |

34.29 |

6.67 |

|

1300000 |

35,00,000 |

1,80,00,000 |

37.14 |

7.22 |

|

1400000 |

35,00,000 |

1,80,00,000 |

40.00 |

7.78 |

|

1500000 |

35,00,000 |

1,80,00,000 |

42.86 |

8.33 |

In case of even new investments the sell volume will be similar as grandfathering value would become acquisition value.

The 35 lakh number and 180 lakh crore market cap is also way higher when total volumes in 2016-2017 were only 24 lakh cr and Market Cap is now down 5-10% from grandfathering date.

P.S – Trying to be liberal by taking 20% profits and zero set-offs !!

The numbers don’t add up

- The total value of Equity Holding in Mutual Funds is 10-11 lakh crores.

- The total value of Equity Holding in Insurance Companies is less than 10 lakh crores.

- The total holding of Retail Investors and Corporates apart from Promoters and FIIs is way lesser than 10 lakh crores.

- The rough holding of total equities is 50% promoters, 20% FIIs, 12-14% MFS and Insurance , 5% FDI , 1-2% PMS AIF and rest 5-10% with Public Investors.

- The net inflows in every year even in peak case is not more than 1.5-2 lakh crores from Mutual Funds and 2-3 lakh crores from FIIs.

- How would 12 lakh crores of Trade Value happen? It just doesn’t add up.

- In the best of the years fresh inflows by Mutual Funds has not crossed 2 lakh crores and FII inflows also have not crossed 2 lakh crores. Even in terms of outflows it has not crossed 2 lakh crores.

The LTCG tax estimate of 20000 cr and 40000 cr from LTCG Tax just does not add up as it expects 30-40% of all Volumes to be LTCG profit booking.

It also expects 6-10% of Equity of Indian Markets to change hands!! The Public holding is less than 10% and another 6% through Mutual Funds!!

(Insurance and MF trades only get taxed on end client, Promoters don’t trade as much, and FDI also does not churn much)

What does this Mean?

- Over the years a lot of operators/promoters have used the system to launder money by taking defunct listed companies up by 10-100 times. SEBI has not been able to do much but had been lobbying for LTCG to stop the tax evasion.

- Check Link - Sebi unearths Rs 34,000-crore tax evasion https://www.business-standard.com/article/markets/sebi-finds-11-000-entities-misusing-capital-gains-benefit-117051501396_1.html

- Such money laundering transactions will stop with a 10% tax and surcharge.

- The data of previous years need to discount the fraudulent Tax Evasion. The focus should be to extract revenues from fraudulent operators instead of taxing the genuine investors and institutions.

- The estimates seem to be an extrapolation of the past 3-4 years which is masked by Bull Market in Smallcaps and Manipulation.

- As per us a practical estimate is if we grow Equities at 12-15% as per GDP and a starting market capitalization of 150 lakh crores and 2-4% of equity changing hands the government can barely get 3000-9000 cr of LTCG Tax annually. This is the best and linear case. Reality could be lower. LTCG revenues could become significant only after a decade of compounding.

- The broader markets have corrected 40% since the budget. Even if new investments become profitable there will be a lot of set-offs available for LTCG Loss for many years. This will cut the LTCG Tax by a big margin for the first few years.

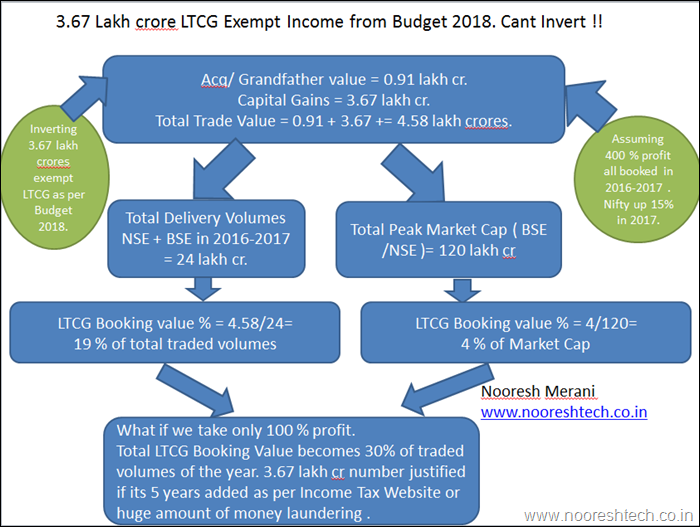

Inverting the 3.67 lakh crore number !!

3.67 Lakh crore LTCG Exempt Income from Budget 2018. Cant Invert ( Pictoral Explanation.)

3.67 Lakh crore LTCG Exempt Income from Budget 2018. Cant Invert ( Detailed Explanation.)

A.Y 2017-2018

Assesment Year 2017-2018 implies the tax to be paid for Financial Year 2017.

All Tax Payers Long Term Capital Gains is 1,33,367 cr.

The LTCG for Assessment Year 2017-2018 from the Budget is 3.67 lakh cr.

|

Year |

Market Cap BSE Cr |

Market Cap NSE |

|

31st March 2016 |

94,75,328 |

9310471 |

|

31st March 2017 |

1,21,54,525 |

11978421 |

|

Year |

Sensex |

Nifty |

|

March 31st 2016 |

25341.8 |

7738.4 |

|

March 31st 2017 |

29620.2 |

9173.75 |

|

% Return |

14.4 |

15.6 |

Market Capitalization is up 20-22% but that also considers New Issues and Equity Dilutions but we need this number later.

The Benchmark Indices are up 15% in Fy 2017.

How is Long Term Capital Gains calculated in simple Terms.

- One buys 1000 shares at a price of 10 rs.

- A few years later sells it for 100 rs.

- The Total Profit is 1000 * ( 100 - 10 ) = 90000 Rs.

- The Tax on this income is 10% i.e 9000 rs.

This implies the sell transaction of 100 * 1000 shares or 1,00,000 Rs.

So when the LTCG number of 3.67 lakh crore would imply a sell transaction of 3.67 lakh crore plus the acquisition cost.

From the lows of 2008 the Index is less than 4 times. Even from the lows of 2002 which is 15 years back the Index is up 10 times.

If we consider 10 times money was made the acquisition cost would 0.367 lakh crores and total value 4.03 lakh cr in minimum case or suppose the acquisition cost is 0.91 lakh cr would mean a trade value of 4.58 lakh crores.

( Taking the extreme possible investment timing !! )

Total Volumes in 2016-2017

NSE Total Volumes = 50,55,913 cr

BSE Total Volumes = 9,98,260 cr

Total Volumes = 6054173

The delivery volumes have been around 40%. ( Taking 10 year average.)

So actual volumes where LTCG booking can happen would be 24.2 lakh crores.

The booked value of LTCG transaction of 4-5 lakh crores implies roughly 16-20% of the total volumes of 2016-2017 is LTCG booking !!

Also a transaction of 4-5 lakh crores in a Total Market Capitalization 120 lakh crores would imply 4% of Equity of India being sold and LTCG booked. (Considering Capital Gains is 4-10 times the acquisition value.). This too considers all the money made in last 10-15 years has only been booked in 2016-2017 !!!

Now if we consider money is doubled the Value of Trade becomes 7-8 lakh crores which would be 30% of all delivery volumes.

So when we try inverting the 3.67 lakh crores number it almost makes us doubt the Budget estimate of AY 2017-2018 but there is no way to verify it as lack of data.

The only way the 3.67 lakh crores number can be inverted is that a lot of manipulation in shell companies which went up 10-20-50-100 times and there are 50-100 such companies.

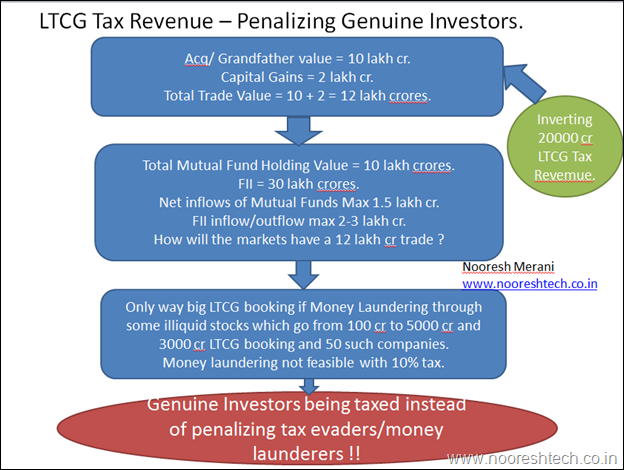

Conclusion ( Pictoral )

Conclusion:

- The 3.67 lakh crores of LTCG exempted Income number in the Budget of 2018 does not add up as per the CBDT Website or on Reverse Calculating from the Market Cap and Market Volumes data.

- Post grandfathering even in the best case of 20% upside in Total Market Cap to get a 10k crore Tax Revenue will need LTCG booking to be 30% of all volumes in India. Doesn’t add up.

- A practical estimate is 2-4% of Equity changes hands every year and Market Cap goes up 12-15% the max collections without any set-offs being considered would be 3000-5000 cr.

- The government collects 10000 cr plus from STT and for quite a few years may not even get LTCG equivalent to STT.

- Scrapping LTCG Tax and increasing STT would give better Tax Revenues.

- LTCG Tax revenues may not cross STT for 5 years even with 15% growth year on year.

- Over the last few years a lot of money laundering happened through small shell cos and that inflated the LTCG exempted income. With 10% Tax plus surcharge this laundering should stop.

- Focus should be to extract penalties from fraudulent promoters and operators for the tax evasion.

- The LTCG Tax is thus going to be applicable to the left out genuine investors, institutions.

- Morally the Tax is justifiable but a lack of revenues for the government does not make a case to continue with LTCG Tax.

- Post the Budget 2018 about 80% of the companies are below the grandfathered value and this will make it all the more difficult to get any tax revenues in next few years.

- Even in the best case of 15% year on year linear growth a revenue of 3000-5000 cr is possible.

- The Market Cap Loss of 5-15 lakh crores in lieu of best case revenue of 3000-5000 crores which will hardly be a few 100 cr this year reminds us of this saying – Khaya Piya Kuch Nahi Glass Toda Bara Anna.

- LTCG goes beyond the damage in near term but stops fresh flows also at a time when India needs a steady stream of Foreign Inflows through FDI and FPI to balance the fiscal pressures.

- There needs to be a re-think and abolish LTCG Tax, Dividend Distribution Tax and Buyback Tax. Rather need to give more incentives to create Domestic Capital.

- The Genuine Investors/Institutional Investors are being taxed instead of catching and penalizing Tax Evaders/Money Launderers.

Disclosure – We have been very liberal in assumptions to curve fit the data and still found it difficult. All the data used is public information from https://www.incometaxindia.gov.in , www.nseindia.com , www.bseindia.com . This is just a scenario analysis and we haven’t done a longer statistical testing of the hypothesis.

September 16, 2019

Broadly agree with your conclusions but then On one side we cry for abolishing quota everywhere , on other side we need taxfree long term.If some one sites STT ,then i think govt, should state that deduct STT paid from LT Gain.I don’t see wrong in taxing long term. One pays only if one earns.Majority who cry for abolishing LT Gain ,dont even hold it for long term. I even feel that Govt should tax Agriculture Income,let them give exemptions till 25 Lakhs,so the person who launder money under pretext of Agri Income ,comes under tax net.

September 24, 2019

The question is Government should maximize taxes or have moral taxes?

Also, LTCG is not there in most developing economies. Rest Agri Income Tax would be the biggest reform.

Do read the article again.