Sensex Technical View :

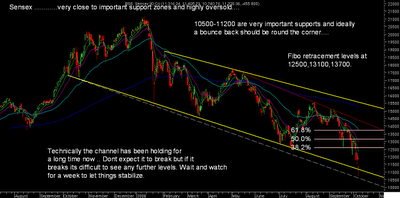

Technically Sensex is making lows almost lower to the channel support and on a simple terms yes its highly oversold but still bearish. Now lets try to simplify it through some technical points .

1) 30 % dip

January the panic month saw a dip of 27.7 % . In July markets fell around 29.4% at 12500. Now in October we have made a low of 10750 which is almost 31 % . So as per previous observation the markets have already fallen as before and a very sharp corrective bounce should be round the corner.

2) Channel and Trendlines.

As we see in the chart there are two lines taking different points. One comes to around 11200-11500 and other at 10500. Also on Dollex charts indices are very close to the support line. Technically markets have not closed below this line even in major panics. If it closes below 10500 then the only sensible technical level is 9700.

3) Indicators

RSI , MACD and many other indicators are almost close to Jan levels which had seen lower ckts. In such a scenario it can be said that markets are getting into highly oversold panic levels.After such a panic scenario the bounce back could be very sharp.

4) Fibonacci Levels

The important fibonacci levels for the entire bull run is at 11900 and 9700 out of which 11900 is broken and implies we may very well head towards 9700 as the next major stop and the most important level for a change of structural long term bull market is 8799 which is a decider over next whole year.

After taking a clear exit calls at 18900/17500/16700/16100 we have been going with a strategy of buying in declines to sell on corrective bear rallies. Earlier we bought at 14k-12.5k to get back to cash at 15k +. Right now the decision to start buying slowly frm 12.5k to 11k seems we had started a bit earlier and only thing which gives a lil comfort is 50-60 % exposure taken and rest cash be kept on hold which should now wait only and let markets stabilize. Lots of stocks might have corrected 20 % lower from starting prices or quoting at those levels below acquisition price.

Technically all indicators, analysis points to an end of the correction at 10500-11200 but at the same time few days back it seemed 11200-11900 should hold so cant really say whether we will stop at 10740 or not but it seems 9700 zone is the most important zone as its the 61 % correction to watch in case there is a whole round panic coming over in global and indian indices.

Earlier in my previous post about the Big debate where in it was presented that 11900 or 9700 which could be the bottom zone for the market. My assumption that Sept/Oct may see an economic peak does seem to be right but the extent of it and the panic which i expected could take us to 11900 + - few hundred points seems to has gone wrong as the panic seen in markets has been much much more then i expected. So the debate seems to have turned in favour of 9700 !!!

Here in another attached view which i had was even if we have to go to 9700 the technical implication would be a low around 11900-11200 which would be 30 % dip and then a bounce of 20-24 % which may take us to 13500 and then we may see whether market breaks the low made around 11200-11900 and then we may take a call whether markets are headed for 9700 odd or not . So technically if we break the low around 10740 or say 10500 in coming days then we could very well head to 9700 odd levels. Also 8799 is the level which should hold over any panic and I HAVE pure belief that we are not going below coz thats a major level for the INDIA STORY which is still the best over next 3-5 -8 years.

Market strategy and Thoughts :

Global cues are pointing way down with Dow Jones almost 670 points gives a real blow to market opening and impacts which may only be stopped by some regulatory intervention which can come during the day or before and it would be better if it doesnt come as any CRR cut , FED cut has only fuelled further selling.

NOW WHAT TO DO :

This is a very tough call to take. Luckily after January there might not be any leverage players so all one has is stocks on money. Although there could be many scenarios with govt interventions, announcements which may change the course of the day.

So there could be two possibilities out here :

1) Sensex holds above 10740 .

This is the most important recent low around 10740 and say 10500 which is another level but in panics no level comes into play. If this holds up for the day then a short term bottom has been formed and markets could head for a bounce. Strategy in this case would be to wait and watch and not buy or sell and let markets stabilize over the next few days

2) Sensex panics and goes to 9500-9700.

Continuing with the global panic starting in US and DOw Jones touching sub 9k levels, Sensex sees a panic and market breaks the lower zone of 10500-10750 then the index could touch the lower freeze level at 10200 and which would imply another touch to 9700-9500 in worst case.

Now this could be an extremely panicky situation and the first thing that comes to mind would be sell but mark my WORDS here i dont expect markets to correct beyond 8800 or say 9500 on a closing or even intra basis as of now. So in such a scenario will it be wise to sell at sub or very close to 10k levels well the answer is a BIG NO. So can we buy at 9500-with the 30 -40 % cash left the answer is obviously YES many stocks would be at irrational levels and if u dont have the guts to do so then dont sell at that price at least be patient over a week or next few weeks and let markets rationalize and stabilize.

" INVESTORS DONT SELL IN LOSS THEY SELL IN PANICS "

" Many investments become LONG TERM coz PRICES have dropped, BUT SUPERLATIVE Gaining Long term investments are created by buying when SENTIMENTS have DROPPED "

CHEERS !!! HAPPY INVESTING

BEST REGARDS,

NOORESH

09819225396