Apart from the fact that many stocks in Nifty50 are nearing range breakouts with Nifty50 making lower tops there are other problems too.

Lets look at them

1) Global Indices – US and Europe near all time highs but India continues to struggle and making lower tops.

2) Stocks in Same Sector – One at all time high the other one at 30% drawdown.

3) What to trust the Breakout Moves or Breakdown Moves ?

This creates a dilemma for a Trader – To trust the Breakout/Breakdown or Not ?

So what to do ?

Its a tough answer but the current situation looks like a consolidation without strong trends as of now.

Wait for Nifty50 to start crossing recent major swing highs ( 24200) and Swing lows ( 222800)

Till then trade on lower and lower sizes.

That's what I would do – What would you ?

Now lets look at some of the charts and the Interesting Formations.

The Struggling Nifty50

- Positive divergences on new lows.

- Still in lower tops.

- Last major swing highs at 24200.

- Swing lows at 22800.

- Every big positive candle does not see any follow up action over next 1-3 sessions. Wait for this to change.

The Multi-Year Range Breakouts or near to it.

Bajaj Finance

- 3 year range breakout after multiple attempts.

- Good Volumes also.

- 2000-2500 pointer range.

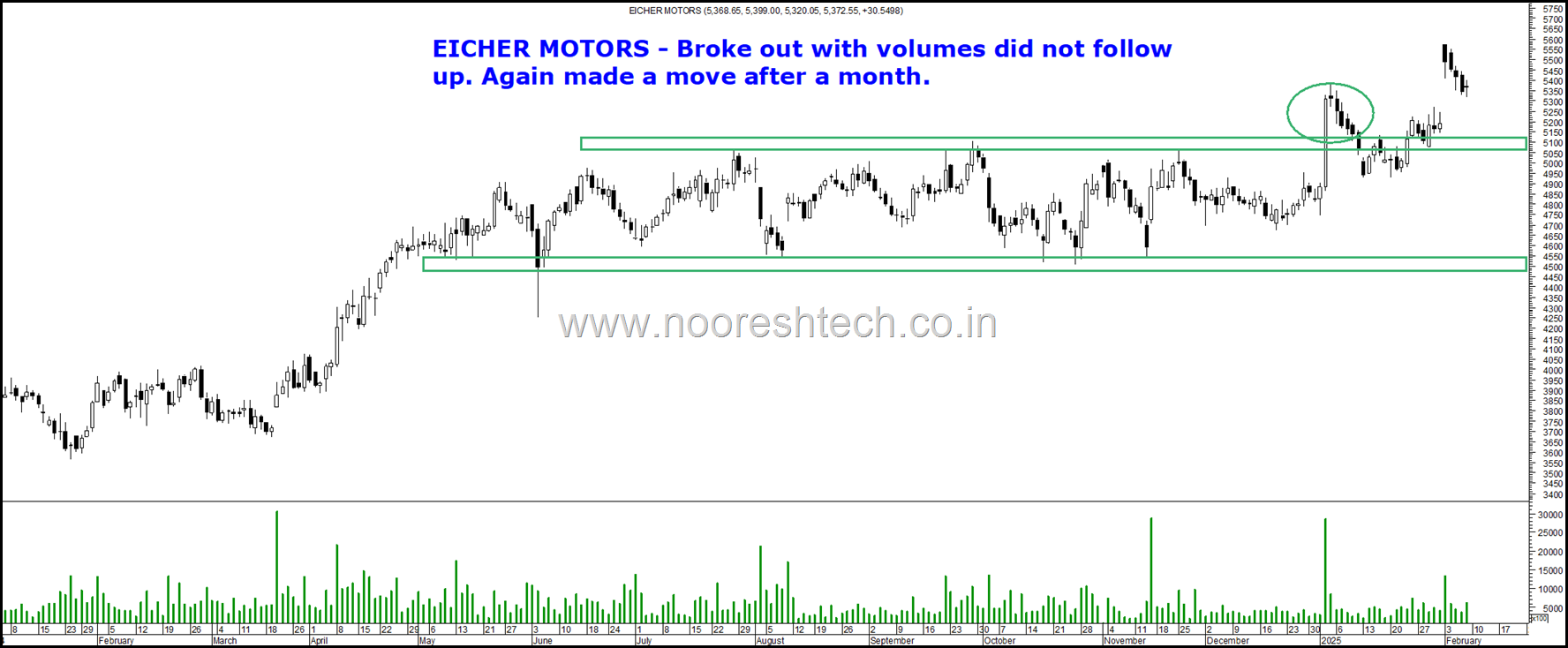

Eicher Motors

- This shows the problem of Nifty50 trend.

- Stock breakout happened with huge volumes.

- 80% of the single day move faded and consolidated for a moth.

- Again makes a move and sees a fade.

Kotak Bank

- Multiple bottoms at 1600-1650.

- Multiple tops at 1900-2000.

- The Knock Knock continues.

Mahindra & Mahindra

- The clear cut leader in Auto Space.

- Back to upper band of resistance.

- Can it continue to remain an outperformer and breakout ?

Maruti Suzuki

- Couple of attempts to breakout failed earlier.

- Went back to the previous range breakout and tested the supports.

- Now back again at the 13000-13500 resistance.

Infosys

- Multiple attempts at 1950-2000.

- Previous cycle highs of 2021.

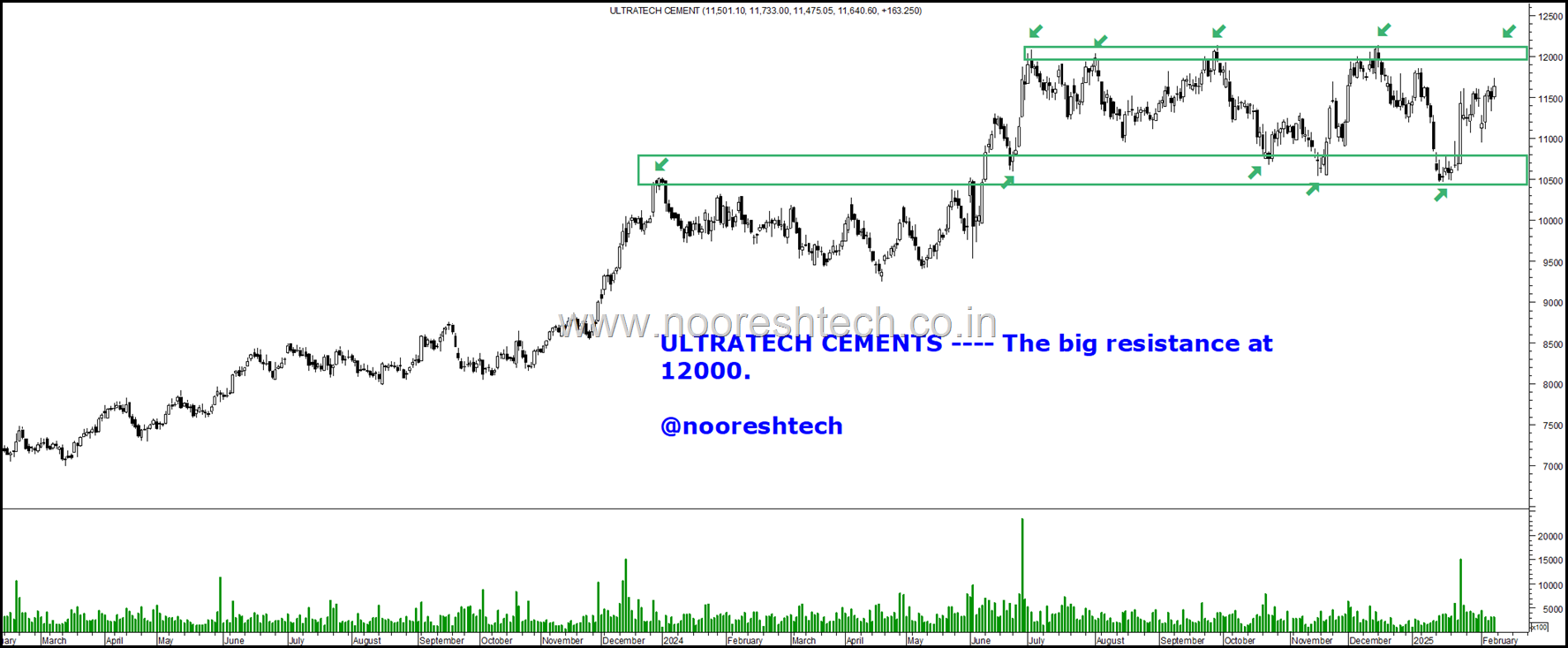

Ultratech Cements

- The big resistance at 12000.

The Laggards near support and can they bounce

Reliance Inds

- 3 bottoms around the 1200 mark.

- Interim highs at 1330-1350

- Has taken a 25% drawdown from peak.

- Will it breakout or breakdown ?

Larsen and Toubro

- Back at the lower end of the range.

- 3200-3250 has been tested for the last 4-5 times.

- Bounce or Breakdown?

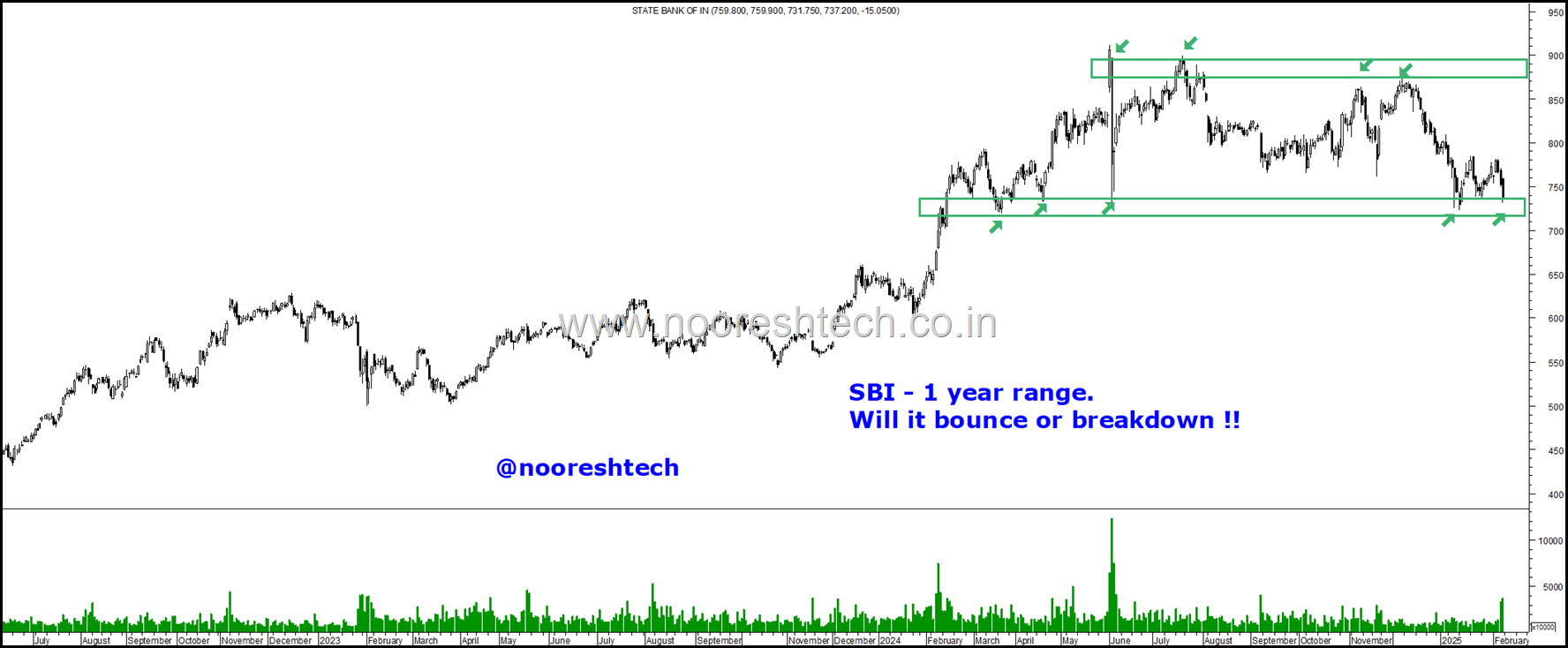

SBI

- Will it bounce or breakdown

Webinar Announcement – State of the Market

Date: Sunday, 16th February 2025

Time: 11:00 AM

Registration Fee: ₹500

Register Here: https://rb.gy/y5gl1r

Topics Covered:

1)The Technical View on Indices – Nifty, Bank Nifty and others. Short Term and Long Term.

2)The Midcap Over-Ownership and Over-Valuation.

3)Why are FIIs selling. How much more can they Sell?

4)Is it 2007 or 2017 again?

5)Strategy in the Current Correction.

6)Sectors to Watch out for going forward.

7) Sectors to Avoid.

8)QnA

Mr. Nooresh Merani

SEBI Registered Research Analyst Registration No. INH000008075

Please read the detailed disclosures on this link - https://nooreshtech.co.in/disclosures