Sunday Thoughts

Every few weeks I tend to write a post on Sunday which is a mix of Technicals, Market Reading, Fundamentals and all other Thoughts.

One of the major reasons why every few weeks Sunday is a good day to think and do Analysis is that – Markets are Shut and you had a Trading Day Break on Saturday.

The Mind is more Calmer and less biased.

So here are 8 interesting charts followed by a few Thoughts.

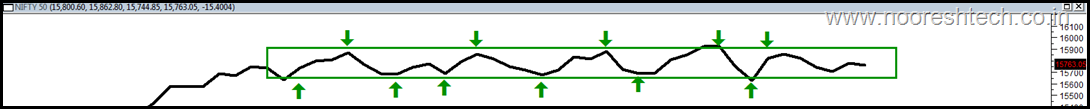

1) Nifty – In a 300-350 Pointer Range on Closing Basis - A Blow out coming in days or max 2 weeks.

Nifty now has spent exactly 2 months in a range of 15450-15940. On a closing line chart the range shifts to 300-350 points.

2) Broader Market Index make Marginal New ATHs.

Nifty may have not crossed 16000 and struggling but on Friday following indices made a new ATH by a very small margin.

Nifty Midcap 150, Nifty Mid & Small 400 , Nifty Metal, Nifty Mid 100, Nifty next 50 , Nifty Small 100 and BSE Smallcap 100.

The Broader Market Index making new highs and even the structure of Equal Weight Indices suggests the coming week is where the range should finally break.

The Bias is obviously bullish as Higher Tops and Higher Bottoms in almost all Major Indices and so the assumption is we breakout on the upside possibly.

3) DOW and DAX – Also waiting for a breakout.

Dow Jones last few days have been very tightly ranged.

4) THE MOST INTERESTING CHART – BSE DOLLEX 30.

Sensex in Dollar Terms.

This has not seen a new high since 6 months.

A cup and handle formation. A breakout above could the highs would be interesting.

5) Dollar Index – Yet another attempt at breakout seems to be failing. – RISK ON below 91.5

Seems like another break below friday lows and 91.5 and we get into a RISK ON mode with Equities and Commodities getting ready to rally.

6) LME ALUMINIUM BREAKS OUT

7) Cotton – US & MCX

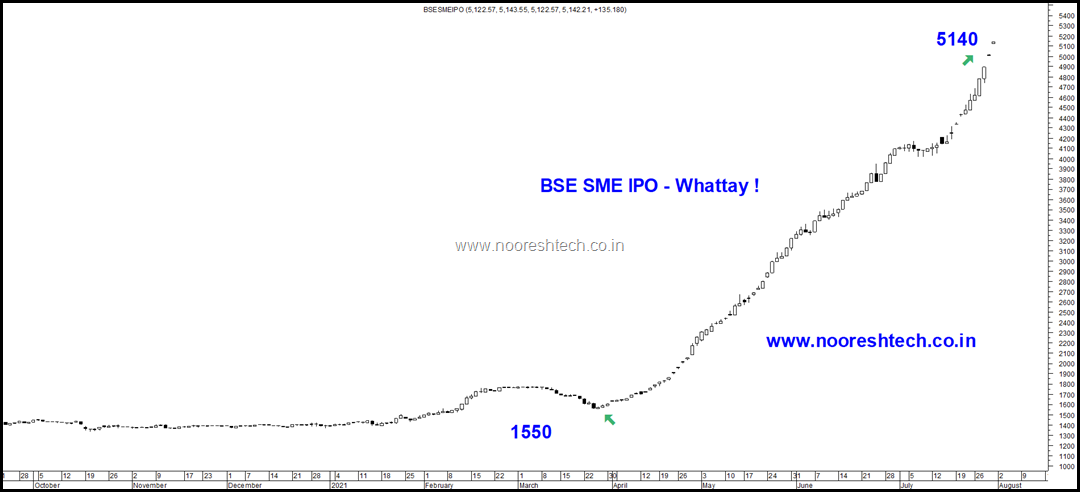

8) BSE SME IPO INDEX – Now thats called Momentum .

This is some super Bullish Momentum. I do not track the #BSESME space. Too illiquid.

Feel like a Beggar with Bag of Money when you cannot get order fills & finally when you get it, you can be left with the Bag. #BSESMEIPOINDEX #Sunday #Timepass

Sunday Thoughts

- First things First. Expecting Nifty to Breakout above the 15900-15950 mark in the next 1-2 weeks given that broader markets have done so. Contractions do not last too long.

- Disclosure – Am Long Stocks and Calls too ! So Biased. Be Ready to cut longs when we break 15450-15600.

- Twitter Thread -https://twitter.com/nooreshtech/status/1421365746739736577 ( The comments are interesting.)

- A tweet from the thread - I go to http://screener.in and run a simple Market Cap > 100/200/500/1000 scan. 2260 above 50 cr. 1900 above 100 cr. 1572 above 200 cr. 1175 above 500 cr. 944 above 1000 cr. 708 above 2000 cr. 469 above 5000 cr. Consider your universe and it's not that many !!

- I see another trend for last many months.A lot of Concern or just Plain Envy amongst a lot of Investors/Traders like us who have been around for years /decades towards the New Investors/Traders of last 12-15 months who are killing it and even outperforming.

- This is a very rare instance where Participation in Equities increased after an ongoing bear market followed by a sharp 30-40% knock on Covid. Generally participation used to increase as the Bull Market kept roaring.

- The Investors/Traders who started in 2020/2021 have got a superb Head Start. Nifty is up 30% after crossing 12400 pre covid all time highs and more than 100% from lows.. BSE Smallcap Index is up 60-70% from November and up 30% above Jan 2018 highs.

- At times one just needs to be at the Right Place at the Right Time. If you bought a bunch of equities in 2003-2004 and held it for next few years and decades, it did not matter whether you understood investing or not you would have made good money. What if 2020 is that moment ?

- Such a head start makes it easier to digest Corrections unless one is using a lot of Leverage or suddenly deploying 10-20x the initial capital.

- The big difference and a Pleasant thing I like – Between 2004-2007 and now is- Even if you want you cannot leverage with the new sebi rules . Derivative margins are way higher and lot sizes too. Margin funding is on client level and not broker. Las, nbfc, broker funding etc is tough. Back in 2007 a client could have a 10-50x leverage if sub broker had money with broker. Now one may not even get 10x leverage on intraday. So only way to blow up an account quickly is naked long options.

- Its like you have a 100 mark paper of MCQs with 50% negative marking and you already have got 60 questions right with passing at 50. All you need to do is not screw up in the next 40!

- So keep it simple do not do crazier things just because you made a 50-200-300-500% in last 15 months. Learn More, Read More and be Disciplined.

A quote from a Book which is a must Read Now.

By 1996, individuals were putting an average of $25 billion per month into stocks, directly or through retirement plans—equivalent to nearly $100 per citizen.29 Mahar, Maggie. Bull!: A History of the Boom and Bust, 1982-2004 (p. 161). HarperCollins.

Conclusion -

- Get set for some trending moves in next few days/weeks in the Nifty. Stock Specific Action to Continue. Keep a stoploss at 15450 or 15600.

- The Global setup is interesting too and keep watch on charts in the post.

- Be happy for people around you making Money. Help them get better or pray they do not end up taking fatal risks.