Nifty has crossed 15000 + and is now at 15300.

Every time I speak to an investor friend about an interesting Stock Idea the first reaction from most is the Stock is up quite a lot from March 2020 lows.

Can u stay anchored to the March 2020 situation forever. Have you behaved the same way in your daily life as you did in March 2020 ?

So it's time to move on and look at What Next rather than What Was.

There are different ways one can anchor to the Index.

- Nifty is up 100% from the lows of 7500.

- Nifty is up 20-25% from Pre-Covid prices and last major highs.

- Nifty is up 140-150% from highs of 2008. ( Still at 7-8% Cagr )

- Nifty is up 6-7 times from lows of 2008. ( Still at 16-17% Cagr. Best possible timing of the last 15 years. )

- Nifty is up 3 times from the lows of 2013. ( Still at 16-17% cagr on another best possible fit.)

If you would have anchored yourself at the March 2020 lows it would have been very difficult to allocate money to equities all through the run and will remain in the future.

Anchoring to the lows of March 2020 or February 2016 or August 2013 or Oct 2008 is what stops most of us from deploying money into equities during the upswing.

We need to remember the bottom prices were there for a few weeks at max and you would have not got a Money Shower to Go all in.

Interesting long term chart to look at. ( made it on Sensex 50k touch)

Keep an open mind and keep looking for Interesting Stocks, Breakouts, Sector Rotations.

We did come out with our Structural Bullish View Report before the Budget named - Sensex Post 50000 Boom or Doom.

A slide from it.

There will be corrections and opportunities going forward as well. So continue to prepare and research looking at the situation NOW.

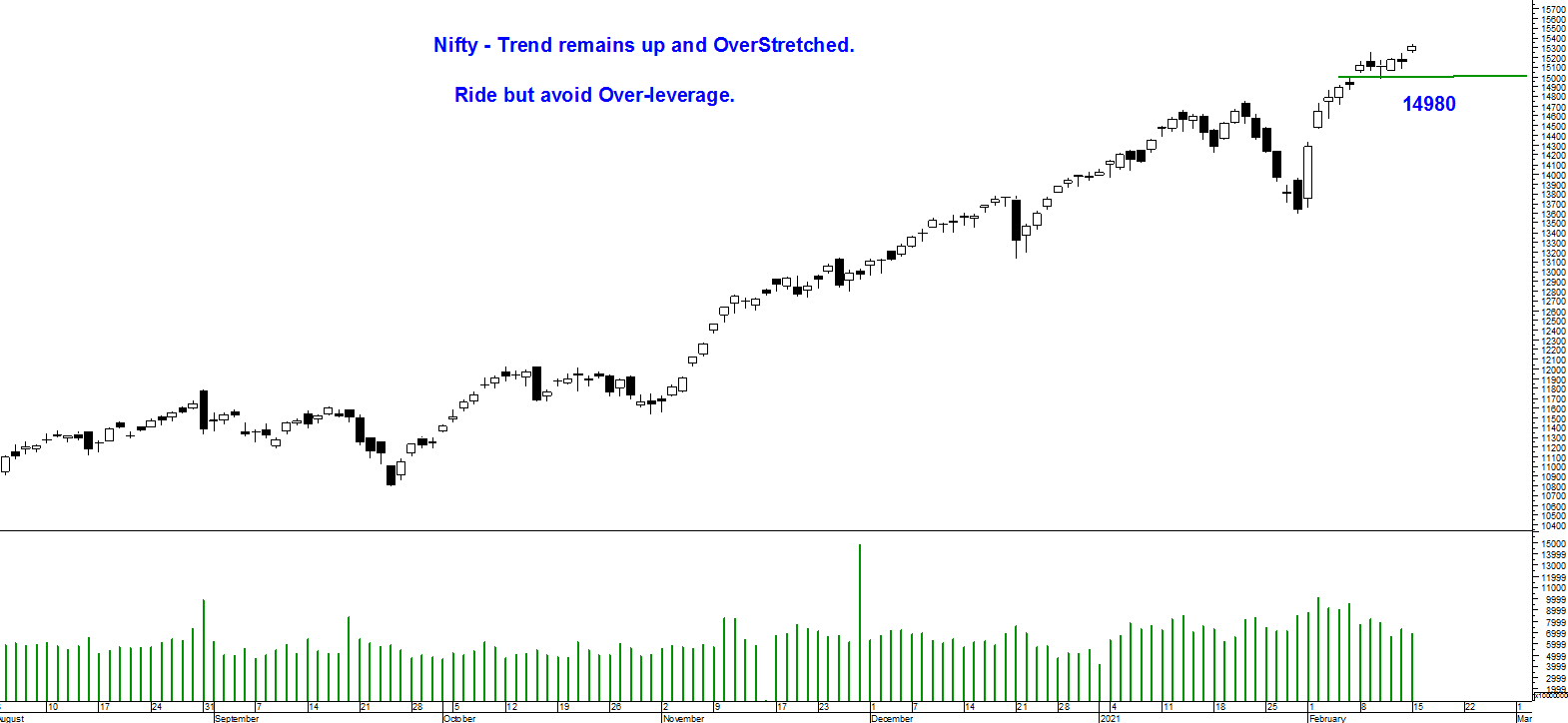

Now a quick technical take on the Nifty.

Nifty - Momentum Begets Momentum. ( Divergences in a Bull Market can last for much longer than you can remain Short and pay up . )

- The Higher Top and Higher Bottom Continues.

- Extreme short-term price point to watch for a reversal would be 14980.

- The last 4 days range was 200-250 points so the next possible target could be 15500.

- Ride but do not be Over-leveraged.

- Evenitis Shortis ( averaging a losing position in hope of getting an even price to exit. It's more dangerous in Shortis).

What Next ?

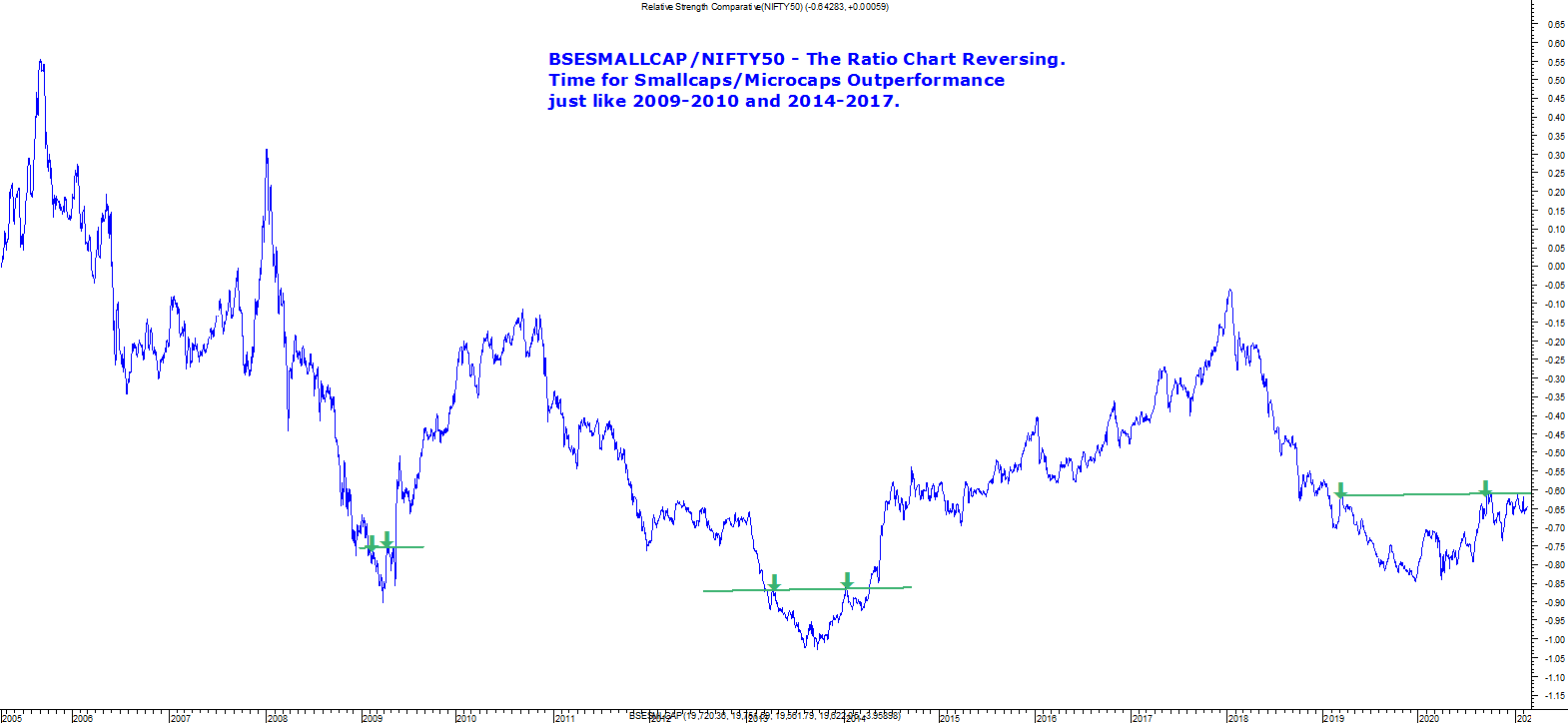

The BSE Smallcap/Nifty Chart suggests that going forward Smallcaps could do better than the Nifty and selective moves could continue even with Nifty getting into a Range or a Consolidation just like in 2009-2010 or 2014-2017.

Can look at some more charts of BSE Midcap and Nifty 500 in the following article -

https://www.timesnownews.com/business-economy/markets/article/broader-market-outperformance-on-the-horizon/720402

Conclusion

- Time to be Stock Specific and watch for New Sector Rotations.

- MicroCaps,Smallcaps, Midcaps - Time to be selective here and maybe avoid largecaps for the short term.

Research Service

Technical Traders Club

Check Link for full details

https://nooreshtech.co.in/quickgains-premium/technical-traders-club

Subscription Link

Half Yearly = Rs 15340. ( Including GST )

Annual = Rs 25960 ( Including GST )

Insider Trading Subscription Link

Quarterly Report Payment Link - https://imjo.in/Mzmtdt

For Annual Subscription – Insider Trading Quarterly Report - https://imjo.in/JtdFVs