There are 2 ways to look at the Nifty50 to make an analysis.

One is to focus on the Nifty chart and second is to focus on the Nifty50 constituents and see for trends emerging.

Over the last few years we have been focusing a lot more on reverse calculating the possible trend in Nifty50 from the constituents. We also share a Nifty Calculator which is an approximation.

Some of the reasons.

- Over Concentration into top stocks.

- Top 2 weight at 22.38%. 1) HDFC Bank at 11.21% 2) Reliance Inds 11.17%

- HDFC Bank and HDFC Limited together is almost 18.5% of the Index.

- Top 3 weights at 29.61%

- Top 5 weights at 42.66%

- Top 10 at 61.82%

- Top 20 at 78.76%

| HDFCBANK | 11.21 |

| RELIANCE | 11.17 |

| HDFC | 7.23 |

| INFY | 7.21 |

| ICICIBANK | 5.84 |

| TCS | 5.04 |

| KOTAKBANK | 5 |

| HINDUNILVR | 3.42 |

| ITC | 3.03 |

| AXISBANK | 2.67 |

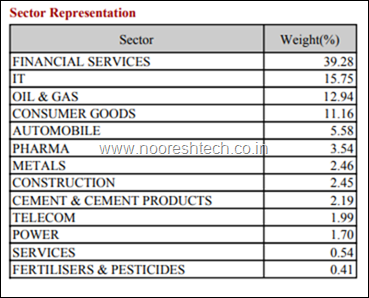

Over Concentration into top sectors.

- Banks and Financial Services back closer to 40%

- IT at 15.75%

- Consumer Goods at 11.16%

- The above 3 comes at 66% and have lower co-relation to the economy as their less investment linked.

- Back in 2007 the top 60% used to Oil and Gas, Power Telecom, Construction.

Analysing the Nifty

The approach is to look at the trends in the top names and sectors technically. ( Another post on that one.)

The other way is to make an approximation of what will happen to Nifty if a particular sector or a bunch of a stocks make a move.

So take your guess.

Guess where the Nifty should be 14000 or 12000 first ?

Click to Download the Nifty Calculator

What is Nifty Calculator ?

-> As per the weightages given by NSE for Nifty stocks we have created the Nifty Calculator.

-> Change the expected price and the expected Nifty will change accordingly

-> Create 3 different sheets for yourself–

Pessimistic ( where you put the worst possible prices you think . Default 10% down )

Optimistic ( the best prices possible. Default 10% up)

Neutral/Rational/Technical / Fundamental ( prices on any reasoning )

Please Note as weightages change every day by small margin this will not give an accurate estimate but will be approximate.

How to Guess?

- Everyone has a view on Nifty based on Macro, PE, Valuations, Technicals, Waves etc. Try to grill it down to the constituents. It should be a reflection of your actual guesstimate.

- Just estimating wild scenarios on the top 20 stocks is enough given the 80% weight.

- Start with changing default fall to 5-10-15-20-40-80 or rise to 5-10-20-40-80.

- Then change stocks which you think may not do the default move.

- Do send me the Excel Sheet if you get beyond 10000 or 16000!! ( Mail me on nooreshtech@analyseindia.com or 9819225396 )