•2017 was a year with not a single 5% correction in most of the Global Indices and Nifty.

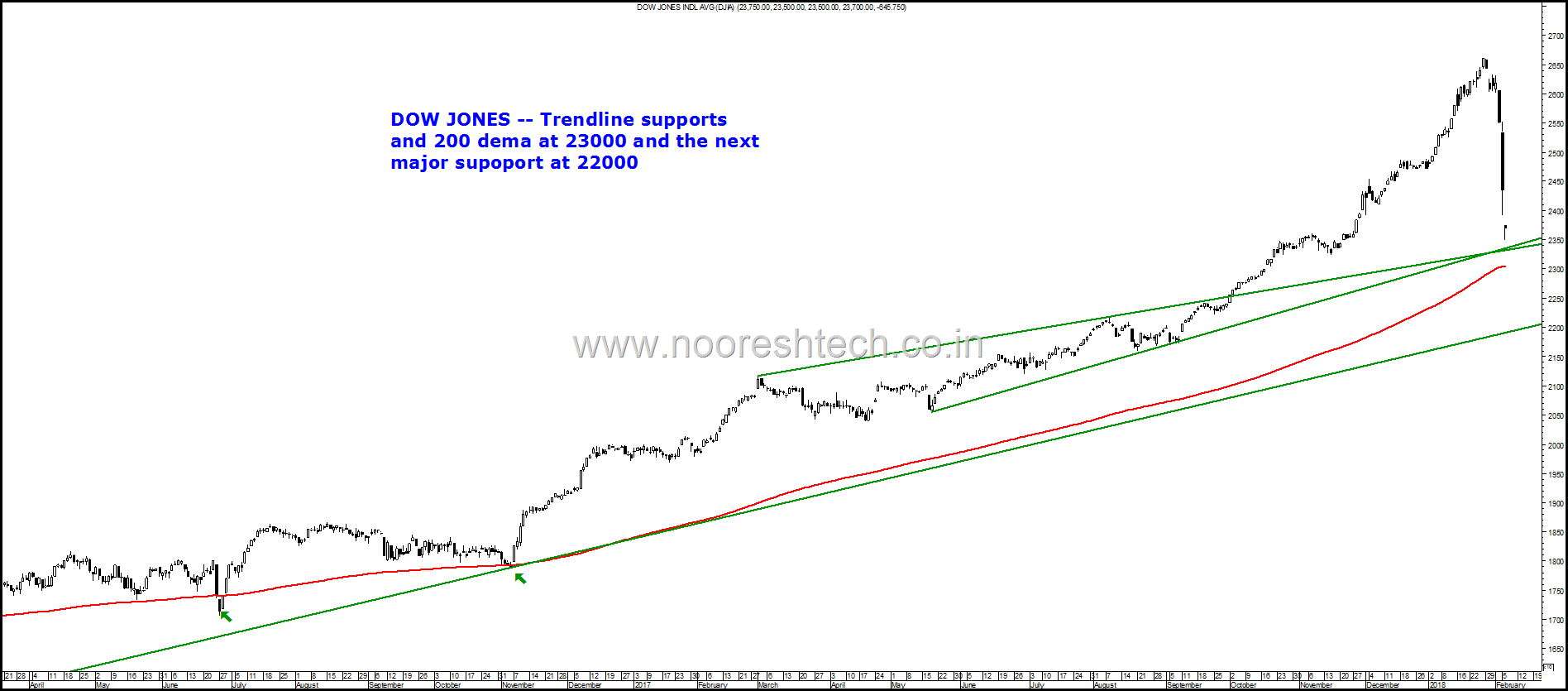

•After a great start to 2018 we have now seen a single day cut of 3-5% in a day and 7-10% gone in next few days.

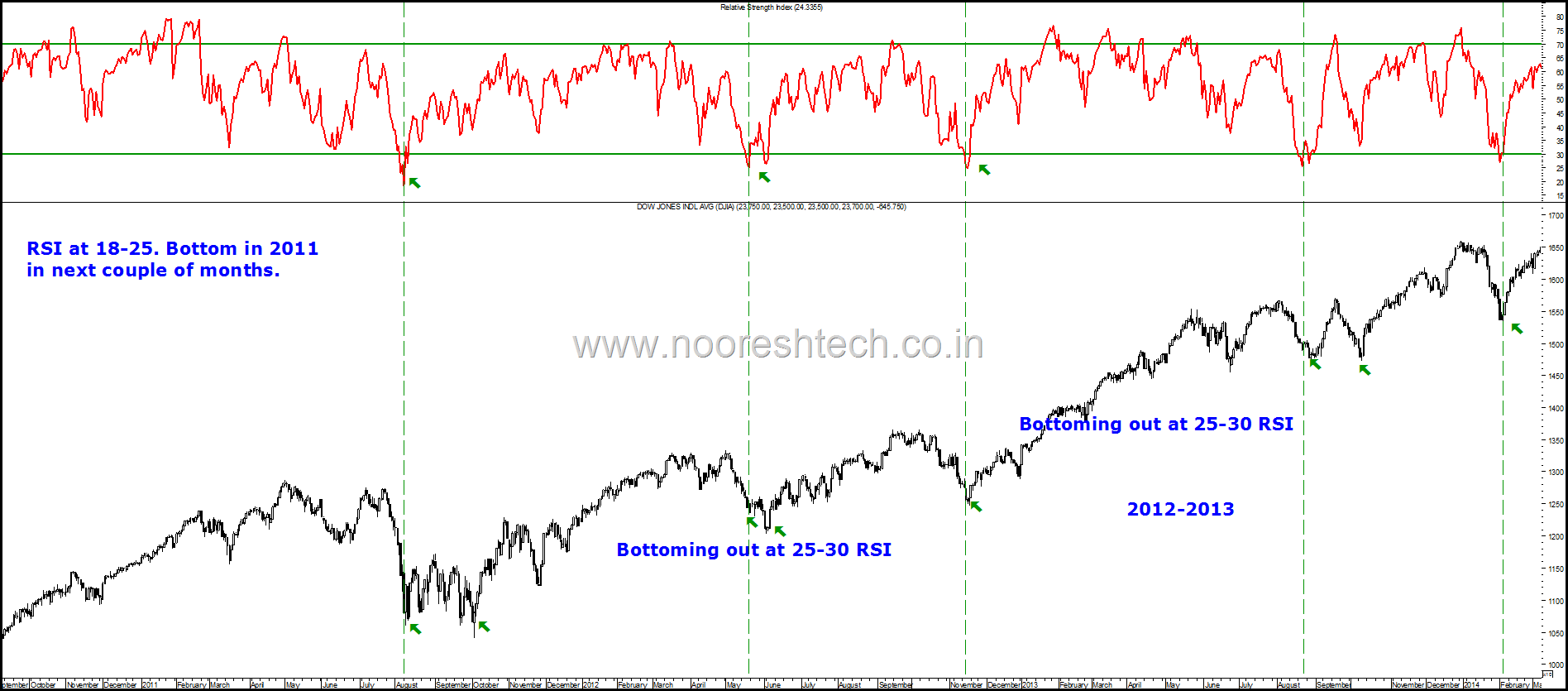

•The VIX across the world had hit almost lower double digits to single digits also in cases which is an all time low and in last few days has gone to 35-40 which is what it reached in previous major falls. RSI is has also gone closer to 25 from an all time peak of 90.

•Although the Global Indices would be only down 10% from their peaks but the Oversold conditions ( RSI,VIX, A-D Line) is similar to major panic bottoms.

This is an ideal combination for a short term bottom across Global Indices.

Conclusion

Nifty at 10100-10000 is a strong support. Whether we get there is a different case but stock specific opportunities to deploy existing cash and fresh cash.

We have just sent out a list of interesting top picks and will be sending out to our clients. If you need that subscribe - https://nooreshtech.co.in/quickgains-premium/technical-traders-club