Just a few stocks which came up on radar - Closer to resistances or breaking out.

Tata Chemicals - Lots of resistance around 580-600.

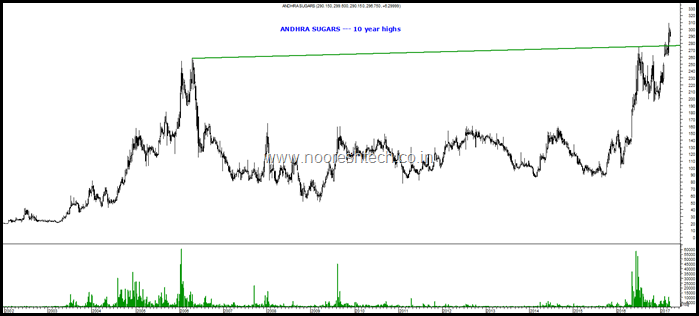

Andhra Sugars - 10 year highs.

Has always been cheap on a P-E Basis. Good track record of dividends. Underperformer in the caustic soda/sugar rally.

DCM Shriram - New all time highs with a good volume tick.

Disclosure - Stock has been recommended in Technical Traders Club

PSU Banks

A lot of PSU banks are pretty close to the resistances of last 12-24 months.

It will be interesting to see if they breakout into a strong upmove.

Disclosure - We would have recommendations on some PSU Banks in Quickgains

Bank of India - Stiff resistance at 140.

Canara Bank - Can it breakout above 300-305.

State Bank of India - Can it breakout above 280-290. Lots of attempts on that trendline in last 2 years.

Technical Analysis Training Mumbai

Date:

8th and 9th April

Timings:

9 am to 6 pm

Venue :

Hotel Park View

37, Lallubhai Park Road

Andheri (W), Mumbai, 400058

Maharashtra – (India)

Tel: +(91)-(22)-2628 7222 /4074 2222

Fees

Rs 16000 ( Inclusive of Taxes ) ( No Discounts)

Registration and Payment Link

https://www.instamojo.com/noooreshtech/technical-analysis-training-mumbai-8th-9th-a/

Nooresh Merani

Securities covered above:: Tata Chemicals, Andhra Sugars, DCM Shriram, State Bank of India, Canara Bank , Bank of India

SEBI Registration disclosure – Investment Adviser ( INA000002991)

Financial Interest:

Nooresh Merani and his family/associates/ analysts do not have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision