A quick look at the Global Indices.

S&P 500

- Oversold and back to sub 30 RSI

- In the previous instance of oversold it has either made a new low and Positive divergence or goes sideways before a clear recovery.

- Will it be a quick recovery or a formation of positive divergences over next few days but eventually a good recovery over next few weeks.

Dow Jones

- Back to june lows as well as pre covid prices.

- Most oversold since covid lows.

- Will it be a quick recovery or positive divergence over next few days but eventually a good recovery over next few weeks is the view.

Nasdaq 100

- Oversold but no positive divergences yet.

- Also the index seems a major top is done like 2000.

- May not gain leadership for long time. A short term bounce here but better to focus on Dow and S&P

VIX – No major panic but no event as well.

Vix - Still a little away from the

35 mark which has been a bottoming out zone for S&P 500.

Panic not as high but no major event as well.

Not the time to be bearish but be ready to watch for reversals.

Nikkei

- Not oversold.

- Holding on above the trendline

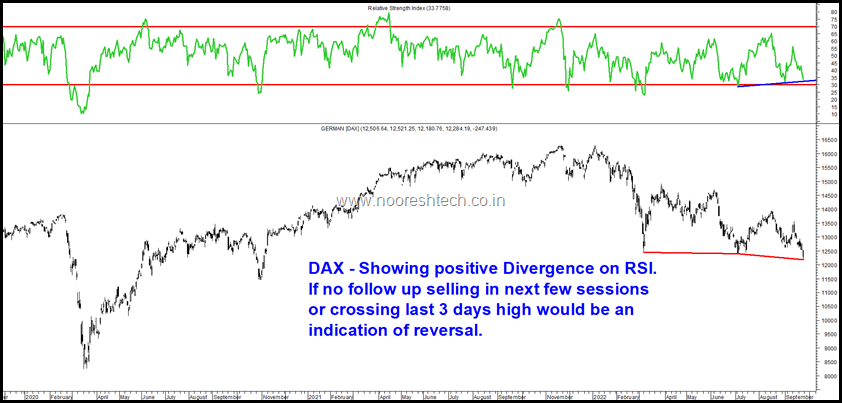

DAX

- Breaks March June lows.

- Showing positive divergences

- If no follow up selling in next few sessions or a quick move above last 3 days highs would indicate a reversal.

For the Nifty we are still away from being oversold. 16800 was the last breakout and another gap at 16950. So that should act as a support.

Bank Nifty 38000-38500 a support. ( still a leader.)

Nifty IT maintain the view to be not bearish and accumulate on dips.

Time to look out for stocks reversing after retesting and holding on to the recent breakouts.

Conclusion

- Maintain the stance of India to outperform global markets.

- Continue to look for stock specific opportunities.

- The outlook remains bullish for the short to medium to long term.

15% Discount on Technical Traders Room

A 15% discount on our new product, Technical Traders Room until 30th September 2022 Use code: MAIL15 To avail the offer, click on the below link https://rigi.club/jcp/l7BZLqDa7i Those who have already subscribed can extend their subscription using the same link

Technical Analysis Training Mumbai–October 15-16.

1) Free Access to Online Course 1 year. (Rs 6000 )

2) Free Refresher

3) 2 months Technical Traders Rooom

4) 10-12 batch size

Fees Rs 16000

Payment Link https://bit.ly/3DCU5vm

For more details https://nooreshtech.co.in/2022/09/technical-analysis-training-mumbai-october-15-16.html