Happy Dhanteras and Wish you a Happy Diwali and a Healthy and Prosperous New Year.

After a really long time Gold has become and interesting asset to look into since 2011 when Gold topped in dollar terms in 2021

Although Gold may not be comparable to Equity or Index Returns but deserves some allocation or an asset allocation.

Also last year has been a good one. No harm in buying some physical gold for consumption !

Gold Technical View

- The only commodity which has really not done well over the last year seems to be Gold.

- The range seems to be contradicting and can eventually breakout.

- As a trade would keep a stoploss at 1700. If it breaks out could go into all time highs.

- As an asset allocation it seems a good time to get some Gold in the asset allocation plan.

Gold INR – Range Bound. Can breakout eventually.

Even Silver could be interesting.

#DiwaliOffer - 15% discount on all our smallcase subscriptions for 6/12 months - Use code - 15DIWALI . All the smallcase on this link - https://nooreshtech.smallcase.com #Smallcase

Stock Charts

Looking at a few of them which are near breakout , topping out and retest.

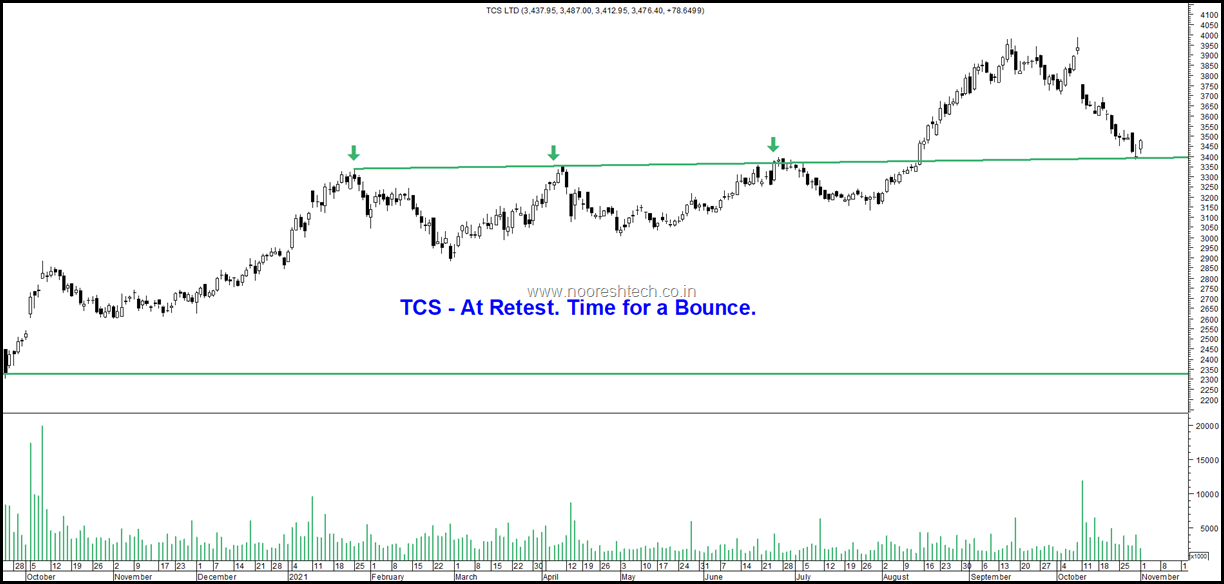

TCS – Retest and Bounce

Coal India – Retest and Bounce.

Bajaj Finance – A double top and Fall or sideways.

ABFRL – Setting up for a breakout into pre covid highs.

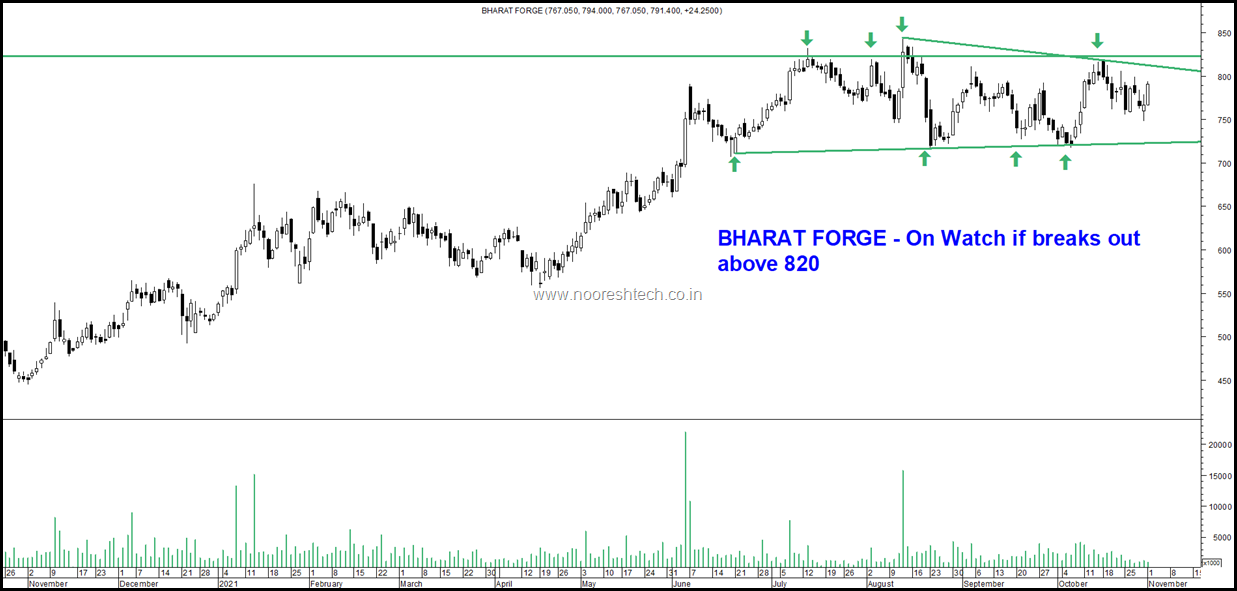

Bharat Forge – Watch for a break above 820

BHEL – Cup and Handle. Big resistance at 80

Sun Tv – After 2-3 false breakouts can it finally breakout.

#DiwaliOffer - 15% discount on all our smallcase subscriptions for 6/12 months - Use code - 15DIWALI . All the smallcase on this link - https://nooreshtech.smallcase.com #Smallcase

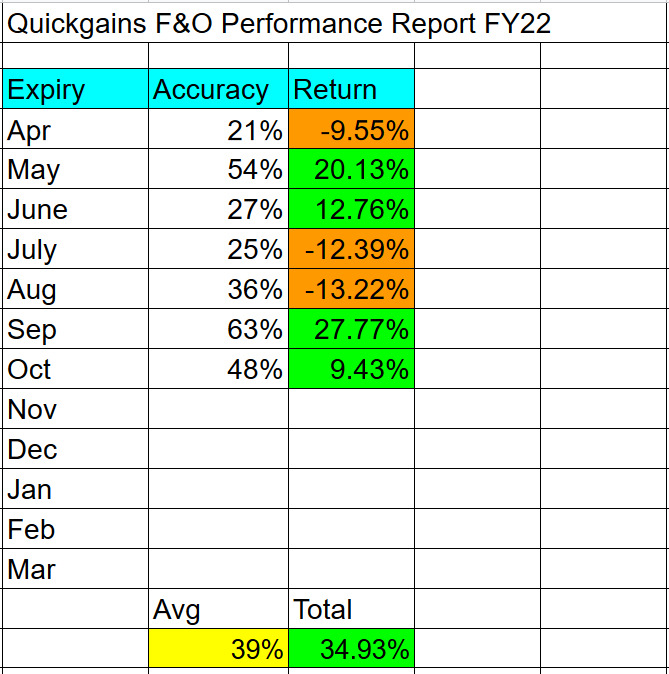

Quickgains F&O Performance FY22 ( Till Oct) https://nooreshtech.co.in/quickgains Subscription link --- https://instamojo.com/noooreshtech/quickgains-newsletter-service-annual-members/