In a similar post we looked at how PSU as a sector is making a major turnaround back in October/November 2020.

Since then the CPSE and PSE Index has started outperforming the benchmarks for the first time in a decade. One our picks – BHEL is up 130 % since then.

Also there were many trading opportunities in these names in last 6-8 months.

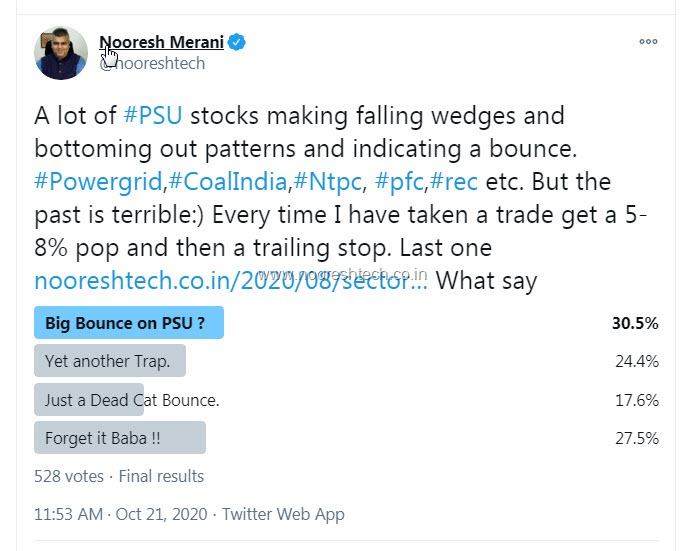

A snapshot from the post – What is interesting is 27% did not even want to look at PSUs.

Journey of a Trade – BHEL

The Journey of a Trade series helps you not just understand technical analysis but the amount of emotional swings you will get in a journey of a big trade.

Its never linear, lots of volatility, dips, retests, fakeouts etc.

BHEL was the most volatile one in the journey from 32 to 74. Also the stock would go into derivative ban which would add more volatility.

A snapshot of a technical breakout chart looks easy but the video replay shows all the twists and turns.

Hope you like the video.

BHEL Stock zoomed 131.25% in 6 Months.

This video explains the analysis and journey of BHEL stock which gave 131.25% returns after the breakout.

The above recommendation was made in our Research Service ‘Technical Traders Club’.

There are a few very simple reasons for a trade on a technical trigger in PSUs becomes a low risk one.

- The Valuations are extremely cheap and maybe deserve to be just cheap.

- Dividend yields are high.

- Ownership is low and is a major underweight position for most institutions.

- 5-10-15 year returns are closer to zero.

- Low Beta and Low volatility.

Eventually a bigger re-rating would only be possible on a complete privatization. ( I came out with a report – Privatization is inevitable in 2019. Hopefully it should finally play out over next 6-18 months)

We last recommended a SIP in CPSE index in our Post 50000 Boom or Doom Report.

So finally we go to the two interesting names !

2 Large Cap Hated Stocks from PSU possibly changing trends after 15 years.

These stocks could also be part of an Anti ESG Portfolio. Personally my view is the ESG theme is going to underperform big time over the next few years!

When that happens we will find a way to re-rate Anti ESG cos with Good Earnings and Potential.

ONGC – 15 years of no Return.

- The only return that has come in this stock is from dividends. ( Even today yield is closer to 4% )

- Stock was at 120 back in 2006.

- By 2007 it was the 2nd largest weight in Nifty !!

- Finally the longer term trend seems to be changing.

- Shorter Term breakout above 120

- The stock can surprise over the long term and head up to 200-300. Long term stoploss 100. Short term sl 115

Coal India – The only time it looked promising was in IPO

- One of the heavily subscribed PSU Ipos at that time and largest PSU stock at that point of time.

- Since then the stock has only had a down trend on a longer term basis.

- One of the few stocks which actually broke March 2020 lows.

- In the short term has made 6-10 attempts to break the 150-160 mark.

- Sustaining above that would be a big breakout and upside to 200-250 and more.

- Short term stoploss 145 and long term sl 135.

There are some more PSUs which look interesting across various sectors for trade and investment opportunities. Time to keep an open mind and approach them.

Disclosure – The Author has vested interests in both stocks as well as ONGC recommended in Quickgains F&O. Also we can book out whenever we want. Please do your own research and risk management.

Sunday Thoughts - The Belief/Faith Bias

There are a lot of advantages of having had a multi-cycle experience in Markets. ( 10 year plus.). Big Moves give Big Learning's – Either side.

But one of the disadvantage is that some of the experiences/inferences become hard core beliefs and are so hardwired that its difficult to accept a change.

The older you get more such biases almost become faith and its difficult to accept anything out of it.

The MNC Bias

One of the first group of companies which created obscene wealth for investors were MNCs.

I have a good old friend Gujju Kaka from whom I have learnt a lot about patience and having fun. He loves MNCs.

Just cannot accept a MNC is bad even if it has started an unlisted subsidiary which now does most of the biz in India.

Luckily he understands a sector coz of his career and that has good Indian cos too.

There are many such biases which become Faith – FMCG Bias, I Buy only High Quality Cos, Avoid Cyclicals they always lose money, Avoid PSU, Growth at Any Price, Chor Bane Mor Always etc etc.

- One of the classical one was – Multibaggers happen only in Small Companies. Elephants dont Run etc . ( Reliance the largest company of was one of the best performers from 2017-2019-20)

- Everyone saw JIO happening , everyone saw 8 year breakout – But how many of us could ride it ?

- FMCG underperformed between 2000-2010. By 2013 ITC was largest weight of Nifty. Now its a Meme/Joke favourite. ( Best one – Brokers give a 15% haircut on ITC and 20% on Gold)

- Pharma was a defensive. It became the most aggressive in 2012-2015. Sun Pharma Promoter networth came close to Mukeshbhai. Now its Adani near Mukeshbhai.

- Chemicals are Commodities. Now Specialty. Name Changes. China + 1 etc. From 6 P-E to 15 x Sales !

- Quality at any P-E, any Price to Sales. 40 became 140 PE. Will it become 250 PE ?

Simply put our biases tend to stop us from participating new emerging trends and leadership themes. Longer the time spent in markets, more the biases.

For example a friend made almost a doubler in a Futuristic company in a less than two months and I just could not get the courage to buy on a breakout even though the stock was a big boom and doom in 1999-2000 when I was in school and not trading!!

( I have traded much worse cos. The decision to not buy was 1 sec !)

The experiences/inferences should not become faith and one should be ready to research, re-think, re-evaluate. ( Extremely Difficult)

Its extremely difficult to be able to keep an open mind as a lot of past experiences help you from a screw up.

But all we can do is not reject a company/theme/sector etc in a second because of our past experience.

Let data, research, earnings, technicals, fundamentals, scuttle butt etc or at least some work be done before letting our bias control our decision. Difficult but we can always try.

Free Technical Analysis Ebook ( if you have not read yet.) – Analysis that Works

Online Technical Analysis Training Video Course – 1 year Access.

LinkTree - Links to all our services and products - https://linktr.ee/NooreshTech

DISCLOSURE Nooresh Merani

SEBI Registration disclosure – Research Analyst INH000008075

Financial Interest:

Nooresh Merani and his family/associates/ analysts do have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts does not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

Also read the detailed disclaimer - http://nooreshtech.co.in/disclaimer