A quick technical take on Nifty

NIFTY Daily Chart

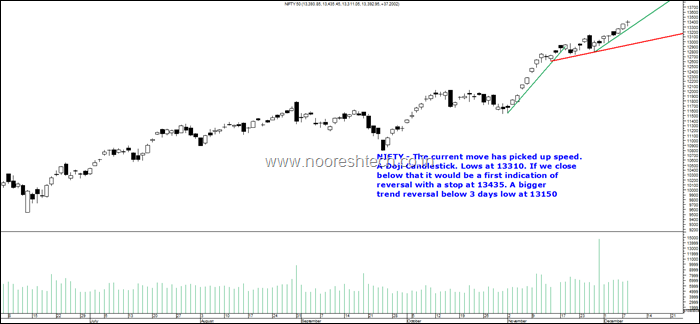

- The current move has picked up speed.

- A Doji Candlestick. Lows at 13310. If we close below that it would be a first indication of reversal with a stop at 13435.

- A bigger trend reversal below 3 days low at 13150

- The red trendline break would confirm momentum shift to down.

- Till the time price does not give evidence of reversal got to ride but be alert.

India Vix is back to the Pre Covid zone.

- The Covid fear is finally out from Volatility Index.

- Till the time we do not cross 25 we could continue to see a less volatile environment.

Nifty50 Equal Weight – A Broad Rally Finally

- From the Lows of October Nifty us up 16% and Nifty Equal Weight is up 21%.

- Ever since January 2018 peak all rallies were very narrow.

- Since mid of 2018 this is the first time Nifty50 Equal Weight made a new high.

Conclusion

- A lot of breadth indicators are overbought. All Nifty stocks above 200 dma, 90% of stocks above 200 dma, Nifty50 Equal Weight outperforming Nifty, Nifty Next 50 finally near 2018 highs.

- A correction would be warranted but such Breadth Breakouts have a tendency to over-extend and the best way to do is ride till price reverses.

- Secondly in many such instances of Breadth Breakouts are indications of a long term trend starting in smallcaps,midcaps. Also stock specific action continues even with a sideways correction in the Index. ( Remember 2015-2016- Nifty 9000 to 8000 but Textiles, Chemicals and other sectors did really well.)

- Simply put – One needs to now go stock specific and sector specific. Keep hunting for interesting companies.

- We did a detailed post on how one needs to be stock specific last month. Do read it again even if you have read the post.

Nifty up But Stocks are Down !!. Time for Stocks to Catch Up in coming years.

Do read this snippet .. ( Some of these beliefs have started being challenged – Smallcap Index up 10-12% , PSU up 30% , Cyclicals up 30%, Quality Companies going sideways.)

According to me these are the Top 3 Beliefs which may be challenged and can get broken.

- Smallcaps/Microcaps in the end lose money. Long Term Return is equivalent to LargeCaps. Do not buy Microcaps/Smallcaps.

- Quality Companies, Super Growth Cos can be bought at any Valuations. In the Long run they give Returns.

- PSU companies, Utilities, Cyclicals are wealth Destroyers and not to be touched forever.