We notice Retail Investors shareholding goes up dramatically in a stock which falls 50-70% sharply in a very short amount of time.

I have not been able to understand how this behaviour of Buying Lower Prices and Dips is consistent across market cycles over the years. One reason is the above stocks continue to be in the news stories on a daily basis and create an association towards those companies and impulsive buying by individual investors. The adage buying low also indirectly bears on investor minds as to “Aur Kitna Ghirega”

But the same behaviour is not replicated in companies which fall 50-70% over 2 years. The increasing participation happens only when prices drop sharply.

There was always a dilemma why do we jump in a stock down 70% in 2 weeks and not in 2 years ? Is it just short term memory or the news reels also the number of people behaving similarly is also large.

| Company | Retail Shareholders |

| Reliance Inds | 2215623 |

| HDFC Bank | 720646 |

| Larsen Toubro | 984805 |

| Infosys | 891820 |

| TCS | 752155 |

| ICICI Bank | 803890 |

| Yes Bank | 1339418 |

Yes Bank has more retail shareholders compared to most Nifty 50 names and just lesser than Reliance Inds. Beats every other company !!

When the first fall in price happened the number of retail shareholders was 6 lakhs and 8.54% of equity. Today it is 13.39 lakhs and 27.37%. Now Indian Retail Investors own more than all FIIs combined at 26.5 % of equity. FIIs are down from 39.5% to 26.5%.

Its just Crazy.

I think I have found the reason for such behaviour. Worldwide most people react to the Black Friday Sale, End of Year Sale which is for a short duration and suddenly prices for a lot of known products are down 50-70%.

Basically !!!

WE ARE CHEAPOS!!!

Now that’s not an insult or insinuation but a Reality.

We all love to buy a known product 50-60-70-80% lower than MRP. Its a great feeling.

What do we buy?

In a hindi film Dialogue – Roti Kapda aur Makaan are the minimum things we buy or we need.

- Basic Food – The day you buy it and consume it does it increase in Value. Inflation is slow. ? (Well I just become fatter if I eat more. CAGR of my weight has been positive.)

- Eating Out – If you spend on a lavish meal does it increase in Value or Prices increase by 3x if you do not have it this weekend ? On a delivery meal dont we always hunt for zomato discounts.

- Kapda – Over a period of time the clothes we buy either don’t fit us, or they get torn, or they are out of style and in the end it goes to the dumps.

- Electronics – The New Clothes – On a normal day the costliest thing on me is my Mobile Phone.( Maybe because I wear shorts to work or cant afford the custom made shirts.)

- Does the price of your Mobile Phone go down after buying or go up after buying. Well the phones nowadays become obsolete in 2-5 years. The car you buy loses 10-20% resale value the next day.

- Makaan – This is the only consumable item which we buy is an asset and prices can go higher.

To sum it up on a daily or weekly or monthly basis whatever we buy or spend the resale value of that item either goes to zero or goes down.

Why is it a great feeling because almost 90-99% of all our spending or buying is on products which depreciate in value and it makes sense to buy them CHEAP.

Well that’s why we are always on a hunt for a discount in whatever things we want to buy. The whole gamut of Manufacturers understand this and that’s why every Store or first page of all Online Stores is all about Sales and Offers. If we reflect a 20% discount on a branded product is not as enticing as a 70% discount on MRP of a lesser known brand.

It’s perfectly right to be a CHEAPO in spending but the tough part is because of the daily ritual of spending cheaply or hunting for cheap prices our behaviour towards assets is to look for a Bargain in Investing.

But when it comes to buying Assets – We buy it either for Protection of Capital or Purchasing Power and Price Appreciation in the future.

So buying at 50 or 250 is irrelevant for the present it all depends on what can be the future or what we think is the future opportunity.

Now consider this scenario.

1) A stock is at 250 today was at 100 just a year ago. It fits all your investment criteria and see an opportunity of stock going to 1000 in 3-4 years.

2) A stock is at 50 today and was at 100 a year ago. It fits all your investment criteria and see an opportunity of stock going to 200 in 3-4 years.

Which one would you buy?

…………………………………????

Generally the first reaction would be to prefer a stock at 50 as it has fallen in price and we are CHEAPOS!! even though return expectation is same.

“The market does not care for your Buy Price or the Highest Price of the stock. “

A stock which has gone up from 100 to 250 shows that maybe the market thought the company has done something right in the last 1 year or the market perceives something good about it or it’s a fad or whatever be it but the market is happy about the performance or the perception of better future.

A stock price falling 50% could be because of various reason but it could not be because the market perception of better future performance for sure.

So the question you need to ask is do you want to be CHEAPO because that’s what you are on a daily basis?

( This thought process even hurts the best Fundamental Investors also as many screens start with 52 week lows and not 52 week highs. Are we always hunting for value in fallen prices and missing out businesses where price is sideways or up but the Value of the Business has gone much higher in the same period.? )

THE INDIAN RETAIL INVESTOR – BIGGEST CHEAPOS !!!

We notice is that Retail Participation increases in stocks which have fallen 40% or more.

Let us look at how Retail Shareholding increases in Stocks going lower and Decreases in Stocks going higher.

One of the classical examples which flummoxes me. Everyone under the sun knew that Kingfisher Airlines had gone bust but Retail Investors kept buying into Kingfisher stock hoping for god knows what. If that was not enough same got repeated in Jet Airways.

The problems in Kingfisher Airlines started from 2009 and by end of 2012 it had shut.

Check the Timeline on this article - https://www.thehindu.com/business/Industry/kingfisher-airlines-crisis-timeline/article14380262.ece1

· The stock price started falling from 2008 with the whole world markets crashing.

· But the first doubts in the Airlines started with the Debt Recast in 2010.

· By 2012 Salary Payments, Notices from Mumbai Airport, DGCA etc were there in daily headlines and finally the lockout in end of 2012.

· The stock price was still above 10-15 bucks in 2012 end. Ended up at 1.5 in 2014 and it was still traded !!

The only way one can explain Retail Investor increasing in Kingfisher Airlines is – Hope for Good Things to happen !!

Retail Investors – Hope is an Investment Strategy !

|

KINGFISHER AIRLINES |

SHAREHOLDERS |

|

|

Retail Shareholders (2008-2018) |

No. of Shareholders |

No. of Shares |

|

March 31, 2008 (1L) |

50,098 |

73,52,296 |

|

March 31, 2009 (1L) |

64,730 |

1,26,90,145 |

|

March 31, 2010 (1L) |

81,311 |

2,02,79,212 |

|

March 31, 2011 (1L) |

95,421 |

2,66,73,862 |

|

March 31, 2012 (1L) |

1,35,547 |

5,51,99,258 |

|

March 31, 2013 (1L) |

2,30,069 |

16,64,78,828 |

|

March 31, 2014 (1L) |

2,33,242 |

19,73,99,714 |

|

September 30, 2014 (1L) |

2,33,393 |

21,16,70,473 |

· Shareholders holding upto 1 lakh paid up capital went up from 50k in 2008 to 2.3 lakhs in Sept 2014.

· In March 2012 there were 1.35 lakh shareholders and by September 2014 there were 2.3 lakh.

· The terrible part number of shares from 2012 to 2014 went up from 5.5 crores to 21 crores !!

The same story plays out again with Jet Airways

Check this timeline - https://www.moneycontrol.com/news/business/jet-airways-timeline-when-and-what-happened-so-far-3846461.html

Retail investors below 2 lakh paid up capital has gone from June 2018 when all the problems were clear has gone from 7.5% of Equity to 14% by June 2019. ( Sept 2019 shareholding is not available.)

Take another case of Unitech – The darling stock of 2007.

· In January 2008 it was No 16 on the Nifty 50 and had a higher weightage than HDFC Bank and Wipro.

· Stock fell by 90-95% in 2008.

· Stock again fell by 90-95% in 2014-2018

Retail Investors – Hope!!

|

UNITECH |

SHAREHOLDERS |

|

|

Retail Shareholders (2008-2018) |

No. of Shareholders |

No. of Shares |

|

March 31, 2008 (1L) |

2,49,289 |

11,19,39,329 |

|

March 31, 2009 (1L) |

5,22,964 |

19,57,61,728 |

|

March 31, 2010 (1L) |

6,89,772 |

25,56,69,940 |

|

March 31, 2011 (1L) |

6,70,755 |

26,12,18,578 |

|

March 31, 2012 (1L) |

6,75,895 |

29,34,59,089 |

|

March 31, 2013 (1L) |

6,20,945 |

28,60,70,971 |

|

March 31, 2014 (1L) |

6,23,760 |

39,12,97,449 |

|

March 31, 2015 (1L) |

6,03,580 |

42,71,07,230 |

|

March 31, 2016 (2L) |

6,70,571 |

86,24,24,282 |

|

March 31, 2017 (2L) |

6,46,657 |

91,06,34,205 |

|

March 31, 2018 (2L) |

6,32,726 |

90,81,79,187 |

· Number of Investors below 1 lakh paid up capital doubled in March 2008 to March 2009. No of Shares increased from 11 cr to 19.5 cr. This is when stock has gone down by 90-95%

· The number of shares held by the category has only kept on increasing over the years!!

Now a quick take on two recent examples.

1) Vakrangee Limited.

· The stock went up 5x from March 2016 to end of 2017.

· After a crazy run the stock was at 50k crore market cap with almost no Mutual Funds holding it. Lot of FIIs were holding this one though.

· See this news item at 37000 cr market cap - https://www.bloombergquint.com/business/how-vakrangee-turned-from-a-penny-stock-into-a-rs-37000-crore-firm#gs.77k3uIA

· It was higher than a couple of Nifty 50 companies in terms of Market Cap.

· Stock fell 90% in 2018.

The Retail Investor Goes Shopping when Prices are dropping.

|

VAKRANGEE |

SHAREHOLDERS |

|

|

Retail Shareholders (2016-2018) |

No. of Shareholders |

No. of Shares |

|

March 2016 (2L) |

14,755 |

2,56,58,545 |

|

June 2016 (2L) |

16,534 |

2,68,64,913 |

|

September 2016 (2L) |

14,687 |

2,51,51,585 |

|

December 2016 (2L) |

16,945 |

2,51,15,610 |

|

March 2017 (2L) |

16,895 |

2,49,09,256 |

|

June 2017 (2L) |

18,851 |

2,56,26,944 |

|

September 2017 (2L) |

21,396 |

2,56,66,911 |

|

December 2017 (2L) |

32,309 |

4,33,70,826 |

|

March 2018 (2L) |

75,389 |

4,90,67,803 |

|

June 2018 (2L) |

1,41,786 |

11,17,13,789 |

|

September 2018 (2L) |

1,65,292 |

14,19,89,568 |

· From March 2016 when the stock price went up there was hardly any increase in number of shares in below 2 lakh paid up capital criteria.

· The Retail Investor finally got sucked in end of 2017 with no of shares going up from 2.5 cr shares to 4.33 crore shares and 50% jump in no of shareholders.

· From December 2018 the no of shareholders doubled in March 2018 and again in June 2018. During this period the stock was down more than 50% from the peak.

· By September 2017 5x increase in No of shareholders and no of shares from 4.3 crores to 14.2 crores when prices dropped by 90%.

As the prices kept crashing the Averaging and Buy Low strategy kept sucking in more people. It just amazes me how this behaviour remains same even after decades.

1) PC Jewellers

· The stock went up 3-4x from the low of end of 2016.

· Almost doubled in last 4 months of 2017.

· No Mutual Funds holding it but a lot of FIIs.

· The company announced a meeting for Buyback and did not approve the buyback trapping Retail Investors.

The Retail Investors – Sucked in by the Buyback

|

PC JEWELLERS |

SHAREHOLDERS |

|

|

Retail Shareholders (2016-2018) |

No. of Shareholders |

No. of Shares |

|

March 2016 (2L) |

17,620 |

20,76,152 |

|

June 2016 (2L) |

16,686 |

19,55,511 |

|

September 2016 (2L) |

15,525 |

17,68,102 |

|

December 2016 (2L) |

16,704 |

17,83,066 |

|

March 2017 (2L) |

17,629 |

19,01,645 |

|

June 2017 (2L) |

19,092 |

20,81,091 |

|

September 2017 (2L) |

24,587 |

43,24,536 |

|

December 2017 (2L) |

29,578 |

48,36,182 |

|

March 2018 (2L) |

67,236 |

91,25,066 |

|

June 2018 (2L) |

1,81,243 |

4,81,22,131 |

|

September 2018 (2L) |

2,03,229 |

6,35,26,675 |

· Not much of a change in 2016-2017 end in number of shareholders and shares but a sudden jump in June to December 2018 when the stock doubled quickly. Shareholders increased by 50% and no of shares from 20 lakhs to 48 lakhs.

· December 2017 to March 2018 shareholders double and then almost tripled between March to June 2018. By end of September the no of shareholders went up from 30k to 2 lakhs and the no of shares went up from 48 lakhs to 6.35 crores.

· The buyback announcement trap in May 2018 did the trick where in a single quarter no of shares in the 2 lakh paid up criteria went up 5x. Also during that time the stock was down more than 50% from peak.

There is Quote which I have come up with

“Retail Traders go Bust Via Leveraging and Retail Investors get Lost via Averaging !!!

Buying Lower Prices – Even in Large Known Companies!!

Looking at above examples it seems the investors get into falling smallcaps and midcaps. But when we look at the data of Lower Prices and Shareholding Changes it is no different for large caps.

The Pharmaceuticals Rush of 2014-2017

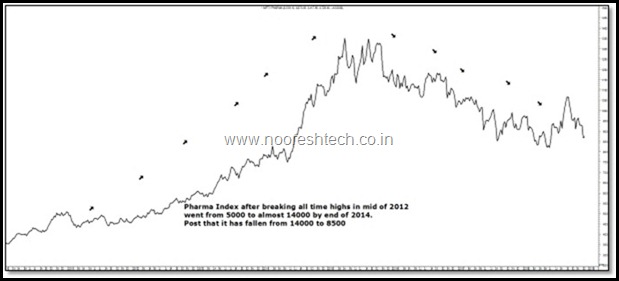

· Nifty Pharma Index after breaking all time highs in mid 2012 went up from 5000 to almost 14000 by end of 2014.

· During the same period the Nifty could not cross new all time highs and was at 5000-6400.

· Post the topping out in 2015 it has dropped from 14000 to 8500.

Let us look at shareholding changes in the top known names.

Sun Pharma

· The top weight in the Pharma Index and a large known pharma company.

· Stock went from 150-200 in 2010 to 1100-1200 by mid of 2015 in a strong trend without much of a correction.

· Has fallen from 1100-1200 to 400-450 in the last 3 years.

Retail – We only Buy Falling Prices

|

SUN PHARMA |

SHAREHOLDERS |

|

|

Retail Shareholders (2008-2018) |

No. of Shareholders |

No. of Shares |

|

March 31, 2008 (1L) |

32,505 |

85,91,317 |

|

March 31, 2009 (1L) |

36,561 |

80,95,348 |

|

March 31, 2010 (1L) |

37,370 |

77,00,190 |

|

March 31, 2011 (1L) |

68,260 |

3,99,61,848 |

|

March 31, 2012 (1L) |

64,721 |

3,82,22,546 |

|

March 31, 2013 (1L) |

65,653 |

3,71,21,156 |

|

March 31, 2014 (1L) |

1,23,929 |

7,61,53,544 |

|

March 31, 2015 (1L) |

1,60,009 |

7,70,66,666 |

|

March 31, 2016 (2L) |

4,16,627 |

12,55,74,216 |

|

March 31, 2017 (2L) |

5,42,995 |

14,32,60,121 |

|

March 31, 2018 (2L) |

5,64,673 |

15,10,83,470 |

|

September 30, 2018 (2L) |

5,31,244 |

14,18,73,698 |

· The retail shareholders increased in 2011-2012 by a big margin with roaring prices.

· In 2012-2013 when the majority of the price appreciation and outperformance happened the no of shares by below 1 lakh paid up capital reduced and a marginal bump in shareholders.

· Finally in 2013-2014 the no of shareholders and no of shares doubled up.

· The increase in March 2016 to March 2018 with falling prices shows excessive participation.

· Finally in September 2018 when the prices dropped sharply in last 6 months has seen some reduction.

We can see the same trend of increasing retail shareholder participation in 2016-2018 in companies like Dr Reddys and Lupin.

|

LUPIN |

SHAREHOLDERS |

|

|

Retail Shareholders (2008-2018) |

No. of Shareholders |

No. of Shares |

|

March 31, 2008 (1L) |

49,342 |

48,59,390 |

|

March 31, 2009 (1L) |

41,622 |

38,54,536 |

|

March 31, 2010 (1L) |

43,830 |

42,28,368 |

|

March 31, 2011 (1L) |

1,00,032 |

2,44,40,047 |

|

March 31, 2012 (1L) |

81,157 |

2,04,33,447 |

|

March 31, 2013 (1L) |

86,723 |

2,16,43,922 |

|

March 31, 2014 (1L) |

93,275 |

2,21,12,163 |

|

March 31, 2015 (1L) |

1,07,440 |

2,29,42,985 |

|

March 31, 2016 (2L) |

1,65,073 |

2,64,54,618 |

|

March 31, 2017 (2L) |

2,10,803 |

3,11,33,056 |

|

March 31, 2018 (2L) |

3,48,401 |

4,42,00,285 |

|

September 30, 2018 (2L) |

3,08,438 |

4,04,88,601 |

|

DR REDDY |

SHAREHOLDERS |

|

|

Retail Shareholders (2008-2018) |

No. of Shareholders |

No. of Shares |

|

March 31, 2008 (1L) |

95,435 |

1,68,63,191 |

|

March 31, 2009 (1L) |

88,923 |

1,57,65,663 |

|

March 31, 2010 (1L) |

66,212 |

1,37,75,712 |

|

March 31, 2011 (1L) |

74,700 |

1,33,89,602 |

|

March 31, 2012 (1L) |

69,640 |

1,27,76,378 |

|

March 31, 2013 (1L) |

67,002 |

1,25,03,429 |

|

March 31, 2014 (1L) |

64,744 |

1,19,53,118 |

|

March 31, 2015 (1L) |

69,341 |

1,17,98,852 |

|

March 31, 2016 (2L) |

1,00,409 |

1,31,72,928 |

|

March 31, 2017 (2L) |

1,22,588 |

1,36,90,700 |

|

March 31, 2018(2L) |

1,27,391 |

1,41,97,910 |

|

September 30, 2018 (2L) |

1,20,764 |

1,38,17,161 |

Conclusion

- · The Retail Investors (based on data of shareholders holding less than 1lakh or 2 lakh paid up capital) does not increase with rising prices.

- · The Retail gets sucked in when these stocks or sectors go bonkers and become a news item.

- · The participation keeps increasing with lower and lower prices. This is what has been a wealth destroying strategies as some of these companies go down by 50-90% and never come back up for many years and some stay there forever.

The Solution

Let me tell you the urge to buy a 70% stock is same like an urge to eat the worst street food. Like you see it everyday when you walk down the road just like you see the newspaper, news channel everyday. The solution is buy just 1 single Share everytime you get an urge.Your name gets added to the list of retail shareholders but you dont lose a lot of money, just the way you would have one plate street food. ( Not naming any as I love all the street food.)

Another smart solution is.

1)Dont buy Stocks Going Down just because its down 50-70% . Better have some sound reasons for it to take a contrarian bet. Don’t want to be a CHEAPO Investor just because am a CHEAPO daily. So work harder on the fundamental thesis on stocks going down.

2) Buy stocks Going UP just because they are Going Up. At least am contrarian to the Daily CHEAPO I am. This is the better way to get Lucky. Buying a stock up 50-70% higher in a week/month/quarter you might actually get lucky.

Dont be a Cheapo in anything related to Investments !!

January 4, 2020

In Short Bhaiya bolna kya chate ho itna saab likh ke. Have been Following you since ages. I understood by this post that buying which is up 50-70% has much higher chances of rising up than the one which has fallen 50-70%.

Jai Hind!!

January 4, 2020

Great post.Fantastic data points!

January 4, 2020

Nicely explained chepo

January 5, 2020

?

January 12, 2020

Absolutely correct. Whether it is in we Indians’ mind set/mentality or something different, do not know.

Probably, a similar study of some developed country’s market would throw more light on this.

I think a great and well-oiled machinery works here. All big operators come to know of the impending disaster much earlier than retail investors and they create a big news/rumour on all the media outlets creating a huge bug around the stock. And then, retail investors flock to it, finally holding all the shares when the music stops and by that time, big investors had already sold off their holding.

January 4, 2022

[…] Source: https://nooreshtech.co.in/2020/01/we-are-cheapos-but-dont-be-one-while-investing-money.html […]