Nifty Midcap 100 – Showing strength

It has crossed the highs made 4 days back and is close to crossing 2019 highs. Interestingly lot of strong trends in top weights of the index like – InfoEdge, CUB, Tata Global, Au Small Bank

Some more seems to be shaping up well.

Do check the constituents here -

We do expect in the coming year SEBI categorization could change and that could lead for a lot of flows in larger midcaps and larger smallcaps.

In a dip post budget or global dip one can look out for momentum and retest opportunities in some of them. Good time to make a tracking list to buy on corrections.

Similarly one should keep Smallcap Index and weights on radar.,will write a post soon on it.

Do read the disclosure and disclaimer. Do your own research and risk management.

MGL – A retest or blow out ?

GMR Infra – Long term trend change – More momentum on crossing 25-25.5

Ujjivan – Setting up for a breakout above 350-355

Ramco Cements – Breakout done

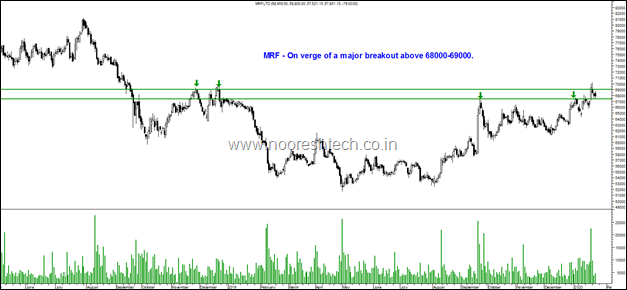

MRF on verge of a breakout

Federal Bank – Good base done and now starting up.

Apollo Hospitals – a 3-4 year high.

Many other trending names in the midcap 100 – Torrent Power, Tata Global , Balkrishna, IGL , Juilant Food

ONLINE TECHNICAL ANALYSIS TRAINING SESSION planned for February end. If interested please mail to nooreshtech@analyseindia.com . And any suggestions of how the format should be. Will soon put details.

DISCLOSURE Nooresh Merani

Securities covered above: All mentioned in the above post

SEBI Registration disclosure - Investment Adviser ( INA000002991)

Financial Interest:

Nooresh Merani and his family/associates/ analysts would have exposure in the securities mentioned in the above report/article.

Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

Also read the detailed disclaimer - https://nooreshtech.co.in/disclaimer