We are back again at the same resistance for the Smallcap Indices the 3rd-4th time in last few months.

BSE Smallcap Index

Back again..

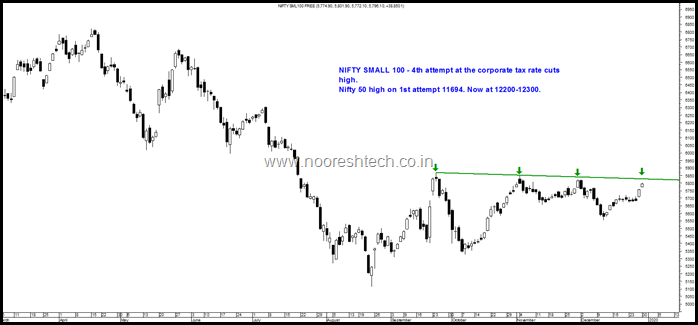

Nifty Small 100

Back again… Nifty has move from 11700 on corporate tax rate cut to 12200-12300 the Smallcaps continue to lag like they have in the last 2 years.

We can expect stock specific action going into 2020.

Some Sunday Thoughts and Ramblings.

Another statement doing round across social media is how its a consensus that smallcaps and midcaps may rally and thats the reason it may not rally ![]() My personal view is there is a big difference between Consensus and Hope. Also its not about the consensus in comments or talk but in the positioning of market participants.

My personal view is there is a big difference between Consensus and Hope. Also its not about the consensus in comments or talk but in the positioning of market participants.

- For example a lot of us commented in end of 2017 how the Smallcaps was overdone and one can go back now and look into historical tweets and comments today we would look at it and think how stupid were we. Consensus was how microcaps and Smallcaps but Portfolio Positioning was still Smallcaps !! But the fact is the overwhelming consensus was Large Money/Returns cannot be made in LargeCaps. What turned out was LargeCaps actually made Returns and Smallcaps crashed.

- The Positioning of the Market was FIIs, Mutual Funds, High Networth Investors not only buying the available shares in the market but subscribing to QIPs, Preferrential Warrants etc as that was another way to get a large chunk of a company holding.

- Today I am confused whether its my Hope ( many others like me ) or Consensus that Smallcaps should turnaround like it was in 2012-2013 or in 2019 and will be in 2020. A lot of comments today are on how Quality Companies is the best way to go and it is being determined. So today the major consensus is Quality Large Caps cannot lose money and Big will get Bigger. The Flight to safety is not just on earnings growth but business which many not see a lot of de-growth.

- The Positioning of the Market today is FIIs, Mutual Funds, HNIs are buying larger midcaps, large caps and there is a total lack off QIPs, Preferrential Warrants and large bulk deals in MicroCaps,Smallcaps. Rather the thought process to avoid smallcaps/microcaps irrespective of value today is – Buying a Smallcap is Easy but who will you Sell it to ? ( What a change from printing new shares !!). The Cycle continues for Smallcaps this way. Even regulators tend to act similarly – Periodic Call Auction in 2013 and now Categorization of Stocks. ( My bet would be this should ideally change in next 1 year. )

- A strange Sunday Thought and discussion with a close friend and investor.

TCS has grown earnings and sales at 18-19% for last 10 years and does OPM of 25% and a lot of ratios similar to Hindustan Unilever/Asian Paints ( and quotes at a 20-25 multiple but Hindustan Unilever/Asian Paints quotes at 60-70 times. TCS has grown sales at 18% compared to 6.75% for HUL and 14% for Asian Paints. Consider you were to see these 3 Balance Shets, PNL of 5-10-15-20 years without knowing the companies names or businesses to do a quantitative analysis ? – Which one would you give a Higher Multiple ? The thought comes from the fact a Technician wont mind knowing the name of the stock should you as a fundamental analyst also try doing an analysis purely on the data for a long period of time to understand quantitative analysis ?

- To sum it up this could be a time to be careful with Large Caps and look for Companies/Themes/Sectors irrespective of Market Cap and liquidity. The market may reward Microcaps/Smallcaps if the thesis plays out well like it did in 2011-2013 and 2014-2017.

- The Smallcap/Midcap Index may not go crazily like in 2014 but selective smallcaps/microcaps could surprise and just when nobody expects a Multi-Bagger they tend to be sprouting up from nowhere.