Whenever the markets correct there are a lot of headlines giving reasons for the correction !! Above can be a good headline as Global Indices across the world have corrected 10% since February 1st ![]() Another nice Tweet to sum it up.

Another nice Tweet to sum it up.

Miles law:Where you stand depends on where you sit

Why is the market falling?

Mercantilist:trade war

Monetarist:Stimulus withdrawal

Taxationist:LTCG

Bankers:Provisioning

Political analyst:2019

Value investors:valuation

Growth investors:earnings

Conspiracy theorists: conspiracy!— Vetri Subramaniam (@VetriSmv) March 24, 2018

Lets get to seeing global charts

What we notice

- Most indices across the globe are down 5-15% from the peak in February.

- Many are now testing the 200 dema and the previous support zones.

- Oversold on RSI and other indicators alongwith positive divergences.

- A short term bounce is possible in near term.

- Review post bounce whether it can take out recent highs or not.

- Some emerging markets like Brazil , Taiwan, Hang Seng are in strong trends. some others too.

Taiwan – Strong chart in all Time Highs.

Shanghai – Down 10-13% from peak and lower end of the range.

S&P 500 – Retesting 200 dma and 2 year trendline. 2500-2550 major support.

Nikkei – Oversold with positive divergences. Below 200 dma but close to supports.

Hang Seng – In a strong uptrend.

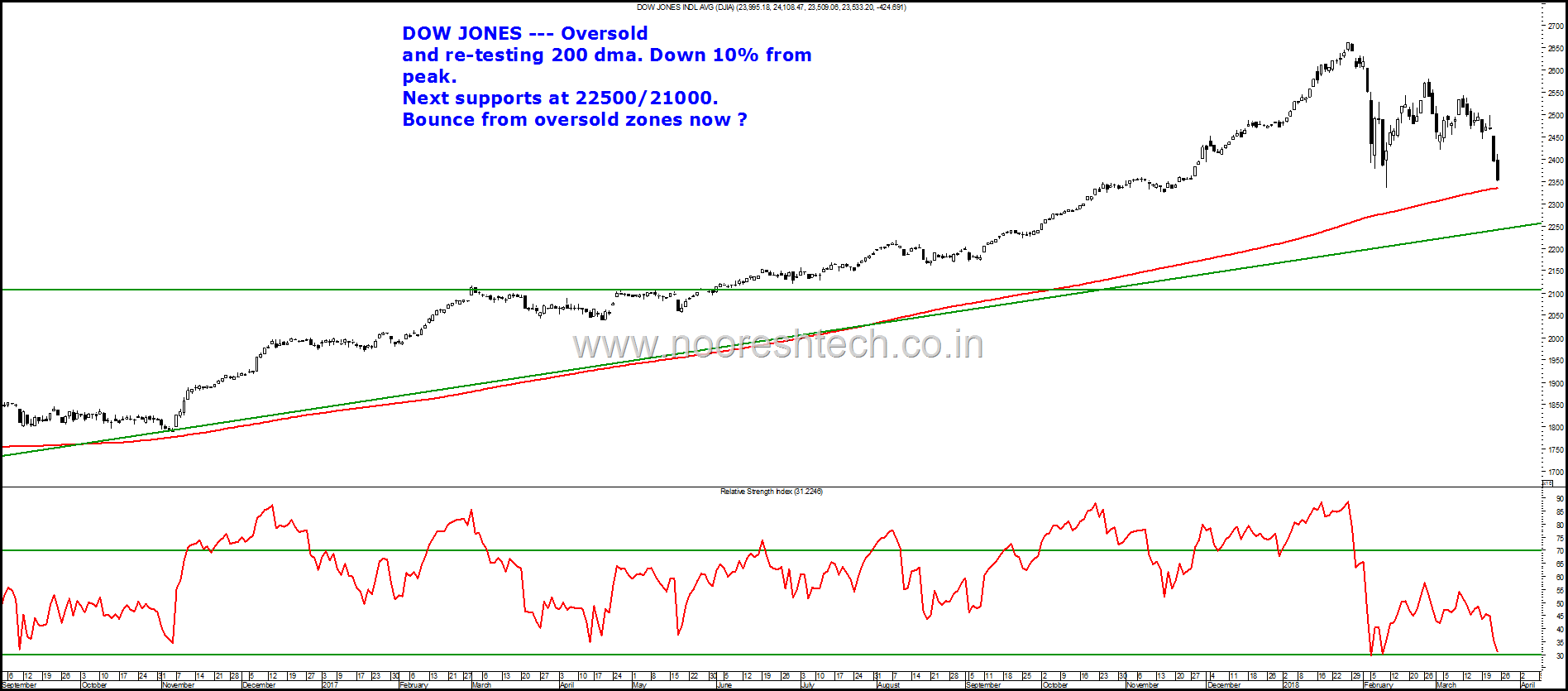

Dow Jones – Oversold and re-testing 200 dma. Down 10% from peak. Major supports at 22500/21000. Time for a bounce ?

DAX – Oversold and at an important support level with divergences. Next supports at 11000. Down 10% from peak.

Canada – Close to retesting recent lows.

CAC – Oversold and lower end of the range.

Brazil – Strong chart and in all time highs.

The Emerging Markets Index fund has not tested the lows of February whereas Nifty/Sensex did break them in last few days and has underperformed the emerging markets index.

- Nifty has gone below the 200 dema and the previous bottom for a day or two.

- RSI is oversold and showing positive divergence.

- The setup seems pointing towards a bounce and even a short term bottoming out.

An older video which explains the RSI oversold strategy - https://www.youtube.com/watch?v=p6WxDxOKGkY and more videos on RSI divergence done in previous years. Alternatively search for RSI on the website and you may get a lot of posts.

Conclusion – Time to look to deploy cash and fresh cash is our view.

Disclsoure - Do your own research – We can be biased as we are now totally invested and looking to deploy fresh cash.

TECHNICAL ANALYSIS TRAINING by N S FIdai

14th-15h April Hyderabad

( Venue will be updated shortly )

Maximum participants 10-15.

Fees - Rs 16000

Payment Link - https://www.instamojo.com/nsfidai/analysis-that-works-technical-analysis-class-6bc13/

Bank Account Details

Nooruddin S Fidai

ICICI Bank, Yari Road Branch

SB A/c 125101503988

IFSC ICIC0001251

Important Features

-> Learn how to use Metastock Software

-> Small Batch size so highly interactive session.

-> 1 month back up support in case of queries

-> Free Refresher Session any time in next 6 months.*

-> Historical Data since 1979 for practice.

-> Lots of powerpoints/pdfs and training material.

-> Mode of communication Gujarati and Hindi

Fees - Rs 16000

-

And get much much more including access to Analyse India students google groups, refresher sessions, webinars

For more details call N S Fidai 9920120878

or mail to analyseindia@analyseindia.com