Hotels as a sector has started looking interesting with demand supply scenario improving. After almost a decade of lower ARRs and Occupancy ratios there seems to be a small uptick. Valuations do not seem to be stretched. The recent price movement also indicates strength.

The only concern is the limited choices of listed companies and liquidity in some of them.

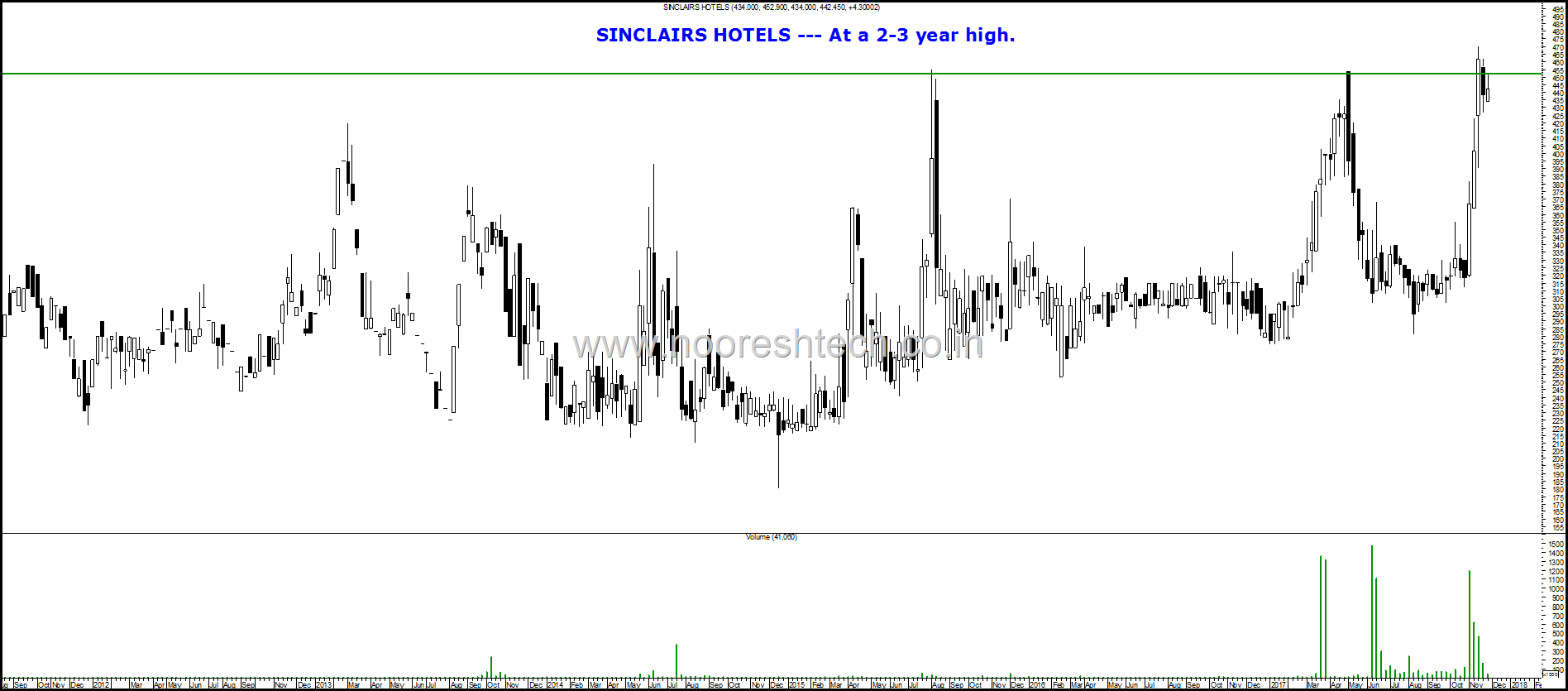

A quick look at how technically many of the names are getting into 2-8 year breakouts.

Sinclairs Hotels – At a 2-5 year high. Around 250 cr of mkt cap debt free and 35 cr cash and around 350-370 rooms and some more possibility of expansions.One of the few companies in the sector that has been profitable all through and with good margins. P-E funds sold at 310 and promoters added stake at those prices. Will keep it short given my positive bias on the company ![]()

Disclosure – The author, family and friends own the stock. It has been recommended in our Advisory Services at lower levels.

Indian Hotels – Short Term breakout done but 130-135 is a big resistance. Good volumes. A rights issue recently reduces the debt and makes this one interesting.

Kamat Hotels – Although the stock turned around with huge volumes at 40s with a lot of P-E selling being absorbed the stock is now getting close to a 6-9 years high.

EIH Associated Hotels – Not far from the breakout but not a very liquid stock.

EIH Hotels – On verge of a 8 year high.

Disclosure – Recommended in Technical Traders Club

Advani Hotels – A very illiquid one but at a 2 year high.

Royal Orchid Hotels – Earlier covered on the blog at 130. Another interesting name in the hotel sector and close to a 8 year high.

There are a few more hotel stocks like Savera Inds, Orient Hotels, Asian Hotels, Jindal Hotels but not very liquid.

Nooresh Merani

Securities covered above:: all above

SEBI Registration disclosure – Investment Adviser ( INA000002991)

Nooresh Merani and his family/associates/ analysts do have exposure in the securities mentioned in the above report/article. ( Sinclairs Hotels )

Nooresh Merani and his family/associates/ analysts do not have any financial interest/beneficial ownership of more than 1% in the company covered by Analyst.

Nooresh Merani and his family/associates/ analysts have not received any compensation from the company/third party covered in the above report/article ever.

Nooresh Merani and his family/associates/ analysts has not served as an officer, director or employee of company covered in the report/article and has not been engaged in market-making activity of the company covered in the report/article.

The views expressed are based solely on information available publicly and believed to be true. Investors are advised to independently evaluate the market conditions/risks involved before making any investment decision

December 2, 2017

Hello dear friend pls send recomendations if u dont mind.tks Jayarajan