I am not an economist or a very knowledgeable person to understand the short term / long term or whatever impacts of #brexit and #rexit.

But the online media was unanimous as to how every investor should buy the dip and so on.

This tweet by Manoj Nagpal shows that possibly a lot of people bought the dip.

Yesterday #Brexit was a huge UP day for equity Mutual Funds

Equity MF purchases spiked UP by 3X Vs. Normal day for MF industry!!

— Manoj Nagpal (@NagpalManoj) June 25, 2016

All the #whatsapp groups were abuzz as to how this dip is a buy. Just last weekend they were abuzz as to how Raghuram Rajan or #rexit was going to create many problems and the implications. The market did not react much to #rexit.

I do know a lot of investor friends who did buy the dip. Even I was excited that I might get some stocks down 20% and got none so only did some timepass buying.

So Did you Buy The #Brexit Dip ?

If Yes --- Can you really answer what made you do so ?

Lets look at Nifty as to how big the dip was !

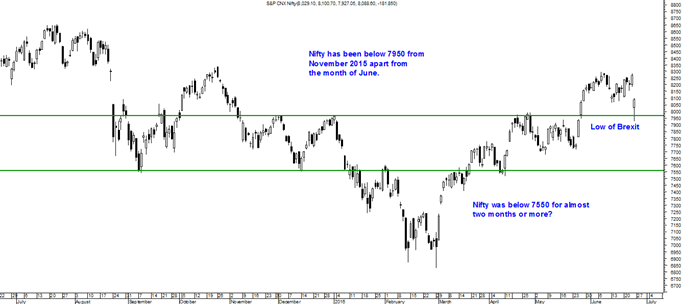

The Nifty made a low of 7950 approximately.

Nifty apart from June 2016 has been below 7950 for almost 5-6 months. Was it not an opportunity to buy ?

Also Nifty was below 7550 for a good 2-3 months and stocks had also corrected quite a bit.

Did you evaluate your buying decision on a stock basis or just because Nifty fell 300 points in a day irrespective of the price it started.

Its like End of Season Sale we have in Retail shops across India this weekend and next.

Even if you don't need some stuff you do buy because its down 40-50% from MRP which itself is many a time inflated in the season. Only in markets the Sale we had yesterday was 3-10% thats not too big a discount to get excited on.

My Conclusion

So let not an #event decide your #buy and #sell decision. Think and evaluate a stock or a trade individually 🙂

June 25, 2016

I am fully invested so did not buy :-). But most importantly, If someone is bullish and believes this is indeed a new uptrend which started from March 2016 sector leadership in Nifty OR in Midcaps may change due to change in macro. Commodity prices are going to see uptrend/stability from downtrend, Interest rates are going to see downside from high/flat, Rupee may appreciate and lastly Govt reforms be it GST or NPA clean up etc will accelerate.