Its been quite a while since i have written a post due to a lot of new concerns.

This is an educational post and have not personal exposure or financial interest in the stock being discussed.

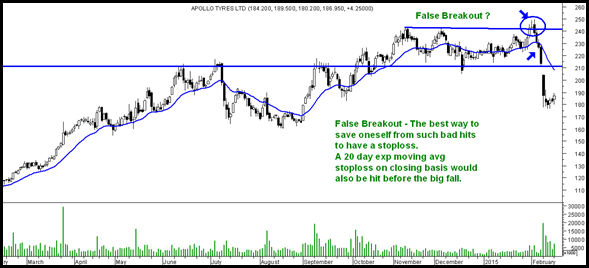

This is the chart of Apollo Tyres

-> The stock broke into new a new high from a range. This strategy has a good hit rate in trending markets.

-> Although volumes did not increase as much. This could be a criteria but at times we just take a pre-emptive bet.

-> After a move above 235-240 the stock has collapsed to 180.

-> A 20 day exp moving average stoploss would have been triggered at 225. There can be various ways to put a stoploss ( i have just taken 20 day as example)

Consider if you use leverage and not keep a stop loss. A 30 % drop with 3x leverage would imply 90% capital erosion. ( This is the reason leverage can be a killer )

This is why we need to keep stoplosses or a positiion sizing which takes care of such a drop . ( At times one can make a mistake of holding out or stops and so on )

I would prefer a stoploss as a trader and be a little diversified as an investor to not get badly hit by 30-40% drops.

Everyone has a strategy. Would love to hear more on how to counter these trades. ( not looking at hindsight reasons of how it was not a breakout and etc )

February 17, 2015

Hi,

These are the scenarios we as traders need to handle. Trading with index like nifty enables us to use options to hedge our positions for the scenarios like this where the price gaps down below our stoploss.

February 18, 2015

Nooresh sir waiting for your Nifty view.. last time you gave correction can come @ 8600 levels & achieved your tgt of 8000 & bonce back to 8450.

Please put an article on view on Nifty. Cant figure out the market, people talking of 9500/ 10000.i know you r busy in your work but i daily check your blog for the mkt view but its not there.. please Nooresh sir your guidance on Nifty helps out a lot..

Thank You..

February 18, 2015

Will soon start posting as of now the trend is up but better to be cautious above 9k and be ready for a correction.