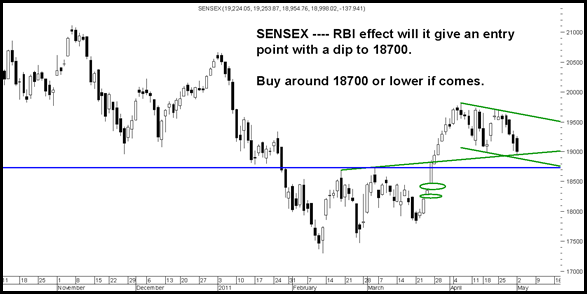

Sensex Technical View:

In the last two sessions the drop in Sensex has been majorly due to the banking index and Reliance. Many PSU banks have dropped 5-10%. Is it because of a downgrade by Morgan Stanley or is it the sudden change in expectation of RBI rate hike from 0.25 bps to 0.50 bps.

Seems Index is factoring in a 50 bps hike but for use would stick to the technical levels. 18700 the previous breakout point will be a good entry point on declines. The gap support at 18373-18480 also remains a very strong support.

We may expect the index to bounce to 19k post a dip to 18700 or lower. Buy on dips with a stoploss of 18370.

Stocks to watchout for :

SBI --- Should bottom out in the next few sessions

LNT – Bottom out or a breakdown stoploss 1530.

Divis Labs – Excellent Medium Term pick …. 740-800

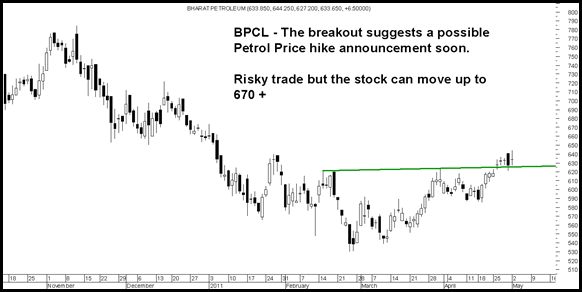

BPCL – Is a Petrol price hike on cards – Seems so as per the chart

Regards,

Nooresh

May 3, 2011

After today’s development, i feel for next 3 months, one should trade cautiously in interest rate sensitives: Financials/Real Estate/Auto. Banks will be under pressure as they will find it difficult to maintain their NIM’s due to:

Time Lag to pass the rate hike to end users, the effect of which will be visible in June and September 2011 numbers.

Savings rate increased to 4% from 3.5% will further dent margins

Loan Disbursement/Credit Growth target will be difficult, as demand will slow down.

Higher Provisioning in sub standard loans declared by RBI

More NPA’s expected in Power/Infra/Real Estate

So it will be good for investing, once the BANKEX stabilizes and quality stocks come at decent valuations.

Presently, i would like to focus on Dividend paying stocks and defensives in Pharma/Education/FMCG and select commodities.

May 5, 2011

Hi Ritesh,

Banks have dropped 15 % so its been taken into the price. But from the policy announcements and general understanding over next 2 qtrs we might be peaking out on Interest rates which seems to be more interesting to me.

May 3, 2011

Nooresh,

How is Ranbaxy, Nocil and Chennai Petroleum for 3 months trading perspective.

May 5, 2011

I dont track any of them