Sensex Technical View :

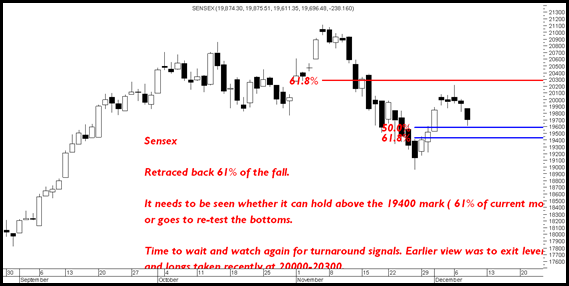

- > After the big crack from 21000 to 18954 the markets had to retrace back which it did by completing the 61% retracement where it was advised to exit short term longs or leverage as well as book positions averaged or new money deployed.

- > Sensex is at a crucial stage now where it is again testing the bottoms made. So we need to watch if index makes a bottom higher then 18954.

- > In the best case index should not fall below the 19400 mark which is 61% of the current pullback. If it does then it can even test the 18500 levels also in panic.

- > So at this stage investors need to just wait and watch and not redeploy the cash generated or add more investments at this juncture and look for turnaround signals.

- > A move to 19400 and a subsequent recovery above 20200 would be signs of turnaround till then get towards 25-30% cash.

BSE MIDCAP and Small Cap INDEX

- > The most surprising element of the current correction has been the huge drop in Midcap and Small Cap Index. Both the indices are down more then 15% which has taken many stocks down by 25% from peak on an average with certain speculative ones dropping 50%.

- > The midcap index is still looking fine as it has tested the channel supports and closer to 200 dema. So a bounce back could be in the offing after any further dip to 7300-7500.

- > The small cap index suggests there is still some more pain left in the system and if it breaks recent low of 9200 then it can go all the way down to 8600.

- > The liquidity is low in the small cap stocks so any drop may not necessarily mean a Fundamental Reason but more of sentiments and over supply.

- > Many of the stocks in our tracking have also dropped by 25% so mistakes have been made but investors need to take it in the stride and look ahead. So the current drop could be a very good learning so we dont make these mistakes at the actual bull run which we have in front of us for the next few years.

Strategy:

- > In the last 1-2 months many portfolios would have been down by 20-25% max from the peak. Also people would be totally invested and would have added more money on declines to average.

- > If you have taken a call to reduce some holdings at 20000 in the bounce as was suggested you should now just wait and watch for further confirmation from the markets.

- > For short term traders this is a time to reduce VOLUME trades - For example if you would buy 5 lakhs worth in every stock then buy 50% of it only as volatility is high.

- > Money lost on a trade can be made but only if you keep the temperament till better times come and one should not increase the stakes in such market conditions.

- > Learn from the mistakes avoid getting leveraged or exposed to Penny/Speculative/Hear Say Stories and do proper risk management.

- > A portfolio down 25% can be recovered but a hit beyond 50% will require a lot of time and patience. Learn from your mistakes as no bear run is permanent in in long term Bullish Market. So be ready that next time you dont make the same mistakes.

- > One of the specific reasons as to why one needs to learn from this correction is over the next 2-3 years we may have much bigger rallies and corrections but mistakes later may be more riskier. This could be one of the biggest learning point in an investors life for now.

Regards,

Nooresh

December 9, 2010

Nooresh,

What are your views about KS Oils, it seems to correct on a daily basis.

Rakesh

December 9, 2010

Hi Rakesh,

K S Oils its a market issue not company issue but in the case u never know how much can it correct.

December 9, 2010

Currently we are seeing a totally unexpected environment in the market.The nfty is just 10% down from peak & midacaps smallcaps beaten down to hell.It seems market in consolidation phase & broader market having a bear market.Nooresh can you focus some light on this weaker section of market that how would they bottom out or how would next coming 3 months pan out there.

December 14, 2010

Hi,

Expect consolidation for next few weeks. Smallcaps one should look to go value picking.

December 9, 2010

Hi Nooresh,

as the market has corrected specially mid cap and small cap.

can i aveg out United Phos, Hind Oil, Bajaj Hind, Lokesh Machine, HItech?

Or do you suggest to wait and watch for more..

also..accentia..planning to buy…your view pls

Thanks for your help!

December 12, 2010

I would add coulpe more to above list.

BILT

Apollo Hospital

Rico Auto

Mic Electronics

Hinduja Venture

Fortis Health Care

Vimta Lab

Camlin

Central Bank

Nooresh Appreciate if you could throw some details in these shares, These all are suggest by in recent past hencce the holding is little huge from myside.,

bhanu

December 14, 2010

Hi Bhanu,

BILT — Good for long term shud average

Apollo Hospital – Slow mover

Rico Auto — Got stopped out no view now

Mic Electronics — If its MIC then did not trigger buy call. I m bullish on Mirc Elec

Hinduja Venture — Hold will test patience

Fortis Health Care — Its more a long term story

Vimta Lab — Add more near 30 1-2 yr story

Camlin — Camling 35-38 a good price for re-entry

Central Bank — Bounce back on cards

December 15, 2010

Thanks for taking time and answering this long list.

I have bought Mirc Elect one of your recos.

i would exit Rico Auto on bounce.

thanks

bhanu

December 14, 2010

Hi Mihir,

Yes you can look to average out Uni Phos, Lokesh and Hitech. Bajaj Hind ( shift to triveni) . Accentia should slowly accumulate but need to be patient

December 10, 2010

What’s your view on stocks like reliance infrastructure and jaypee infratech.

They look fundamentally very strong but technically, they look weak to me.

December 14, 2010

Hi Ajit,

As of i see no reasons to buy into Infra

December 10, 2010

i had bout hindoilexp 600 share for275 and exceed at 220 as u r surrestion…. and what level should i re enter and what will be the target 4 to 6 month

December 14, 2010

Hi Sangram,

Enter at 190 levels reduce at 235-255. Short term range 180-240 roughly

December 13, 2010

sir what will happen to vimal rathod iteams..

Is valecha a good buy @ current levels…

December 14, 2010

Hi Munshi,

All the stocks mentioned in the scam are decent companies but were a little over stretched. Valecha is good below 120. Karuturi below 17.

December 17, 2010

hi nooresh, i just happened to check the historical levels for the global indices like S&P 500 , DAX etc. i was amazed to see that even in 1998 they were at the current levels…so an investor who had put money even for more than 10 years has no appreciation in the capital…while it is always assumed that equity markets generally give a return of 15% p.a. over a long term….so is this assumption only in the context of growing economies like India and what if we also get into vicious circle…( actually i was approached by an agent for investing into SUPERFUND , so i checked i facts..also is it advisable to invest in such fund )..thanks