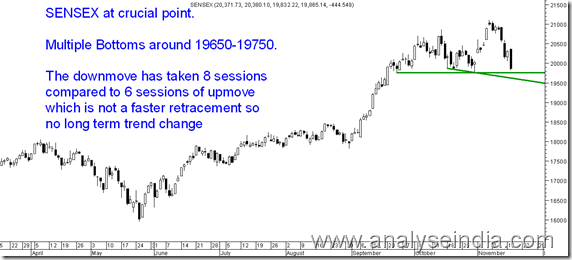

Sensex Technical View:

Negatives:

1) 19650 on Sensex is a crucial level on closing basis.

2) Sustaining below 19650 on closing basis could take index to 19200/18700 also.

3) Recent bottoms at 19750 has been broken in the day.

Positives:

1) Any long term trend change is shown by faster retracement. Upmove from 19750 TOOK 6 SESSIONS.

the downmove has already taken 8 sessions. ( the same theory was used to buy a buy call at 9700 in March 2009)

2) Till we dont see a faster retrcement we cannot term any move as a long term trend changer so any downmoves till then are supposed to be corrective moves.

The current selling for today is more of Marging selling. Sustaining below 5925 and 19650 on closing basis would make us change the view. Also todays low is going to be very important for days to come.

Bottomline : Investors will need to bear the pain for next 1-2 sessions and be ready to see weird prices on small cap stocks due to panic selling. Also be ready to exit a lot of positions if we close below 19650. Also if index holds on to current levels wont be surprised to see 21k being tested ! I stick to my view of holding Nifty bees and Nifty futures stoploss being 19650 on closing basis and time period 3-4 weeks.

Will be posting a detailed technical powerpoint presentation by tomorrow morning for possible

November 18, 2010

sirji i have registered for free trail on mobile since last 15 days but i am not getting any calls till yet.

so i kindly request u to do the same as soon as possible.

my mobile number-9819114169

Thanks

chetan

November 18, 2010

hi Nooresh,

Has Bajaj hindustan broken down? What is the call now Nooresh, Do you still hold bulissh view on Sugar?

bhanu

November 18, 2010

Hi Bhanu,

Remain bullish on sugars but it will take quite some time to turn up

November 18, 2010

well said nooresh ….. i agree with you on price rigging in small stocks, but i feel that its gud opprtunity for investors to accumulate small cap scripts @ nice discounts on this panic selling…..plz give us a few small stocks to accumulate in this panic

best regards

Himanshu

November 18, 2010

Hi Himanshu,

As of now many good midcap and large caps are available at attractive levels. Raj Oils is a good buy

November 18, 2010

Thanks Nooresh, as always supporting and guiding on crucial situations.

we all small investor & trader need your guidance always, thanks.

what you think about kemrock and makers lab

November 18, 2010

Hi Satbir,

Kemrock is a good buy but long term. Makers Lab no idea on the stock

November 18, 2010

Nooresh why not replying to my query(did few days back 2 times)

it s on Aarvee Denims & Marksans.

November 18, 2010

Hi Manish,

Seems missed it. Aarve above 95. Marksans more speculative

November 18, 2010

SIR HOLDING HIND OIL EXPO @275 AND EASUN REYRL @ 141. CAN THESE STOCK BE HOLDED FOR 1 YEAR WHAT WOULD BE THE TARGETS?

November 18, 2010

Hi Nooresh,

thanks for the great view and most importantly as usual it worked!!

so again analyseindia rocks!!

i have few positions on below stocks and they are happening. need your expert view please

– astra micro – recently they announced bonus share…

– kalpena – sebi moved it to T2 segment becasue of not able to comply the electronic share regulation

– yes bank – its currently corrected a lot …or do you suggest shift to another stock may be some psu banks

– city union – it has not yet hit the SL…but not showing up move as well..

thanks for all your help!

cheers!

Mihir

November 18, 2010

Holding 1000 bilt @ 40 , 5000 nila infra @ 2, and 1000 indo bonito @ 11 … Whts ur view on these stocks and some view on network18 they run so many good tv channels with good and successful shows .. Can it be a multibagger

November 21, 2010

Hi xyz,

I remain bullish on Bilt rest i am not so keen on.

November 19, 2010

Hi, Nooresh, can I buy SKS MICROFINANCE after todays crash or stay away?

November 21, 2010

Hi,

i see no technical or fundamental reason to buy the stock

November 19, 2010

hi,nooresh

can we buy lokesh now ?or not?and reliance pl tell me

November 21, 2010

Hi,

Can buy both the stocks slowly for long term

November 19, 2010

hi Nooresh,

do you see any value in Ricoh India?

bhanu

November 21, 2010

Hi Bhanu,

The liquidty is a concern in Ricoh India.

November 23, 2010

Hi Nooresh,

Have been holding Malu Paper and Prism Cement for quite some time now. What do you suggest?Do you advice booking losses on these?

November 24, 2010

Hi Vivek,

I l;ike Prism for long term. No view on Malu Paper